Economic Growth Weakens While Inflation Rises

Why may we see economic growth continue to weaken in the coming months?

- Delta Variant upsurge causes consumers to pair back spending

- Unemployment benefits ending

- Hurricane Ida effects

- Looming government shutdown

Why may inflation continue to rise?

- Material shortages

- Labor shortages

- Supply chain delays

In our view, we believe that COVID will be a primary market catalyst.

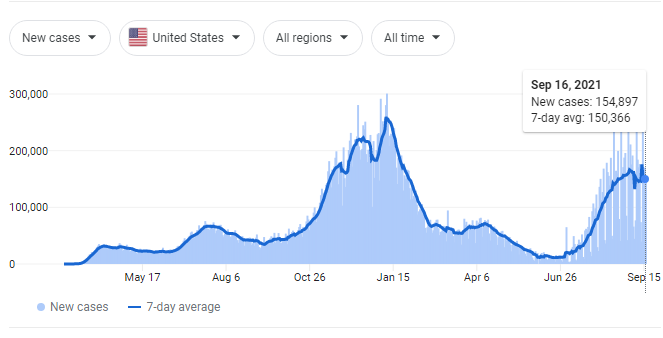

Has the upsurge in the Delta Variant peaked?

It appears that in the short-term this MAY be the case.

Source: The New York Times

So, if it appears the Delta Variant is POSSIBLY peaking, what is there to be concerned about?

- Schools back in session may reverse this.

- We are moving into the cooler months, so more people will be indoors.

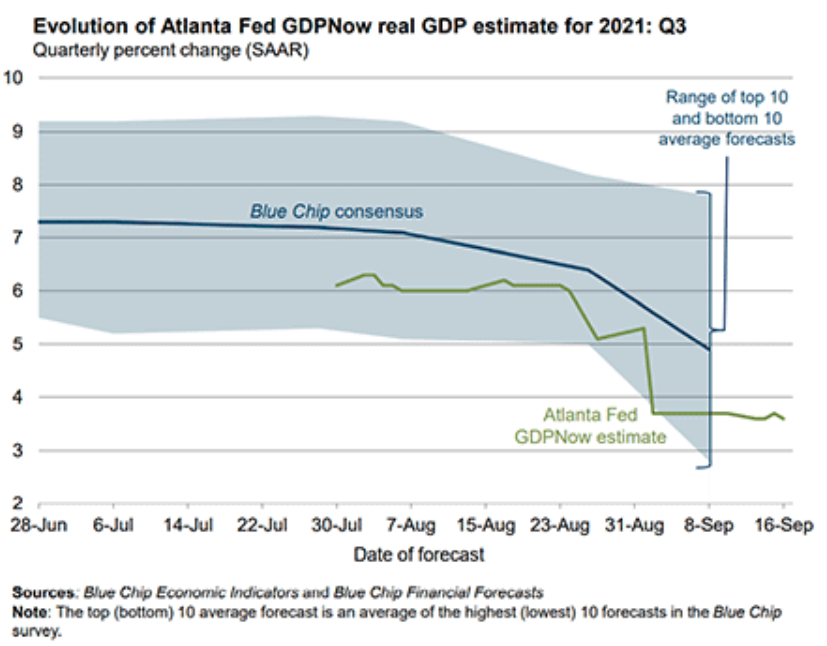

Due to the spread of the Delta Variant late summer, we expect that momentum from the early part of the recovery will continue to erode. You can see below the Atlanta Fed’s GDPNow Model showing a deceleration in their GDP forecasting estimates since May 1st. Their estimate slowed from 6.4% for Q3 to its current rate of 3.6%.

