Can the Infrastructure Lure finally Catch Some Funding?

- Infrastructure should be an easy bipartisan issue.

- How we pay for it is a big sticking point. Getting a bill passed will not be easy.

There are few issues that have been discussed as consistently as infrastructure, but with no meaningful result. Most recently, infrastructure was a key pillar of the Trump agenda, but it went nowhere fast. Now the Biden Administration is talking infrastructure too. The question is whether they can succeed where so many others have recently failed.

On the surface, you’d expect infrastructure spending to be a bipartisan issue, and on the surface, it is. As usual, the devil is in the details and so far, no one has been able to convert the theoretical support into real support. Part of the problem is the red/blue divide. If you thought Trump’s defeat would fix this, think again. There is plenty of talk about ‘bringing the country together’ but no one has held out an olive branch to begin that process. A core inability to compromise on what should be done is not a winning strategy.

In addition, infrastructure brings our financial/debt problems right to the front burner. How much is this going to cost, and who is going to pay for it? The $5 trillion of COVID relief passed in the last 12 months is equivalent to almost one quarter of the economic output of the entire country and it has been financed with borrowed money!

While both sides of the aisle can agree that infrastructure would be a good investment, the sticking point will be who pays for it and how that will be accomplished. Biden plans to pay for some of it with tax increases and the rest by borrowing more. Republicans are only going to go so far with additional debt and tax increases could be a non-starter.

We Shouldn’t Worry About Borrowing, When We Are Investing in Our Productivity

At the end of WWII, we had the only industrial infrastructure left standing. Since then, everyone else has rebuilt, while we have done relatively little. We now have the oldest infrastructure and are at a disadvantage. Probably the proper time to talk infrastructure was in the wake of the Great Financial Crisis. Unemployment was very high and the Federal Reserve had hit a limit on traditional monetary policy (i.e., short term rates to zero) to revive the economy. The Fed was, in effect, begging for Congress to begin some fiscal spending – an infrastructure plan would have been ideal. But it did not happen. Now we have many trillions of additional debt and very little to show for it while infrastructure remains a critical need. The problem is that after all the new debt in the wake of the GFC, and now adding many trillions more in response to COVID, we have a potentially insurmountable debt problem. Ray Dalio, of Bridgewater Capital puts it this way in his recent article “Why in the World Would You Own Bonds When…” (see What We’re Reading for the full text of this excellent article):

“There is now over $75 trillion of US debt assets of varying maturities. US Treasury bonds and notes account for $16 trillion of this and US Treasury securities of other maturities account for another $5 trillion. Holders of these debt assets will either hold them until maturity and endure the previously described terrible returns or sell them. Most holders of debt assets believe that they can sell them to get cash and to buy goods and services with. After all, the only purpose of holding financial assets is to be able to convert them into the buying of goods and services. The problem is that, at current valuations, there is way too much money in these financial assets for it to be a realistic expectation that any significant percentage of that bond money can be turned into cash and exchanged for goods and services. If any significant amount tried to make that shift a “run on the bank” type dynamic would ensue. When such a dynamic—which I call a “reverse wave”—occurs there is no stopping it. It has to be accommodated the way it was accommodated in the 1930-45 period and the 1970-80 period (and hundreds of similar periods throughout history) via printing a lot of money and devaluing it, and restructuring a lot of debt and government finances, usually including large increases in taxes.”

This massive level of debt seems likely to make a Congressional agreement on an infrastructure bill much more difficult than it should be, despite the fact that a quick passage would go a long way to getting unemployment back to acceptable levels. Borrowing all the money for infrastructure would appear to be a non-starter for the fiscal conservatives (we use that term very loosely) and problematic at a minimum for the most centrist Democrats. Biden has hinted that tax increases would pay for at least part of the infrastructure plan, but again, the red team appears uninterested in reversing the tax cuts they implemented only a few years ago. We suspect an infrastructure bill will be a tight squeeze through Congress.

For its part, Wall Street is clearly anticipating an infrastructure bill being passed in the near future. Just take a look at the chart (at right) of some big beneficiaries of an infrastructure bill – Caterpillar, Eaton Corp and United Rentals. All are well above their respective pre-pandemic levels with an accelerating trend recently. We surely hope a bill can be passed, but it might not be as certain as the market suggests.

The Fed Puts ‘Meat On the Bones’: McCulley

- The Federal Reserve’s dot-plot projections grew more hawkish, but most members still project keeping rates near zero through 2023.

