The Taper is Finally Here and Markets Did Not Panic.

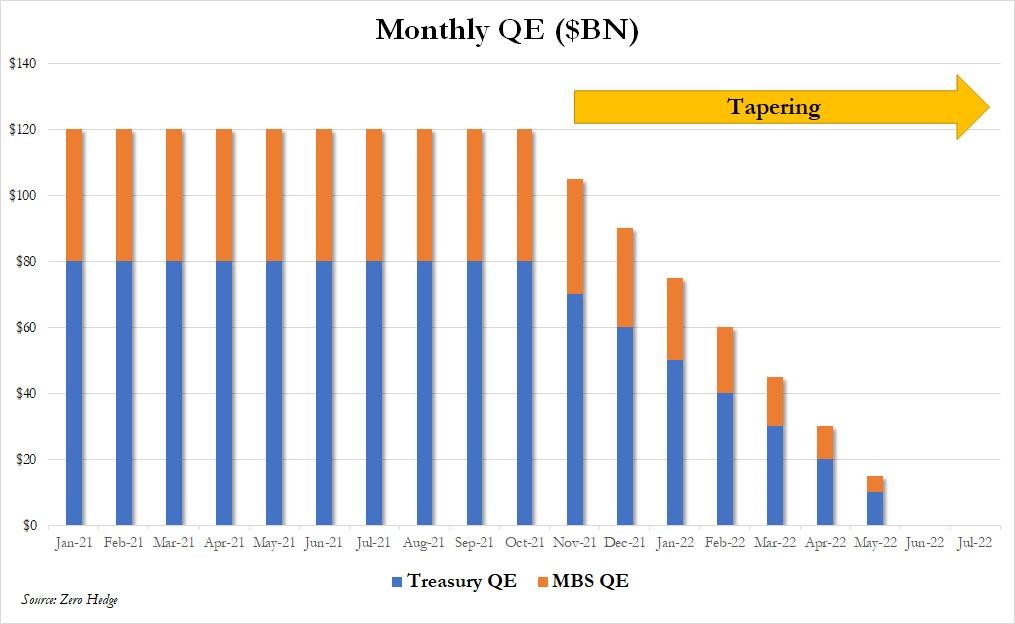

- Tapering simply means that the Fed will reduce, and eventually eliminate, the extraordinary accommodation supplied to financial markets since the beginning of the pandemic. That accommodation was in the form of open market purchases of both Treasury bonds and mortgage backed bonds (known as QE or Quantitative Easing), to the tune of $120 billion per month, which served the purpose of flooding markets with liquidity (money).

- The announcement was that the Fed will purchase $15 billion fewer Treasuries and $10 billion fewer mortgage-backed bonds in November and reduce purchases by the same amount again in December.

- The plan (but not the commitment) is to repeat that reduction each month until purchases are halted completely. The implication is that these bond purchases would be eliminated by mid-2022. (See chart below).

Why Now?

- The Fed believes that the economy, in general, and employment, in particular, has sufficiently recovered to allow this accommodation to be reduced and ultimately removed (i.e., tapering).

- The Fed would prefer to have a full ‘tool kit’ to deal with future problems and this action begins to re-stock that tool kit.

What Are the Risks of Tapering Now?

- The economic recovery from COVID has created an unusual set of economic circumstances (very rapid decline, equally rapid recovery, excess demand and supply chain bottlenecks). This is a situation that has not been experienced before.

- 2021 has been a very strong year economically, on the heels of the short, sharp recession of 2020, but now that we have lapped the worst of the economic shutdown, growth has been slowing. That was recently confirmed when the initial GDP estimate for the third quarter was a disappointing 2.0%. The Fed is blaming that largely on the Delta variant. Now that Delta is under control, they expect growth to re-accelerate in the fourth quarter and into 2022.

- There are plenty of headwinds to that forecast. There is a serious energy problem in China and Europe. In the U.S., supplies are also getting tighter, and while there may not be physical shortages, prices are, and will likely remain, significantly higher than last year.

- This is the worst kind of inflation because when it comes to energy, there are no alternatives, so the higher price acts like a tax that hits the less advantaged hardest. Higher taxes imply less disposable income and falling aggregate demand, potentially leading to stagflation or even recession.

- If their assessment is incorrect, the Fed could be tapering into a weakening economy, which would be counter-productive and potentially make the economic situation worse.

