Why are government bond yields declining?

Is the new Delta Variant a threat to the global economic recovery?

What should we expect from the upcoming earnings season?

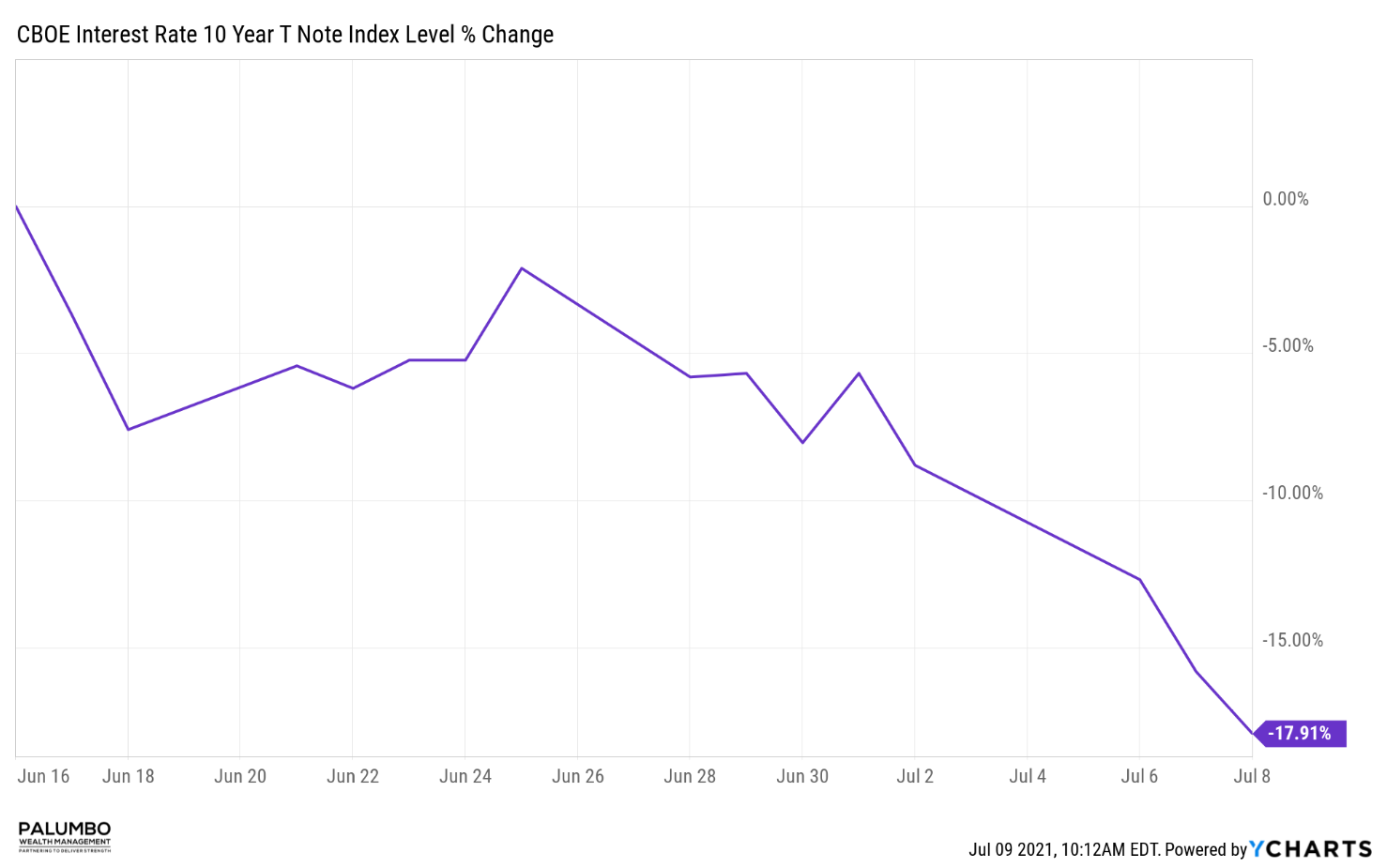

What we found to be most interesting, since Federal Reserve Chairman Powell spoke on June 16th, is government bond interest rates have been on a decline (please see chart). The yield closed at 1.56% on June 16th, and on Thursday it declined to 1.28%.