- The GDP forecast for 2021 was raised to 6.5% from the 4.2% forecast at the December meeting.

- Unemployment is expected to fall to 4.5% in 2021, down from the previous estimate of 5%.

- Inflation is now expected to run at 2.4% in 2021, up from the previous estimate of 1.8%.

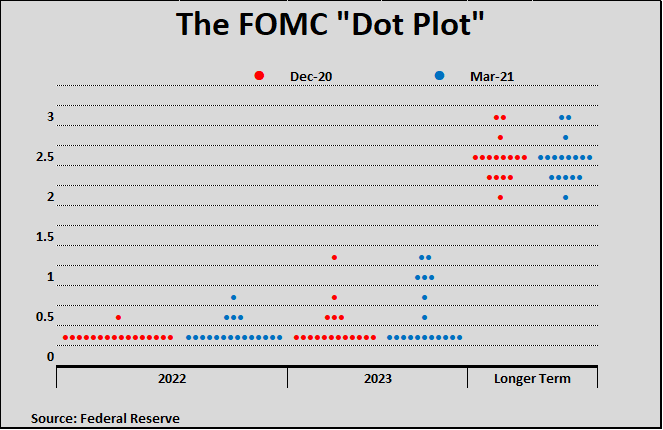

The Fed’s quarterly release of its economic projections arrived on St. Patrick’s Day following a great buildup of expectations due to the recent move toward higher long-term interest rates. Would the Federal Open Market Committee (FOMC) react to those increases, and if so, how? Would they signal any changes in policy? The answer was expected to be in the “Dot Plot”, which is a compilation of the estimates made by all members of the FOMC. Back in December, the previous release, 5 of the then 17 FOMC members projected at least one rate hike in 2023, with two of those projecting 2 or more hikes in 2023. (See chart below).

There was speculation that the FOMC would become a bit more hawkish to appoint where the median dot would project at least one rate hike in 2023. We didn’t quite get there. However, 7 of the current 18 members projected rate hikes in 2023 and 6 of those projected more than one rate hikes in 2023. This is definitely a more hawkish tone on rate expectations, but not out of line considering a) the improving COVID situation, b) success of the vaccines and 3) the expectation of a faster re-opening that had been initially projected. All of these are supportive of expected increases in GDP and inflation.

Markets took in the news rather well in the hours after the meeting, but Thursday morning was a different story as markets took the results to signal that the Fed would allow rates to go still higher, and they did. The bond vigilantes are not dead.

With all that said, our perspective is that maybe the most meaningful analysis came from Paul McCulley (former PIMCO Chief Economist) in a CNBC interview, where he called this meeting “the funeral for the doctrine of preemption”. Allow us to explain. Back in the old days, the Fed would only make policy changes when the situation became obvious. That always brought criticism that if they had only acted earlier, things wouldn’t have been so bad. Beginning with Greenspan, the Fed began to act more proactively as the theme for the time was that this could be possible to eliminate economic cycles. That gradually transitioned into a pre-emptive framework, where the Fed would act on expectations even before there was firm evidence of that change. Last year, the Fed indicated a change in that framework, and this week was the first true test of that framework. Economic conditions are clearly improving faster than they expected, yet the FOMC did not act preemptively by easing its foot on the economic accelerator in the face of stronger growth. For McCulley, as well as for us, this is a welcome change. The experiment to eliminate the economic cycle has clearly failed.

Does Passive Investing Have a Death Wish?

- Passive (index) investing has seen enormous growth.

- But if passive investing continues to grow, it can add risk.

There is an increasing amount of discussion that passive investing, which has become enormously popular, is also creating a unique set of risks for itself – a victim of its own success. First let’s define passive, versus active investing. Passive investing is built on the idea that it is very hard, if not impossible, to beat the market consistently. As a result, an investor is better off simply investing in a broad index of stocks, like the S&P 500. There are numerous mutual funds and ETFs that mimic the S&P 500, as well as other broad indexes and more recently other sub-indexes, based on themes, factors, and other criteria. The point is that a passive investment is designed to replicate that index no matter what it does. There is no ‘stock picking’ in a passive investment. It simply owns everything in the index proportionately, i.e., it is passive. Active investing is ‘old school’ investing. It is an attempt to beat the market, or some other benchmark, by picking better stocks.

