Story of the Week: Markets Hit All-Time Highs During the Week, Again!

This is why market timing is so difficult. When the market was declining in September, many Wall Street strategists like Mike Wilson from Morgan Stanley, were calling for a 10-20% correction. Many thought we had seen the peak.

With all the resources that these major firms have, more often than not, they get it wrong and that has been the case throughout our many years of collective experience. After a -5.2% decline from the S&P 500’s peak (see chart below), the market, once again, recaptured it’s high during the week.

Why?

- Earnings continue to be strong

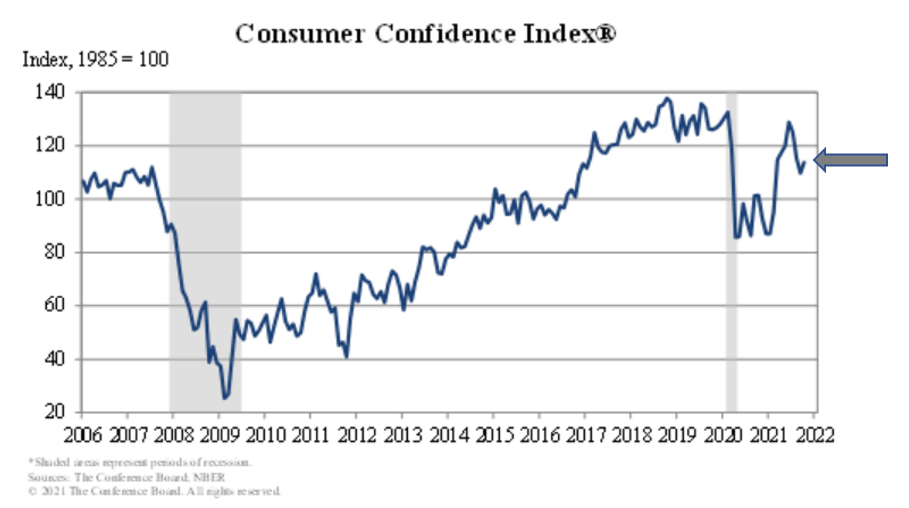

- Consumer confidence came in higher than expectations (This monthly report details consumer attitude, buying intentions, vacation plans and consumer expectations for inflation, stock prices and interest rates).

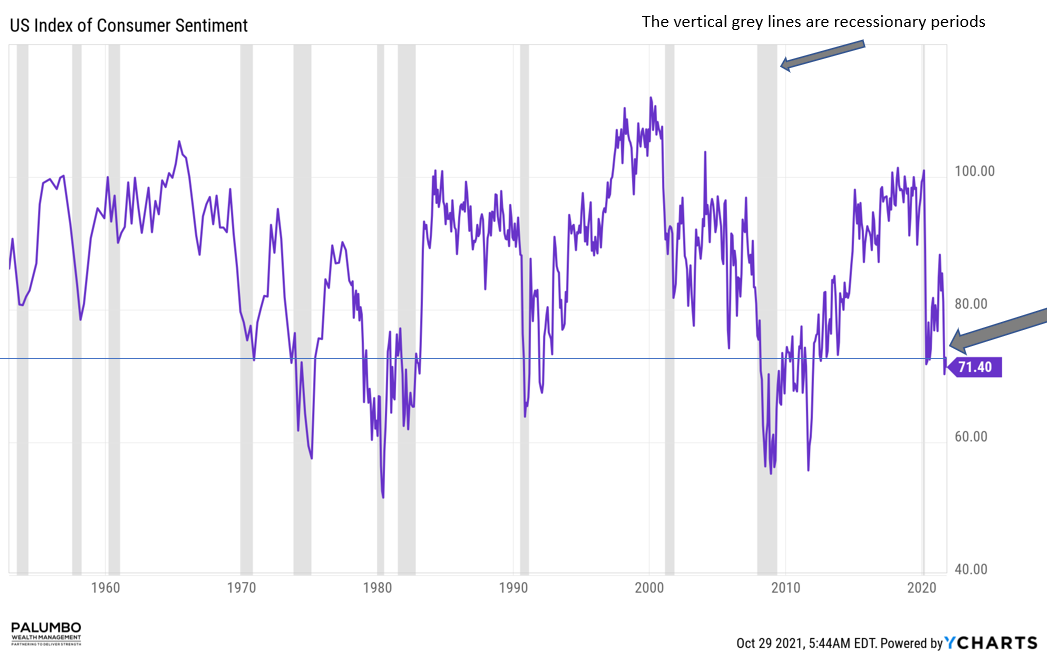

As a side note to the Consumer Confidence Index chart above, The University of Michigan US Index of Consumer Sentiment (tracks sentiment among US households’ personal finances, business conditions, among other topics) last reading was concerning. The current reading is typical during recessionary times. Please see chart on the next page.

