Does the Financial News Have You Confused? Here is a Simplification.

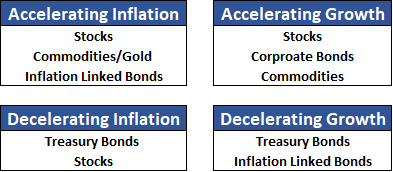

Today’s world of instant and constant information can easily put us in a position where we can’t see the forest for the trees. Stepping back from the constant barrage of seemingly conflicting financial data points and focusing on the ‘forest’ can be an enlightening exercise. We view the world through a prism of four basic economic states: rising or falling inflation and rising or falling growth. PWM client portfolios are built such that a part of our portfolio is expected to perform well no matter which combination of growth and inflation we experience. In simple terms, here are the asset classes that we would expect to perform well under these different scenarios and we attempt to balance the risks of each asset class in our portfolios.

The Accelerating Growth and Rising Inflation Phase: We Believe We are There

At the moment we believe we are in a growth accelerating mode and entering an accelerating inflation mode. Evidence of this is seen in the following economic conditions:

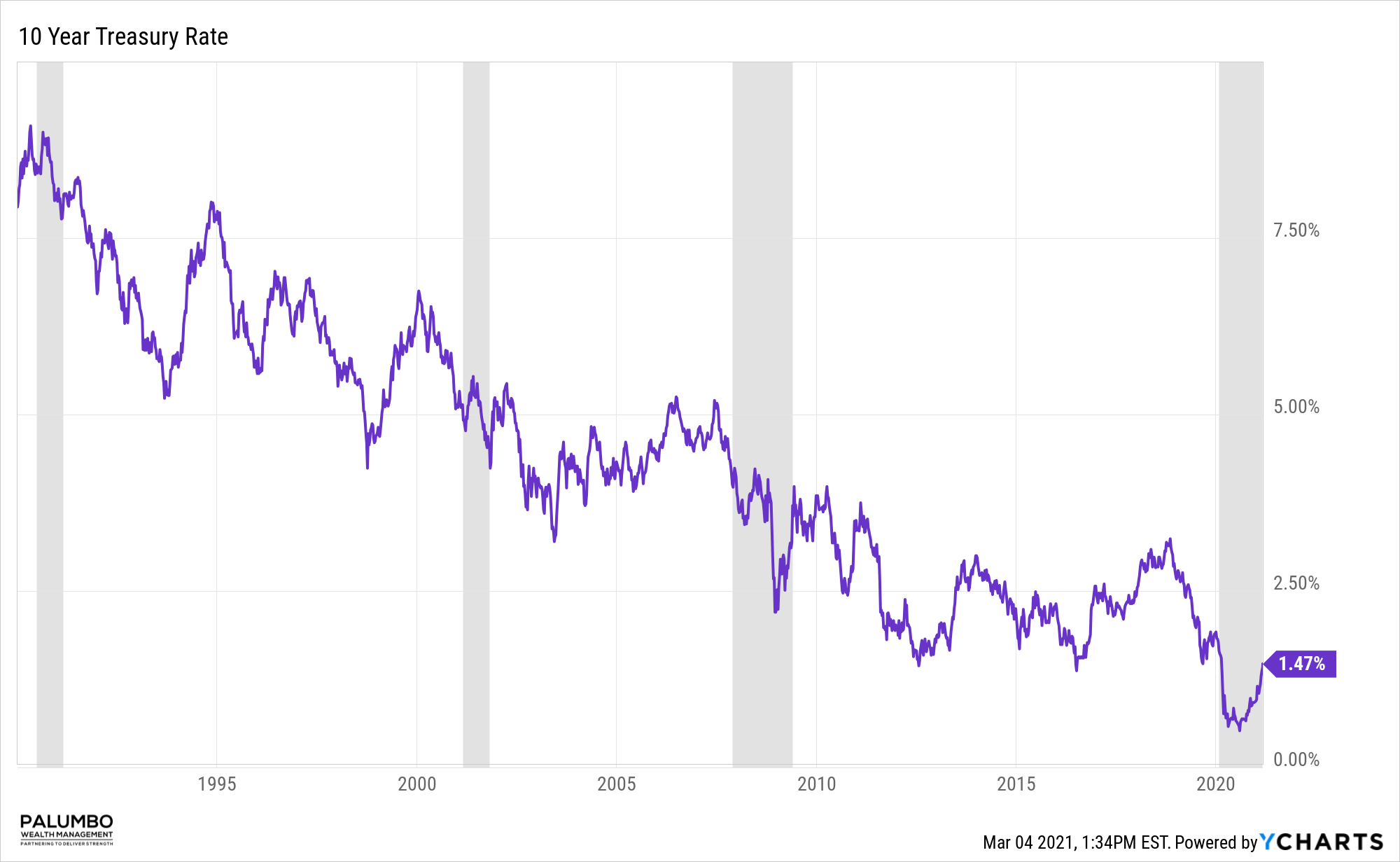

Interest Rates are Being Pressured Higher: This makes absolute sense. As we enter a recession, typically rates are relatively high and the recession is the impetus for the Fed to lower interest rates in an attempt to jump start the economy. Conversely, as we exit a recession, interest rates tend to move higher, as they consistently tend to do at this point in the economic cycle, reflecting the fact that business is improving.

This can be easily seen in the chart below, where the gray vertical bars highlight recessions. Note that after a recession starts, rates tend to go down. As we exit the recession, rates tend to recover a bit (circles). This time is no different than the many cycles before. It is fully expected at this point in the economic cycle.

What is different this time?

- 1) Rates were already very low when the COVID recession hit and

- 2) Massive money printing ensued in response to the pandemic, creating inflationary concerns.

As inflation concerns come to the surface, the ‘bond vigilantes’ tend to be close behind pushing rates higher. This is because bond holders demand to be compensated for the declining purchasing power of the dollar due to inflation. The more inflation they see, the higher the rate they require. The fact that rates have increased a bit early during this recession is an indication that for the first time in a long time, inflation concerns are being taken very seriously by the market.

Commodity Prices are Rising: As we have discussed previously on these pages, a whole variety of commodity prices are rising. Oil is back into the mid-$60 area, fully recovering to pre-COVID levels; virtually all major grain prices are rising; copper and other industrial metals are also rising. Logically, rising commodity prices are eventually reflected in higher prices for goods and services – or inflation. The reasons for the commodity rally are numerous.

- Very Large Chinese Purchases

- Supply Chain Bottlenecks

- Pent-up Demand

