The Bond Market Looks Confused

- Market sentiment has been flip-flopping back and forth between inflation concerns and economic concerns.

- The very rapid economic recovery has outpaced a COVID constrained supply chain and caused price increases and inflation concerns.

- Now, the COVID acceleration and rising prices are beginning to slow demand (see the recent housing data) and concerns of an economic slowdown are filtering into the Wall Street narrative.

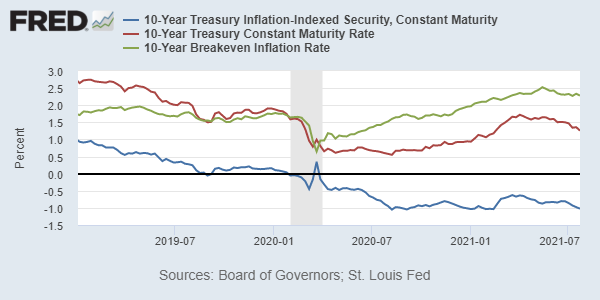

Bonds have generally reacted as expected, but not nearly to the degree that might have been predicted. Nominal yields (actual interest rates bonds are paying) initially rose with inflation fears but recently have headed back down. However, real yields (nominal yields minus inflation) have remained stubbornly low, in fact, negative.

The chart below shows the yield of the 10-Year Treasury Inflation Indexed bond (blue line); the yield on the 10-Year Treasury bond (red line). The green line is the breakeven inflation rate which is simply the difference between the two. The breakeven inflation rate is the inflation rate where the return on both bonds will be equal. If inflation is less than the breakeven rate, the nominal bond will have the higher return and if the inflation rate is higher than the breakeven rate, the inflation protected bond will produce the higher return over time. Because of this characteristic, the breakeven rate is the market’s expectation for inflation.

In light of the sharp economic downturn that the pandemic produced, it not shocking that real interest rates turned negative for a while. Government intervention was aggressively pushing down interest rates and inflation was not a risk as the economy declined.

With the fast recovery, why has the bond market been surprising slow to respond to inflation fears?

The bond market appears convinced by the Fed’s argument that inflation is transient due to the unusual characteristics of this pandemic recovery.

What about the massive stimulus that may still be coming in the form of infrastructure spending, won’t that push inflation higher?

It may. Aggressive fiscal policy during a period of high growth increases the chances, but does not guarantee, a persistent inflationary trend. However, we believe the delta variant is currently the primary risk factor and has been for the past month. Until investors are confident that this is under control, they will continue to buy assets that can protect their risky investments, like Gold and Treasuries. The chart below shows the outperformance of these asset classes relative to the S&P 500 below over the past month.