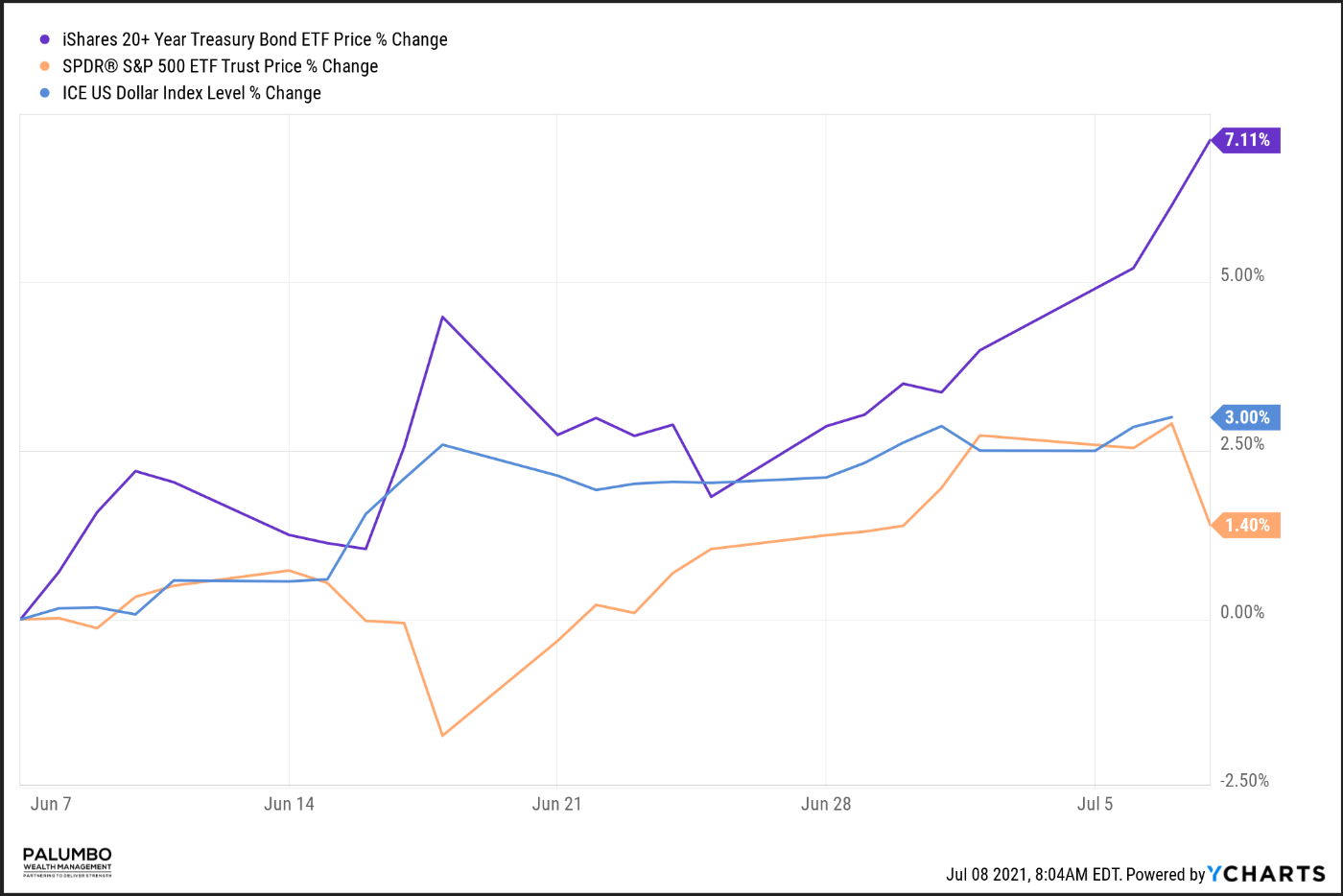

Most recently, long-term treasuries and the dollar have been increasing more than the stock market (please see chart below).

As investors, we have to ask ourselves, why.

We believe the new Delta Variant is a cause for concern and the reason why ‘Flight to Quality’ assets are increasing and risk assets are declining. What does ‘Flight to Quality’ mean?

- Investors buy assets that they feel will be secure during a potential economic downturn.

- The assets that historically have protected capital are the US dollar and US treasuries. Gold has also been an asset that has proven to protect during downturns as well.

As investors, what should we do about the potential for the Delta variant to cause additional lockdowns around the world?

- First, we, nor anyone else, know precisely when COVID in general will be behind us.

- Our narrative has always been that one risk to the current global economic expansion are variants that can potentially breakthrough the current vaccines.

- It appears that fully vaccinated people have some protection, but the efficacy has been reduced. The Israeli government said in a statement on Monday that the Pfizer-BioNTech vaccine provided 64% protection against the infection. The good news is the vaccine was now 93% effective in preventing severe disease and hospitalization. This is a reason why we believe the Delta variant “growth scare” may have peaked for the markets this past week.

