When is it Too Much?

First the pandemic bred fear, and then it bred money. Clearly there was a great financial need among many millions of Americans as the pandemic closed down the economy in the Spring of 2020. Congress came out swinging with several bills, spending trillions of dollars in an attempt to offset the pandemic impact. That effort was mostly successful, but because it was impossible to direct the money precisely where it was needed, we decided it was better to over-spend than under-spend. That is a legitimate decision, but one that appears to have come with some unintended consequences.

- Giving many people more money than they lost in the pandemic set up an incentive to spend it, pulling future demand forward into the present.

- When this happens, companies that can meet rising demand can show spectacular profits. A recession will typically lead to cost cuts. Combine that with rapidly recovering demand, and presto, profits soar.

- It can also push inflation higher. When demand suddenly spikes, in an environment that is supply constrained by the pandemic, shortages are tend to develop. That leads to higher prices, and of course, higher prices also contribute to soaring corporate profits.

The Fed sees the current inflation as largely transitory. The reason for this position is that much of the inflation is the direct result of market dislocations, there is not enough current supply (depressed by COVID) to meet current demand (accelerated by fiscal policy). These things naturally correct over time, but as they do, it can create unusual swings in economic data.

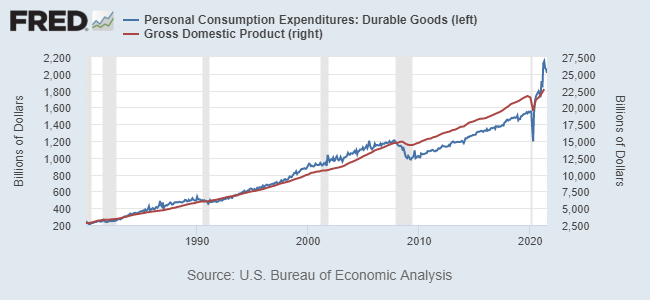

Here’s an example. The chart on the following page shows Personal Consumption Expenditures for Durable Goods (blue line) and GDP (red line) over the past 40+ years. Durable goods are items that do not wear out quickly, like washing machines, small appliances, cars, etc. In short, items that do not wear out quickly and therefore do NOT need to be replaced often. The dislocation in durable goods is obvious on the chart.

Durable goods expenditures and GDP have generally mirrored each other over the years. Today, while GDP is back to trendline, durable goods expenditures have gone parabolic. It is clearly unreasonable to think that durable goods demand is now on some new growth track. Rather, demand that might have occurred over the next several years was pulled forward by the influx of free money.

- Pulling demand forward merely makes demand uneven, squeezing longer-term demand into a shorter window. But once that surge is over, you typically go back to sub trendline demand.

- Less than trendline demand ultimately puts pressure on corporate profits. In other words, by pulling demand forward, we have also pulled profits forward!

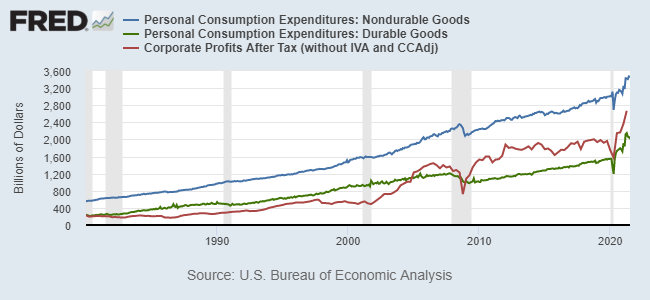

Now take a look at this chart, which compares Personal Consumption of Durable Goods and Nondurable Goods with corporate profits. Note the spike in durables and nondurables mirrors the spike in profits. This makes it easier to see how when demand is pulled forward, it also pulls profits forward. There is no reason to believe that demand for durables and nondurables are on a new, rapid growth track, and the same can be said for profits. The effect is similar to an item going on sale. The sale spikes sales, but when the sale ends, sales decline because the sale did not increase demand, it simply pulled demand forward.

If there is trouble in the market, one source could be that pundits are very focused on the transitory spike in profits today, and not focused much at all on the what happens when demand normalizes. The euphoria created by that mindset makes for higher equity prices until that transition occurs.

What we do know is that at least some of the recent inflation is transitory in nature, as is the corporate profitability driven by transitory demand. Where and when will it all settle? We certainly do not profess to know that answer. Our guess, at this point, is that markets are in for an uncomfortable awakening when the narrative begins to change to slower growth.

As we said last week, it is an unpredictable world. Predicting the future is not easy and predicting it consistently is impossible, which is why we stick to our plan, and leave the predictions to others.

What Could Go Wrong?

An email went around the office of a ‘bright light’ with a Gopher problem. He decides the best idea is to release some propane into the hole and then ignite the propane. What could go wrong? (Think Caddyshack.) He was probably successful in ridding himself of the gopher, but he was left with a fairly significant hole in the ground. Luckily, no one was hurt.