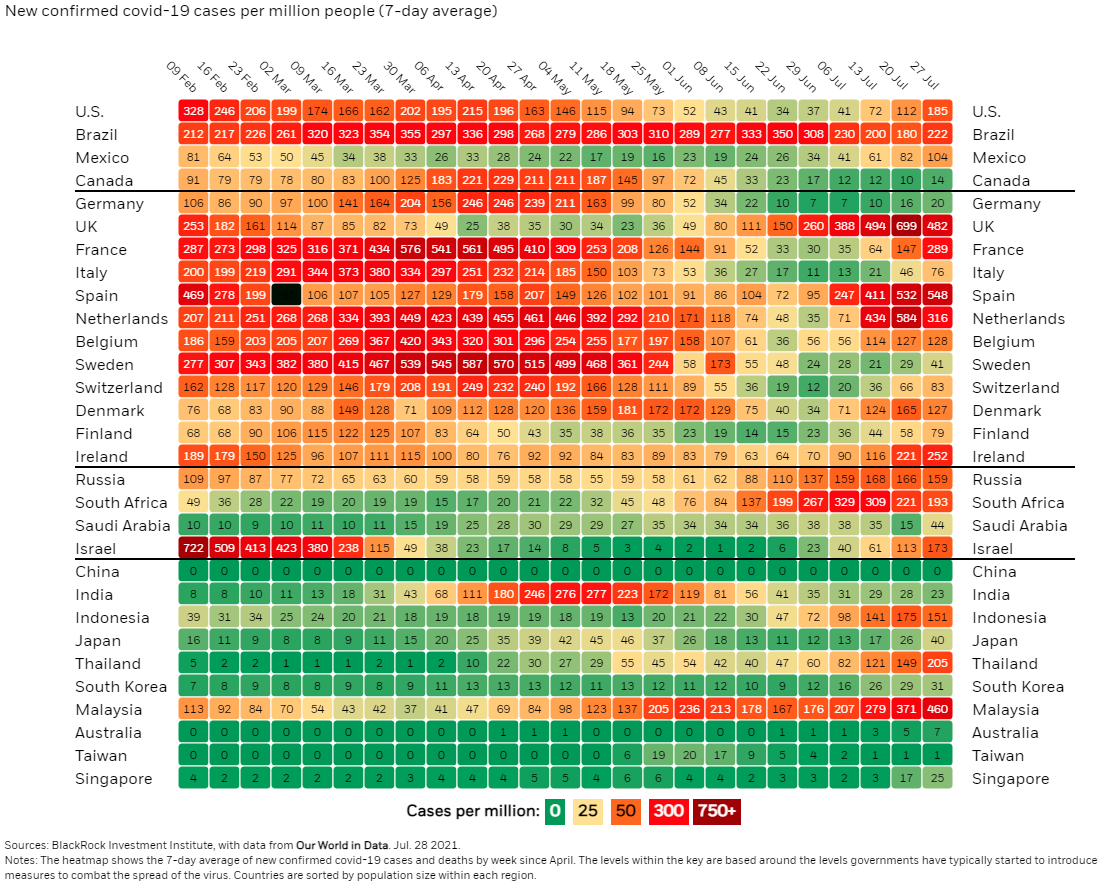

Market gyrations are to be expected as sentiment waffles with the daily news flow. Our perspective is that the global COVID scare is a bigger issue than in the U.S. Although the U.S. recovery is well entrenched, global risks remain as supply chains depend heavily on Asian countries, many of which are largely unvaccinated. We suggest that infection rates in Japan, South Korea and throughout Asia may be a tell-tale sign of what comes next in the economy. If COVID picks up in these areas, it could further pressure stretched supply chains and extend inflationary pressures on prices. That would logically push interest rates higher.

Fed Takes Action to Head Off Market Stress

- If the repurchase (repo) market doesn’t function well, financial markets in general cannot function well.

- The Fed is creating a permanent repo facility to enable it to quickly provide liquidity in times of market stress.

When market turmoil inevitably arrives, there is typically a bit of a panic in markets. This panic is driven by too many sellers and few, if any, buyers. When this happens, you will read about a ‘lack of liquidity’ in markets. The Fed steps in and ‘provides liquidity’ via the ‘repo’ market, thus easing market stress.

Repurchase Agreements (Repos) are a critical part of our financial system that you normally never see. It is estimated that some $2 to $4 trillion of debt are financed in the repo market each day. It is often described as the plumbing, or the heart of the financial system. When it’s working you don’t notice it, when it’s not working, it’s a real problem.

A repo is when a firm sells securities to another and agrees to buy back those securities at a slightly higher price, usually overnight. It’s a very short-term collateralized loan and the interest, or repo rate, is the difference in price.

Why does this happen?

Because financial institutions do not want large amounts of cash sitting around idle earning nothing.

What occurs during stressful economic/market times with the repo market?

- The demand for cash can grow quickly; i.e., no buyers available, which dries up available credit.

- When you have limited buyers of anything, especially credit (short-term bonds), it can push up the repo rate (and other interest rates). Rates on these vehicles rise to attract buyers.

- This makes it harder for businesses to get much-needed funds and that is clearly not what’s needed at times of stress.

- The Fed steps in and provides cash (liquidity) to the market using repo agreements.

The problem is that it takes time for the Fed to put their repo facilities is in place and the delay only allows the stress to worsen. Having a standing facility allows the Fed to be ready for an emergency and that will hopefully will ease market stress more quickly at those critical moments. We believe this is an overdue move that can help to maintain some measure of calm during heightened volatility.

This facility will initially be limited to foreign governments and government bond dealers, but will eventually be extended to deposit institutions as well. The idea of creating a standing repo facility has been knocking around the Fed since 2019. None of this sounded like a big deal in the news this week, but it is.

What We’re Reading

U.S. delta-driven Covid spike could peak in 3 weeks,

Internal CDC doc urges new messaging, warns delta infections likely more severe

Is the End Near for U.S.-Listed Chinese Companies? Probably, Says Carson Block

U.S. GDP rose 6.5% last quarter, well below expectations

Shrinkflation! (2 Min. Video)

Current Reservoir Conditions in California

Pending home sales drop in June — more evidence of a housing turnaround

A full recap of the Fed’s interest rate decision and Chair Powell’s press conference

As Vaccines Do Their Work, Focus Moves to Long Covid

California NIMBYs Threaten Biden’s Clean Energy Goals

SEC freezes Chinese company IPOs over risk disclosures

Retirement Planning:

Why You’ll Likely Spend More Than You Think Post-Retirement

Think you’ve got an idea of how much you’ll spend when you retire? Think again.

Estate Planning:

Estate Planning for New and Aging Parents

What to anticipate when expanding your family.

Tax Planning:

Biden’s Tax Plan Could Make ‘Marriage Penalty’ Worse

The so-called “marriage penalty” may have just gotten larger for high-earning dual-income households.

Health:

7 Questions You May Be Afraid to Ask About Stylish Shoes

Move over, Carrie Bradshaw. Those pointy stilettos and fashion sneakers may not be worth the pain, after all.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Asia, Bonds, COVID, Federal Reserve, Inflation, Interest Rates, Liquidity, Repos, Treasuries, YieldArticles, General News, Weekly Commentary

By: Adam