- Furthermore, as long as developing countries have limited access to vaccines, and some people in developed countries refuse to get vaccinated, other variants will emerge over time, perhaps stronger than Delta.

- We believe COVID is going to be an endemic, like the flu. We as a world have to get used to living with this disease.

Our Conclusion

What should you do with your portfolio?

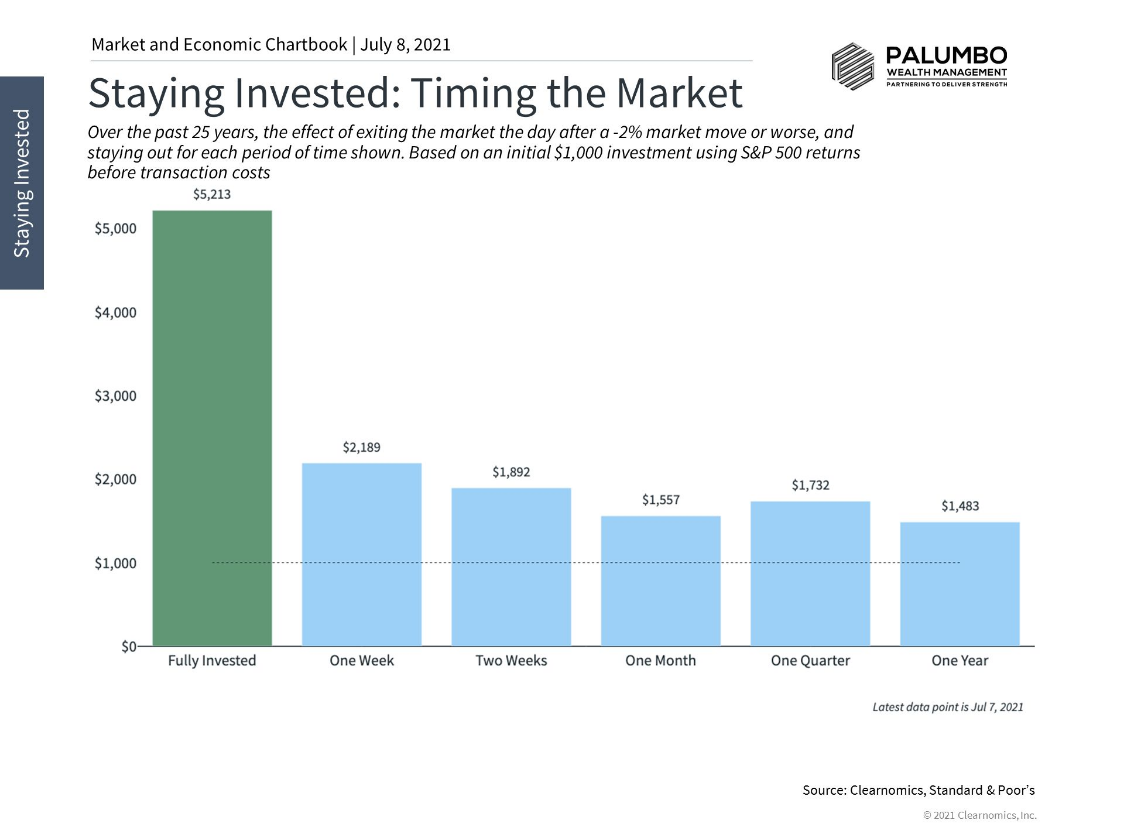

- We don’t believe any investor should sell their risky assets, such as stocks, on anticipation of this variant or others impeding economic growth.

- We believe there is more risk to timing the market then being in the market (please review chart below).

- As we constantly say, being balanced and rebalancing when there are dislocations in various markets, is a sound strategy that will prevail over time.

What should we expect from the upcoming earnings season?

As the earnings season for the second quarter begins, investors will be looking for:

- New signs of growth in corporate revenues and profits.

- In countries like the US, the conversation continues to shift from recovery to expansion as the economic impact of the pandemic fades and inflation heats up.

- Whether the bull market can continue and lofty valuations can be justified will depend largely on whether the economy can find a new gear to sustainably grow.

What can investors expect from company profits in the quarters ahead?