What Comes Next?

- The Fed remains convinced that inflation will be a temporary problem and therefore they continue to respond in a way that that assumes that outcome. On the other hand, they also admit the current inflation is lasting longer than expected and will last into 2022.

- The Fed also made it clear that raising interest rates (which would logically be expected when tapering is complete) will be a separate decision. At this point the market doesn’t appear to buy that story as the current rate structure would imply a roughly 70% chance of an increase in rates in July of 2022 and a 90% chance by year end 2022.

What Do We Think?

- First, and most important, these issues are mostly impossible to predict. Business news offers many perspectives, but no one really knows, including us. We don’t try to predict the future as much as we want to understand the risks that may lie ahead. From that perspective, our gut is that there are significant headwinds to the re-accelerating growth narrative.

- Our assumption is that there are plenty of potential potholes ahead, which is why we preach for a diversified portfolio. By balancing portfolio risks, we are able to stay invested and worry less about what the Fed is doing and where the economy is going.

- If we had to bet (and we don’t), we would wager that inflation won’t be as temporary as the Fed believes and that Q4 growth will disappoint. That would imply we could be headed toward stagflation (slow growth with inflation).

The Heat Is On

- The most surprising event of the week, and probably one of the most surprising events of this year, occurred on election day. The fact that the Virginia governorship went red isn’t that much of a surprise. It was a close race all along. The big surprise came in other places, like New Jersey, Buffalo, Minneapolis and right here on Long Island, where the progressive left was rejected by voters and the center of the electorate moved their vote from blue to red.

- It was always difficult to see how the Democrats would be able to maintain their control over the house and Senate in 2022. It is very typical for the incumbent party to lose seats in the mid-term election and it will only take the loss of a few seats to lose control. After this past Tuesday, it now appears we are firmly on that path. Ciatterelli was down by double digits in the polls, yet came within a fraction of a percent of beating Murphy for NJ governor. That was an eye opener. On election night CNN showed some exit polling stats from the race in Virginia were of particular interest.

- Both Biden and Trump had a 54% negative opinion in the exit polls.

- Among those that disapproved of Biden AND had a negative opinion of Trump, Youngkin, the Republican, beat McAuliffe, the Democrat, 67% to 32%.

- These results place enormous pressure on the Biden Administration to get something done and the progressives have to decide if they want to continue playing hardball at the probable expense of getting nothing done.

- Pelosi has promised a vote late Friday, Nov 5. News reports indicate that the progressives have gotten on board, but now moderates are concerned about voting before the CBO has a chance to review and score the legislation. If that position doesn’t change, the bill won’t be addressed until sometime around Thanksgiving.

What We’re Reading

Zillow closes troubled home-flipping business amid a ‘decelerating’ housing market

Fed sings the ‘transitory’ inflation refrain, unveils bond-buying ‘taper’

COP aims to end coal, but the world is still addicted

Pfizer says antiviral pill 89% effective in high-risk COVID cases

Legendary investor says US stocks are in a ‘magnificent bubble’; crazier than1929

Here’s where the jobs are — in one chart

Covid-19 Lockdowns Ripple Across China

Pfizer’s Covid pill with HIV drug cuts the risk of hospitalization or death by 89%

Visualizing Congestion at America’s Busiest Port

Biden and Trump Both Lost This Week

Estate Planning:

What Estate Planning Should You Do Now That Congress Might Not Change Anything?

Tax Planning:

It’s not too late to reduce your 2021 tax bill. Here’s how.

The tax-smart ways to donate to charity, pre-pay college bills and deal with your Roth IRA

Health:

The #1 Best Way to Prevent Holiday Weight Gain, Says Dietitian

The holiday season can be an incredible time full of family and friends, your favorite activities, and tons of parties and festivities, but it’s also one of the easiest seasons for your weight loss goals to unravel.

Entrepreneur:

Why Empathetic Leadership Is More Important Than Ever

Understanding and sharing the feelings of others is emerging as a critical leadership trait, but how can you be sure you are truly empathetic, and not just sympathetic?

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

COVID, Democrats, Federal Reserve, GDP, New Jersey Vote, Quantitative Easing, Republicans, Stimulus, Supply Chain, Tapering, Treasuries, Virginia VoteArticles, General News, Weekly Commentary

By: Adam