Is Big Oil Dead?

- Energy stocks have been on a tear in 2021 as the economy re-opens.

- The Biden Administration is pushing hard for Green Technology.

- Ironically, that could make oil and gas reserves more valuable.

The best performing sector this year has been energy, rising almost 6% this week alone and 47% YTD, as oil prices resumed their rise this week. At the OPEC+ meeting this week, producers agreed to slowly increase supply over coming months to accommodate rising oil demand. This measured approach to adding production is working well for OPEC members as crude oil prices have not only fully recovered from pre-pandemic levels, but are now nicely above those levels with spot WTI crude trading over $69/bbl on Friday.

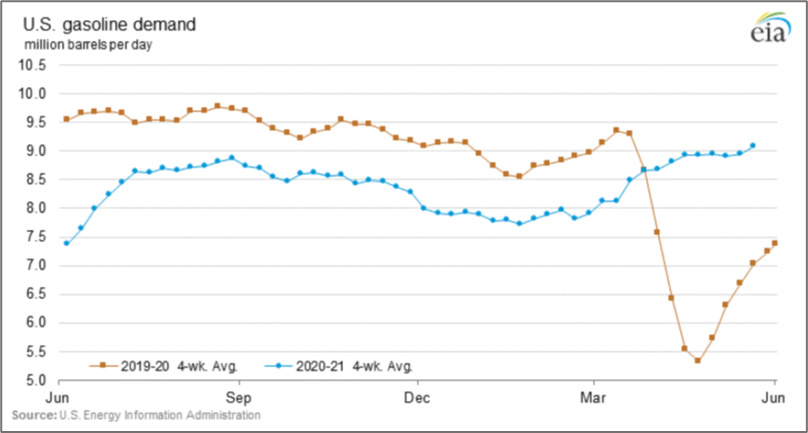

This ascent of crude prices coincides with our revived thirst for gasoline which is back at levels just before the pandemic and heading to demand levels seen at this time of year in 2019.

It would be easy to presume that the bull run in energy is largely behind us as demand would not be expected to grow materially from here without continued rapid economic growth beyond 2021. There are many predictions for 2022, some calling for continued high growth and others calling for a moderation in growth following the spike from pent-up demand. However, either way, there is a pathway to continued higher oil prices.

The push toward renewable energy under the Biden Administration is logically pulling investment from fossil fuels and redirecting those dollars to other energy sources. Just this week, Engine #1, a very small owner of Exxon, pulled a stunning upset when they successfully elected two new, (as in not management sponsored) members to the Exxon Board of Directors. The back story is that Exxon’s investment returns have been miserable over the last several years and while the world advances to new energy sources, Exxon has appeared to lag behind in those efforts. Now, with these new Board members playing a role, it is expected that Exxon will review their capital spending plans with a new set of eyes and with more money allocated to newer technologies and less toward fossil fuels. Don’t think for a minute that the message was not received at other big oil companies as well.

The advancement of disruptive technologies is as old as time, probably beginning with fire. Most any meaningful change is disruptive one way or another. The printing press was disruptive. Gunpowder was disruptive. Railroads were disruptive. The telegraph was disruptive and if you think for a few minutes, you can name all manner of disruptive technologies over the centuries. Disruptive technology fundamentally changes the way we do things, and that change has always brought opportunity to those embracing technology and failure for those that fail to adapt.

In many respects this change will be no different. Some will succeed and some will fail to navigate the changes. But there is one thing that is different this time around – market forces are not the only things at work and ironically, that could imply that returns for fossil fuel companies could be actually be elevated.

Rather than have renewable energy alternatives develop at a pace dictated by market responses, we are attempting to manage the process and that leaves ample room for error. We must stay cognizant of the fact that new technology needs to replace fossil fuels at least as quickly as fossil fuels are depleted. If not, we have a problem – too much energy demand and not enough energy. That naturally leads to shortages (read high prices). Likewise, moving to a greener energy solution requires not just cost competitive alternatives, it also requires a major overhaul of our electric grid as well as substantially better battery technology for energy storage. Does anyone really believe that government can accurately predict the pace of change in the extremely complex energy markets in order to affect a smooth transition? We didn’t think so.