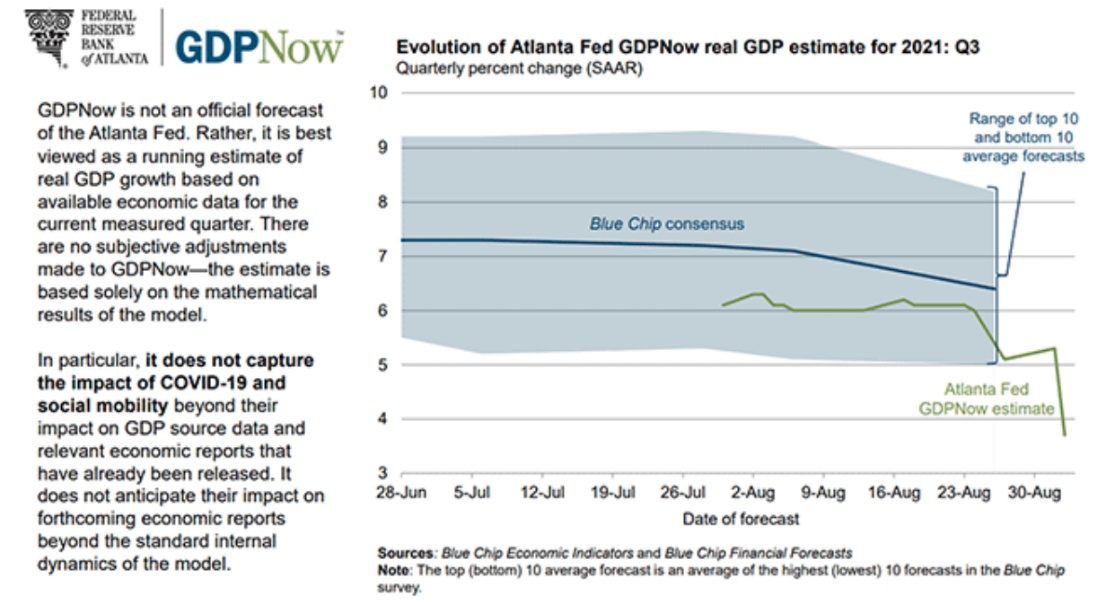

As we mention above, the financial world is highly focused on strong corporate profits and that of course, is the rationale for the continuing stock market strength, despite high valuations. What could go wrong? As Bobb Farrell, the long-retired guru form Merrill Lynch, opined many years ago, in his 10 stock market rules, when all the experts and forecasts agree – something else is going to happen. The beginnings of that ‘something else’ may be appearing. The Atlanta Fed, in its most recent GDP estimate for the third quarter, reduced the estimate from 5.3% to just 3.7%, a substantial change.

Also this week, Morgan Stanley economist, Ellen Zentner, reduced her third quarter GDP estimate from 6.3% to only 2.9%. And of course, this comes on the heels of a similar reduction at Goldman Sachs, which was discussed on these pagers previously. To be fair, Zentner’s Q4 GDP forecast remains at 6.7%. She writes: “With August as the low in activity, our forecast for 4Q GDP remains at 6.7%, helped by momentum in September as the sequential data begins to improve into the final quarter of the year.”

We suspect the path of COVID globally will define the near-term path for GDP. There are some early signs that the surge in the U.S. is peaking, but with schools re-opening, it is highly uncertain what that means for the path of COVID as winter approaches. COVID infection rates in Asia could be a strong determinant of supply over the coming months as growth in infections has already slowed their ability to supply the goods we desire. Indeed, a slowing of growth in the U.S. might not be welcome by the stock market in the near term, but it could give supply chains a chance to finally catch up, which would be a welcome event in the long run.

What We’re Reading

Pandemic’s $794 billion unemployment benefits were historic.

How the August jobs report plays into ‘stagflation’ arguments

As U.S. unemployment benefits end, firms hope for a wave of applicants

Damage from Hurricane Ida could reach $80 billion

China’s Regulators Are Moving Fast and Breaking Things. Watch Out.

Senate Democrats Eye Taxes on Stock Buybacks, Excess CEO Pay

China ‘tells US envoy John Kerry it will follow its own climate road map’

Slowest rise in activity so far this year as demand recovery slows during August

Retirement Planning:

How Stretch IRA Tactics Have Tightened

New rule for inherited IRAs.

Estate Planning:

The Very Rich Already Have A Plan To Escape Biden’s Tax Increase

Wealthy Americans are scrambling for places to hide from plans by Democrats to hike their taxes. Many on Wall Street think they’ve found just the thing.

Tax Planning:

The Very Rich Already Have A Plan To Escape Biden’s Tax Increase

Wealthy Americans are scrambling for places to hide from plans by Democrats to hike their taxes. Many on Wall Street think they’ve found just the thing.

Health:

The Language of Long-Term Care

Navigating the care maze can be overwhelming; understanding the lingo can help.

Entrepreneur:

What’s the Real Difference Between Leadership and Management?

The distinctions between managing and leading people impact your professional purpose. Here are five aspects that set them apart.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

COVID, Demand, Federal Reserve, GDP, Inflation, Liquidity, PandemicArticles, General News, Weekly Commentary

By: Adam