Passive investments typical carry lower fees as there is no need for a research staff, and other investment infrastructure. Active funds, because of their higher fees, therefore have another hurdle to clear to beat their benchmark. They must not only beat the benchmark; they must beat it by more than their fees. That isn’t easy.

The passive vs. active debate has been most prominent in qualified retirement plans, like 401ks and 403bs. Plan sponsors, fearful of lawsuits about their plan investments, have moved strongly into passive investments for this reason. All those target date funds you see in your plan are passive investments.

As is often the case, this all appeared to be well and good, but as passive investing popularity grew, it started to raise questions about unintended consequences. When there were relatively few passive investors out there, everything was fine, but now that passive is now larger than active, it is raising some unforeseen risks. The problem is that as money pours into index funds, that money is added relative to the weight of the stocks in the index. Naturally that adds more of the bigger stocks and less of the smaller stocks and none of those not included in the index.

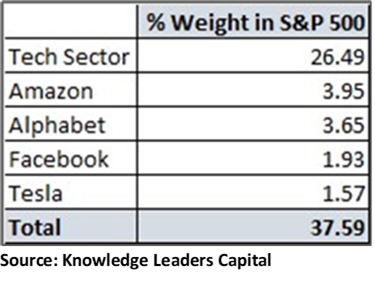

That might matter because it can (and actually has been) adding to the sector risk of the index. Broad indexes are supposed to be just that, owning a broad array of stocks in various industries, a diversified portfolio of stocks. Here is the problem. The S&P 500 index is now essentially 38% in one sector. The technology sector is about 27% of the index. Amazon, Alphabet (Google), Facebook, and Tesla are not in the technology sector, they are in the consumer discretionary or communications sectors. When those are added in, the group totals almost 38% of the index.

With valuations for this group of stocks being particularly elevated, owning a passive S&P 500 index funds could have substantially more risk than the investor anticipated with a large portion of the portfolio invested in the most expensive stocks and it is being done without a second thought. What is interesting is that the more prevalent passive investing becomes, the bigger the problem becomes. This is a difficult problem to overcome, especially in qualified retirement plans (401ks and 403bs) as there are precious few alternatives available.

FYI, our equity portfolio investments are primarily in individual stocks, chosen based on a variety of criteria, and designed to be diversified, but not locked into a passive allocation and this is the reason why. There are many ways to be diversified that do not require passive investments.

What We’re Reading

Why in the World Would You Own Bonds When…

U.S., China kick off ‘tough’ talks in Alaska with rare public rebukes

Ford cutting shifts, partially building pickups and SUVs due to chip shortage

Recap and analysis of Fed Chairman Powell’s market-moving comments on rates

Biden Eyes First Major Tax Hike Since 1993 in Next Economic Plan

COVID-19 is no longer the biggest tail risk: BofA fund manager survey

Capturing the Renewable Energy Shift

U.S. to push more ‘aggressive’ messaging effort to deter migrants

Germany’s Greens vow to scrap Russian gas pipeline after election

Everywhere You Look, the Global Supply Chain Is a Mess (WSJ, Subscription Req’d)

Retirement Planning:

Social Security Basics: Full Retirement Age

Full retirement age is the age when Americans receive full Social Security benefits. Your full retirement age varies depending on the year you were born.

Tax Planning:

How you can still find a 30-year mortgage rate under 3% for your refinance

Rates have been rising, but remain very low by historical standards, meaning many homeowners still have a major incentive to refinance their mortgage.

Estate Planning:

Careful Use of Life Insurance in Estate Planning

Life insurance may play a vital role in an estate plan because insurance proceeds can be counted on to provide liquidity when it’s needed.

Health:

Carbs are essential for weight loss, according to a nutrition doctor.

Both the quality and the quantity of carbs matter for your diet goals.

Entrepreneur:

Practical Ways To Protect Your Company From Hackers And Phishing Attacks

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Active Investing, Alphabet, Amazon, Asset Allocation, Asset Classes, Asset Valuation, Biden Administration, Borrowing, Bridgewater Capital, Caterpillar, Congress, Debt, Eaton Corp, ETFs, Facebook, Fed Dot-Plot, Federal Reserve, Fixed Income, FOMC, GDP, Hawkish, Inflation, Infrastructure, Passive Investing, Paul McCulley, PIMCO, Portfolio Diversification, Ray Dalio, S&P 500, Spending, Taxes, Technology, Tesla, Treasuries, Unemployment, United RentalsArticles, General News, Weekly Commentary

By: Adam