If our drive to greener energy pushes us to reduce fossil fuel investment enough, and/or if the development of the required green technology and infrastructure are delayed, we can easily be left in the ironic position where old school energy has at least one last party before the changeover occurs. We may be at the very beginning of that process.

Of course, there is one very large potential fly in the ointment – Iran. If the Iran nuclear deal is revived and sanctions are lifted, the world may once again be awash in excess crude oil. In the long run, supply and demand matter and there is nothing about the green revolution that implies traditional energy stocks can’t be great investments again.

A Contrarian View of Bonds and Inflation

- The consensus forecast is fixated on Inflation and therefore rising pressure on bond yields.

- Whenever everyone is thinking the same thing, we tend to think that something else will happen.

- Here’s a forecast for lower bond yields at the end of the year and for years to come.

We read and watch a lot of research every week, and this week we came across an interview with Michael Collins, a managing Director and Sr. Portfolio Manager at PGIM (Prudential Global Investment Management). Collins’ view of the landscape for fixed income is widely divergent from the consensus view that growth is picking up and inflation is staging a comeback. To summarize his views, 2021 is obviously going to be a boom year due to the tailwinds of a thawing trade war and the effects of economic stimulus. The consensus calls for 6% growth globally and 6.5% growth here in the U.S.

However, Collins believes that this is already priced into the market and what is most important is what happens in 2022, 2023 and 2024. That is where his view diverges from consensus. His points are these:

- The 10-year Treasury bond has already reacted to the inflation we are seeing, reaching a high of 1.75% (and fluctuating in a rough range of 1.55% to 1.65% currently).

- But the economic impact of big deficits and enormous debt is that they restrict economic growth. This excessive debt needs to be addressed with higher taxes, a reduction of governmental benefits and/or a higher savings rate. All of these restrict economic growth. In 2022 and beyond, Collins foresees economic growth reverting to the lower growth rates we had been experiencing since the Great Financial Crisis in 2008.

- The ten-year, ten-year forward rate is projecting inflation of some 2.5% for a very long time and he believes this is unlikely to happen. As a result, in 2022 and beyond, Collins foresees the 10-year rate declining between now and year end, with a target of 1% by year end.

This forecast is about as far out of the consensus as we can imagine. Time will tell if Collins is correct, but we always find strong contrarian views interesting, and often, enlightening.

What We’re Reading

The Covid Trauma Has Changed Economics—Maybe Forever

The Lab-Leak Theory: Inside the Fight to Uncover COVID-19’s Origins

Housing boom may be cooling as weekly mortgage demand drops again

Biden Floats 15% Minimum Corporate Tax to Fund Infrastructure

Americans look forward to ‘revenge spending’ after a year inside

Global food prices rise at rapid pace in May

Netanyahu opponents reach coalition deal to oust Israeli prime minister

New insights from study of people age 90 and above

Visualizing 50 Years of Global Steel Production

Top cybersecurity official warns of more ransomware attacks

Biden Expands Blacklist of Chinese Companies Banned From U.S. Investment

Container ship scores ‘off the charts,’ ‘fantasy’ charter rate: $135,000/day

Retirement Planning:

Enhancing Emergency and Retirement Savings Act Unveiled

The bill would encourage retirement plan participation by giving people penalty-free access to funds in the event of an emergency.

Tax Planning:

Opening a Roth IRA in your 20s could set you up for success later in life

If you’re young and investing for the first time, you may be facing a confusing decision: traditional IRA or Roth IRA? For most, a Roth is the right choice, according to many financial experts.

Health:

Secret Side Effect of Stretching Before Breakfast

Here’s why some experts call “stretching” the “new coffee.”

Entrepreneur:

How To Protect Your Small Business From Cyber Threats

As cities become increasingly smart and digital, there is a downside to that internet and technology dependency, which is the vulnerabilities of anything connected to the internet.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Barrels, Biden Administration, Bonds, Crude Oil, Energy, Fossil Fuels, Gas, Green Energy, Inflation, Infrastructure, Investment Performance, Oil, OPEC, Renewable Energy, Supply & Demand, Treasuries, WTI Crude, YieldArticles, General News, Weekly Commentary

By: Adam