What is my point in showing two consumer indexes?

Sometimes, economic data can be misleading and confuse investors. Making economic forecasts, like market timing, is very difficult to do and most economists track records are very poor.

So, why have we been talking about bubbles in various markets? (Click Here To See Our Latest Interview) In our view, there is clearly excessive speculation occurring in various markets, including technology and real estate, not to mention the cryptocurrencies and NFTs (non-fungible tokens). We discussed numerous times that the government has injected a massive amount of money into the economy due to COVID (which was needed) but this money has not been distributed well, which has created excess for some, and little relief for others.

Should you sell your stocks because we think we are in a bubble?

No! History has shown that it is impossible to consistently time the market, and bubbles can last far longer than would appear logical, or even feasible.

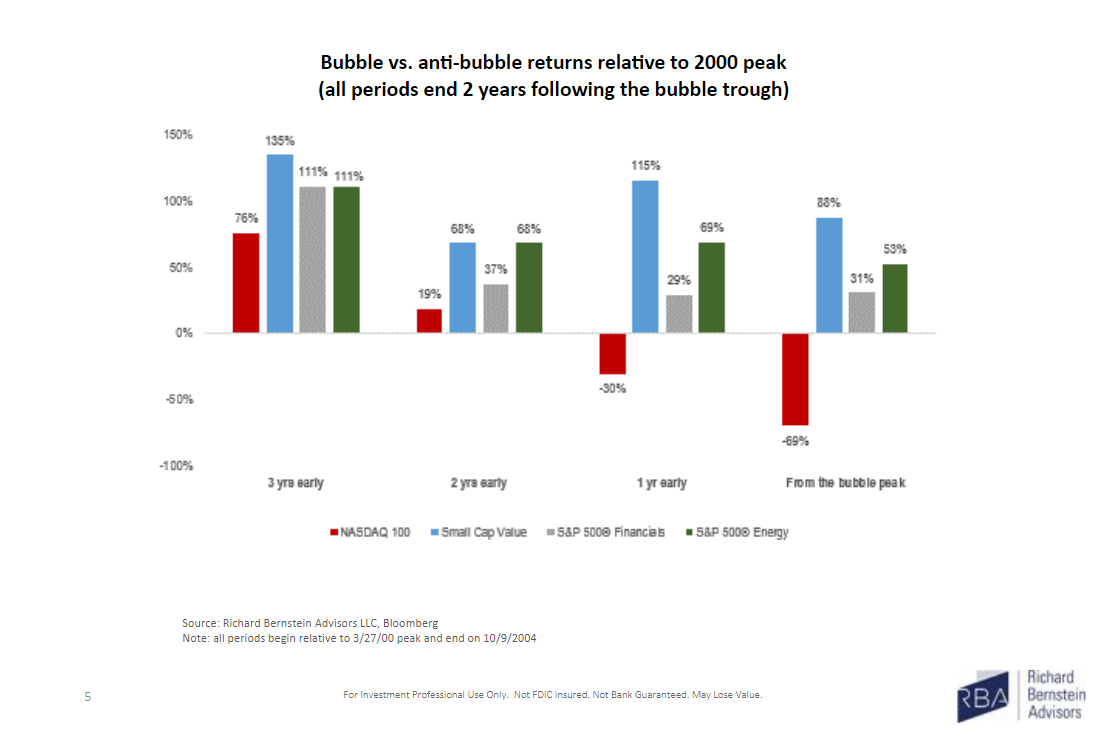

What we as investors should think about is encompassed in the chart below published by Richard Bernstein’s team at RBA:

The point of this chart is that even though there are bubbles in parts of the stock market, there are other areas that can perform well. To help you understand what you are looking at, if you stayed invested in the Nasdaq 100 (last bars to the right) when the bubble burst, your return was a decline of -69%. At the same exact time, Small Cap Value, S&P 500 Financials and Energy had significantly better returns, up 88%, 31% and 53%, respectively. You can go through the same exercise 1 year, 2 years or 3 years earlier to see the same results.

That is why we always talk about the importance of rebalancing your portfolio. It forces you to sell investments that are performing well/over valued and reposition in other areas of the market that have underperformed and offer better return opportunities in the future.