China had COVID first and has been the first to recover. Now that recovery has taken hold, commodity demand is back. Combine that with some poor crops in China and other parts of the world and, re-building the livestock population after a bout of swine flu are pushing prices higher.

We have also discussed supply chain interruptions on these pages during the pandemic. As countries/regions shut down due to COVID, key suppliers were also shut down, and in some cases are still operating at reduced capacity due to a labor force that has been decimated by disease. Supply chain kinks, even small ones, can stop the flow of goods. The average car has about 30,000 parts. A shortage of any one of those parts can halt production.

Supply chains that were designed to be very cost-efficient with just in time manufacturing are now being re-thought to consider the impacts of production shocks. Look for supply chains to be less dependent on a single location/supplier and for more inventory to held as a buffer to supply disruption. In light of the above, it is easy to argue that we are entering a phase of accelerating inflation.

The $64,000 Question: How Will the Fed Respond?

Just because rates have been rising recently, doesn’t mean they have to continue rising. The Fed will likely have something to say about that. Here are the main points of turmoil the Fed needs to address:

- Rising inters rates will slow economic growth and we are not yet out of the recession yet. The Fed needs to be careful that we do not hit the ‘self-destruct button’ and have rates get so high that we cut off the budding recovery.

- We have issued massive amounts of debt to address the pandemic, and the interest cost on that debt can rise very quickly as interest rates rise. That could also put a crimp in the recovery.

- If they act to keep rates low, it can help the recovery survive, but if inflation is rising, it can throw the bond market into some turmoil because, as we said, inflation normally demands higher interest rates.

The Fed is in a very tough situation and how they choose to respond will go a long way to defining how well or poorly the equity and bond markets will perform this year. Our best guess is that the Fed will act to keep a lid on interest rates. The reason for that conclusion is simple: If the recovery stalls, nothing else they are concerned about really matters. From our perspective, the larger question is at what point do they respond.

The good news is that while we have an opinion, the PWM portfolios are not contingent on us prognosticating correctly. Rather, our portfolios are designed with loosely correlated assets and those assets typically respond to the four economic environments outlined above in different ways. So, for some asset classes, higher rates are a good thing and for others not so good. The point is that we do not predict how markets will evolve, we invest client assets in a diversified group of assets designed so that some portion of the portfolio is expected to perform well in most any environment. Our expectation is that our diversified portfolio mix is able to reduce the volatility and drawdowns of our client portfolios.