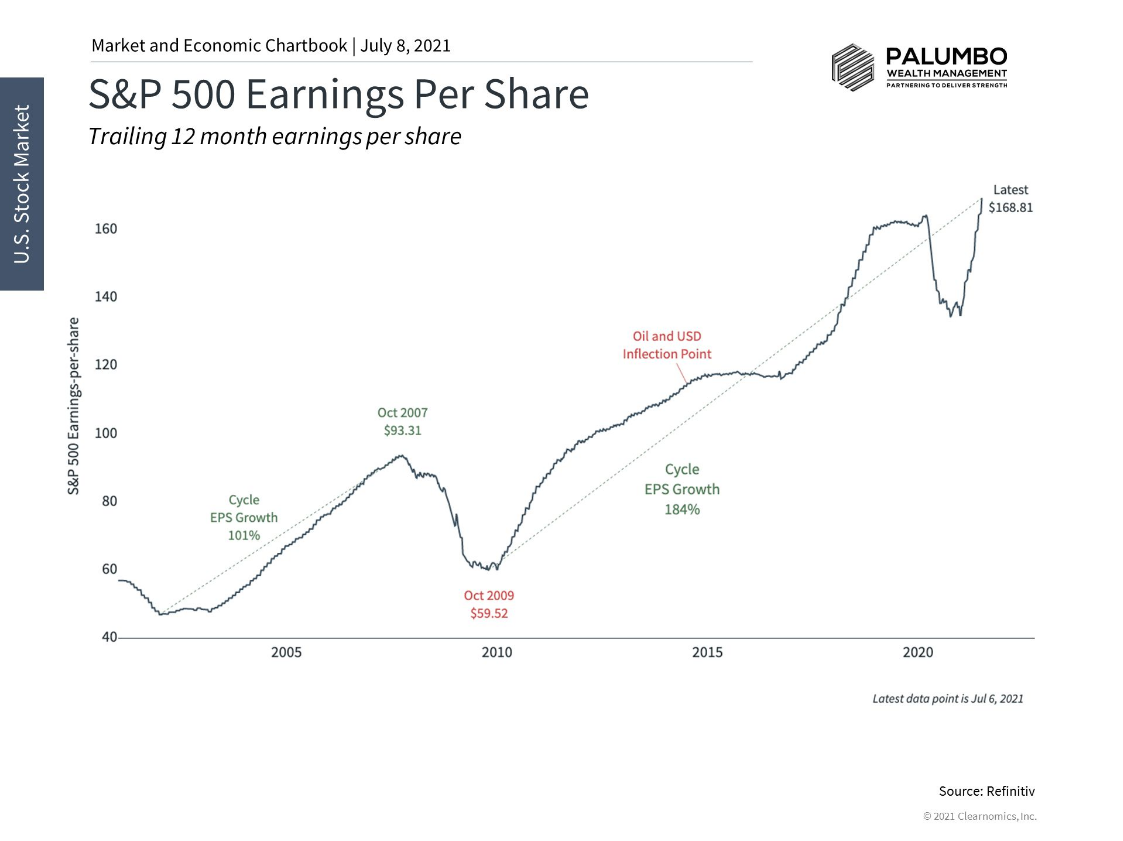

- Current Wall Street estimates suggest that S&P 500 profits returned to pre-pandemic levels of $164 per share during the second quarter, mirroring the expected recovery in GDP across the broader economy.

- This is faster than expected and would represent a 38% growth rate in 2021 and 21% over the next twelve months.

- As recently as the beginning of the year, the market didn’t expect a full recovery until the fourth quarter.

- A full recovery during the second quarter means that the recession in earnings only lasted four full quarters, rather than nearly two years.

Ultimately, investors should continue to focus on:

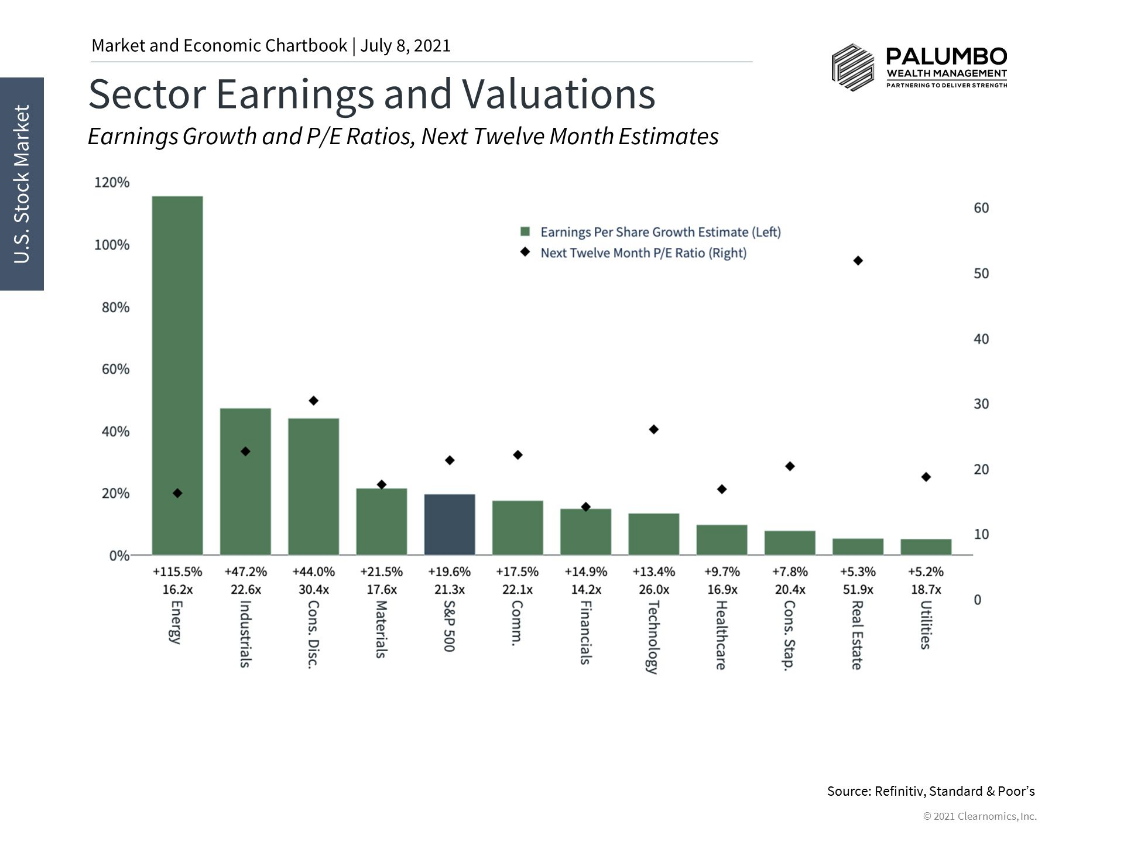

- Earnings and valuations since, in the long run, they are what drive stock market returns.

- Although there are always uncertainties, such as potential new variants, history shows that those who are able to stay invested throughout the business cycle can improve their odds of financial success.

Below are three insights that help keep earnings season in perspective:

- Corporate earnings have likely staged a full recovery

- Many sectors are benefiting from economic growth

- Other regions are catching up

Conclusion

Upcoming earnings reports will be followed closely for signs of continued growth. However, please keep in mind that the Delta variant and others can be a cause for concern for investors. Why? If lockdowns occur throughout the world again, this can cause consumers to pullback spending, which can/will affect corporate earnings in the next quarter or two. So, as much as investors will be paying attention to what companies are saying this quarter, remember that market participants look forward 3-6 months or more to make investment decisions.

What We’re Reading

JP Morgan Chase: Halftime Report: Markets in 2021

130 nations support US proposal for global minimum tax

Reflation rethink sends bond markets into a spin

‘A Narrative of Fear’: Plunging Stocks Finally Heed Bond Signal

10-year Treasury yield falls to 1.25% amid growth/variant concerns

Wells Fargo tells customers it’s shuttering all personal lines of credit

Pfizer says it’s developing a booster shot to target delta variant

US Competitiveness Needs a Shot in the Arm

Retirement Planning:

‘Inflation is the silent killer,’ as many retirees are feeling the sting

Although this might not apply to all retirees, many retirees across the US are seeing the increase in prices across the board effect their bottom line. Being aware of items that are seeing significant price increases can help all retirees remain aware of what they are purchasing.

Tax Planning:

How Charitable Stacking Can Provide Significant Tax Savings

If you donate to charities annually, or are looking for ways to expand your deductions and tax savings during filing season, organizing a donor-advised fund can be one option to look into to save on taxes each year.

Estate Planning:

How to Keep Your Money Safe in the Future

Experts shares strategies for finding a trustworthy advocate to help you keep your finances safe as you age through a power of attorney.

Health:

5 Things To Know About the Delta Variant

Yale’s Division of Medicine updated its concerns of the most prevalent variant of the COVID virus known as the Delta variant. We urge our readers to take a look at their research and findings to gain more knowledge about protection against this strain of Coronavirus.

Entrepreneur:

Horrifying Yet All-Too-Common Marketing Mistakes To Avoid

Marketing for any business can be a tall task, yet avoiding these key mistakes and capitalizing on key opportunities will make or break your marketing strategy.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Asset Allocation, Bonds, COVID, Delta Variant, Earnings, Economic Growth, Federal Reserve, Interest Rates, Jerome Powell, Lockdowns, Macroeconomics, S&P 500, Timing the Market, Treasuries, USD, YieldArticles, General News, Weekly Commentary

By: Adam