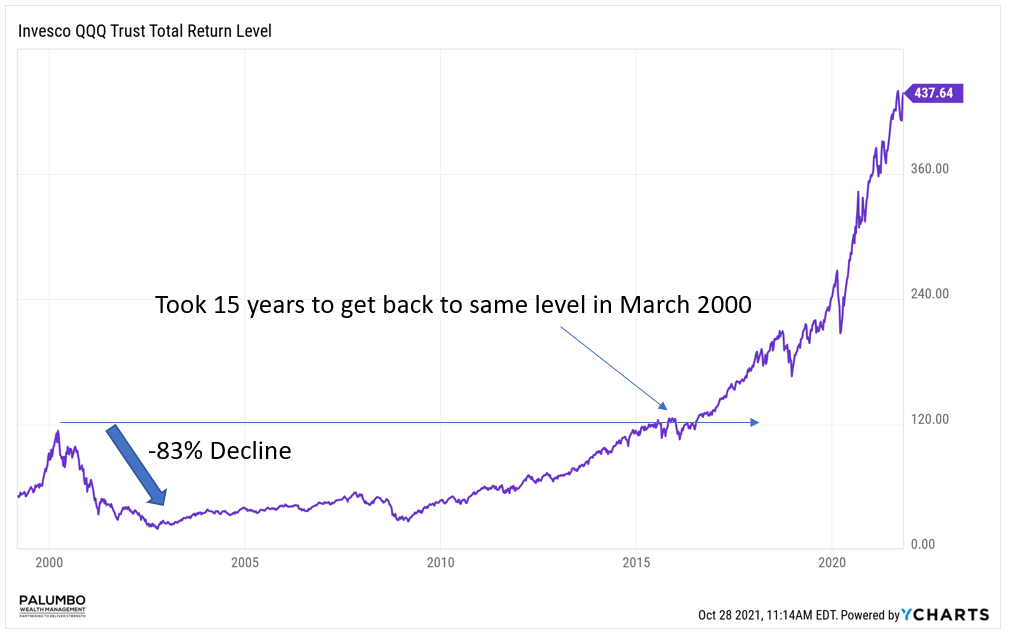

Below is a chart of the Nasdaq 100 ETF (QQQ). As you can see, the QQQ’s peaked in March 2000 and then declined 83%. It then took 15 years to return to its prior peak. We are not suggesting that will occur now, but we must be aware of how quickly markets can reprice stocks when they are at extremes.

Finally, last weekend, we organized a positive and negative list of what can assist the S&P 500 to move higher or lower over the next 12-months. The following were my notes:

Lower:

- The Federal Reserve will be tapering and possibly raise rates next year.

- Inflation continues to be an issue and corporate margins get squeezed.

- Higher corporate and/or personal tax rates under the Build Back Better plan.

- A worsening of the energy shock in the U.S.

- Supply shocks fail to correct quickly.

- Additional dangerous COVID variants.

Higher:

- More fiscal stimulus through the infrastructure and Build Back Better Plan.

- Buybacks (which have also returned to record levels) from corporations.

- The TINA (there is no alternative) trade because bonds are so unattractive.

I am sure we have missed some items, but this is the core of what we think about. These are the known unknowns, and to figure out how this is going to play out, is an impossible game.

That is why we put emphasis on the importance, today more than ever, to stay balanced and rebalance portfolios when risk becomes unbalanced. We all agree, more or less, that risky investments today are valued a lot higher than they normally are.

What We’re Reading

The Role and Use of Alternative Investments

Labor shortage, supply constraints and inflation holding back the economy

What Are The Policies Both Sides Agree On?

Are Workers Returning to the Office?

Hamptons Tries Extreme Climate-Proofing to Save Itself

To Tax Billionaires, Democrats Should Keep It Simple

Higher inflation primary risk to portfolios as funds trim bonds (Subscription Required)

Retirement Planning:

Using Annuities as an Alternative to Bonds to Secure Retirement Outcomes

In retirement, a steady stream of income is important. In low interest rate environments, annuities can provide an option to give you the income you need during retirement.

Tax Planning:

Minimizing Taxes When You Inherit Money

Some inherited assets are tax-friendly, but under new rules, others come with a hefty tax bill.

Health:

5 Sneaky Tricks for Enjoying Exercise After 50

As we age or ability and desire to exercise slowly diminishes. Here are some ways to remain and enjoy being active.

Entrepreneur:

3 Ways to Transform Your Instagram Into Your Resume and Control Your Personal Brand

Social media has now, more than ever, become more and more important to reaching and expanding our businesses. Here are some ways to utilize Instagram to reach your target audience.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All-Time High, Bubble, Consumer Confidence, Consumer Sentiment, COVID, Cryptocurrency, Federal Reserve, Inflation, Interest Rates, Morgan Stanley, NASDAQ, NFT, Real Estate, S&P 500, Speculation, Stimulus, Technology, U Mich Consumer Sentiment IndexArticles, General News, Weekly Commentary

By: Adam