Memo From Jay Powell: We Want to Cool Things Off

(So We Don’t Have to Clean Up the Mess!)

Is Mr. Powell telling us the market is ahead of itself due to speculative activity? Maybe. You have to read between the lines, but it is a real possibility.

Back in 1996, then Fed Chair Alan Greenspan was giving a speech in Japan when he asked “…how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?” Within minutes the Japanese stock market was down and closed down about 3% for the day. Markets worldwide followed suit, but that reaction faded rather quickly as Greenspan’s effort to jawbone the market to a more rational state failed. Of course, it was only a few years later that the tech bubble morphed into the tech wreck.

This week, markets were convinced that Jay Powell, the current Fed Chair, would address renewed inflation fears and the rapid rise in interest rates that has resulted. The markets were badly disappointed as he effectively dodged the issue saying that in the Fed’s mind, inflation was transitory and while they were watching the rate increase, there was no need for action on their part.

For a stock and bond market now accustomed to the Fed responding to almost any minor calamity, this response was a shock and perceived as an open invitation for rates to move higher still. We can’t help but think that this was Powell’s ‘irrational exuberance’ moment, but rather than attempt to jawbone the markets, Powell acted in a very unlikely way by not acting at all.

This act of “inaction” only adds to the perceived risk in markets broadly, that the Fed may not step in to control rates, and that in itself, could invite a correction of more substantial proportion than we have seen to date. Such a correction could be welcomed by the Fed as a correction could remove a good bit of the “froth” currently evident in markets.

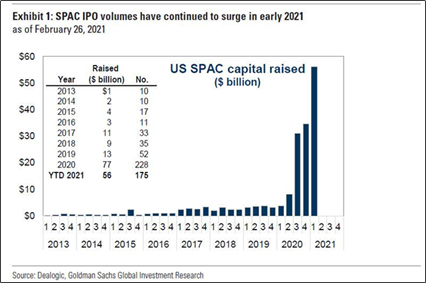

Nowhere is it more evident than in the issuance of SPACs. SPACs, which are blank check companies, are on pace to raise as much money in the first quarter of this year as in all of 2020.

The question is whether Powell’s actions will be more effective than Greenspan’s almost 25 years ago. Only time will tell, but on Friday, at least, the markets were willing to look beyond his comments.

What We’re Reading

US Treasury bond wobble heightens concerns over health of $21tn market

More relief could be a short-lived sugar rush for markets

Ghost kitchens could be $1 trillion opportunity in next decade

Administration is taking new Covid variant in New York ‘very seriously’

The $10B shipping inflation problem and corporate cost concerns

The World Will Pay More for Meat as Food Inflation Deepens

Price Outlook for Grain in 2021

Brazil’s Covid Crisis Is a Warning to the Whole World (NYT, Subs Req’d)

China ‘Worried’ About Bubbles in Property, Foreign Markets

If You Want Real Risk, Invest in Supercars (Bloomberg, Subs. Req’d)

OPEC Shocks Markets By Keeping Lid On Production (6 Min. Podcast)

Retirement Planning:

How Much Social Security Will You Get In Retirement?

Here’s how to figure out how much you may earn from Social Security in retirement.

Tax Planning:

Asset Location Improves Risk-Adjusted Returns

Stocks and bonds are the assets we purchase and whose value changes over time, but asset location is the place we hold them.

Estate Planning:

How Pooled Special Needs Trusts Help Families in Settlement

For parents of kids with special needs, navigating the waters of financial planning can be daunting.

Health:

COVID vaccines and safety: what the research says

It is clear that coronavirus vaccines are safe and effective, but as more are rolled out, researchers are learning about the extent and nature of side effects.

Entrepreneur:

The Benefits And Challenges Of Employee Remote Work

Among the myriad changes of a global pandemic, the outstanding single, by far, is remote work.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Alan Greenspan, Asset Allocation, Asset Classes, Bonds, China, Commodities, COVID, Equities, Federal Reserve, Gold, Growth, Inflation, Interest Rates, Jerome Powell, Oil, Portfolio Diversification, SPACs, Supply Chain, TIPS, TreasuriesArticles, General News, Weekly Commentary

By: Adam