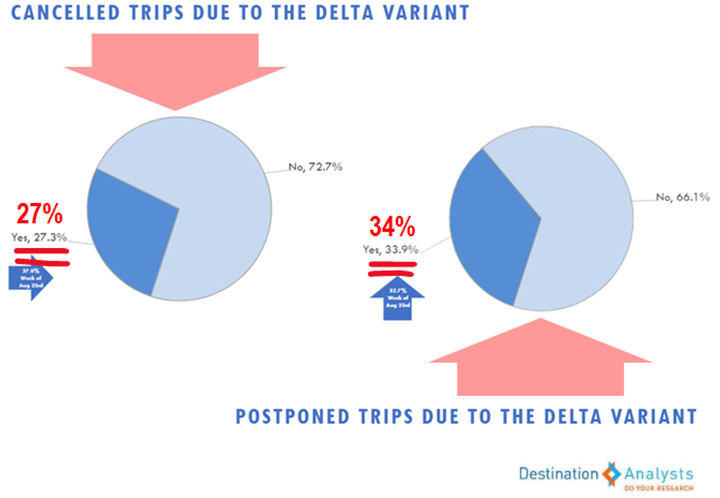

In speaking to many of our clients who are near or in retirement, most are staying home. Staying home generally means they are not spending as they normally would.

Data from DestinationAnalysts.com, a travel research firm that analyzes key traveling data, proves this point. Their latest survey highlights the extent that US consumers are panicking due to the Delta Variant upsurge.

- 59% of travelers are concerned about the Delta Variant

- 27% cancelled their trips

- 34% postponed their trips

Has this effected the performance of the airline and leisure stocks?

The Delta Variant has had a direct impact on the performance of these stocks. Please review data below versus the S&P 500.

- Marriot -3.87%

- Carnival -18.27%

- JETS Airline ETF -18.85%

- S&P 500 +13.69%

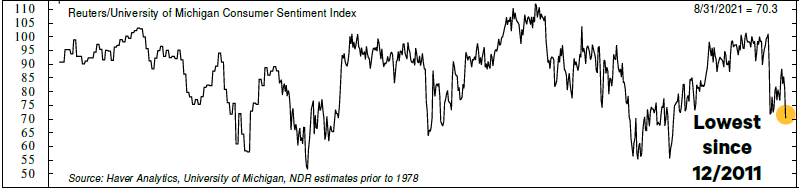

As you can see, while the S&P continues to perform well, many key airline, travel and leisure stocks diverge from the S&P, which we think is a direct result of fears over breakthrough COVID cases. Furthermore, the Reuters/University of Michigan Consumer Sentiment Index is showing its lowest reading since 12/2011 (next page).

What does this mean for investors?

A simple formula to summarize:

Rising COVID cases=dovish fed that stalls tapering=low rates=market continue to make new highs (especially the speculative parts of the market).

Declining COVID cases=less dovish fed that begins tapering=rates move higher=markets correct (quality parts of the markets will do well).

Conclusion:

The following are the key messages we ALWAYS want to get across to our clients.

- Nobody with complete 100% accuracy can time markets. The reason why this is so important to understand is if you tilt your portfolio in a way that follows a narrative that you believe will occur, AND DOES NOT OCCUR, it can really hurt your long-term performance.

- Predictions/Analysis from Wall Street firms about COVID or ANY EVENT are exactly that, predictions, not GUARANTEED TO OCCUR. Optics from large institutions many times look promising, but even their greatest market analysts do not get the narrative consistently correct.

- There is no PLAYBOOK for the current environment we are in.

- The best strategy is to remain properly diversified, ESPECIALLY in an environment where valuations for ALL RISK ASSETS ARE EXTREMELY STRETCHED. Also, remember that stretched valuations ALONE do not kill a bull market, A CATALYST is needed.

- Rebalance when there are dislocations in markets that you are invested in. Right now, stock values in many investors’ portfolios are greater than they normally are. Now is the time to reduce some of that risk. Not because you are TIMING THE MARKET, but you need to be consistent in the level of risk you take.

What We’re Reading

House Democrats Set to Propose Corporate Tax Rate of 26.5%

Democrats Release Details of Proposed Tax Increase

Moderna Developing COVID-19/Flu Booster Combination Shot

November? December? Fed’s ‘taper’ timeline tied to volatile jobs data

Pfizer and Moderna investors brace for eventual drop in vaccine sales

Big picture appeal of Chinese assets remains strong

Americans’ Support for Government Plunges

Falling Off a Cliff: Big Decline In Container Traffic

Debt Ceilings & Interest Rate Floors

Europe’s energy crisis is making the market nervous. Record-high prices to persist

SALT Break Would Erase Most of House’s Tax Hikes for Top 1%

Retirement Planning:

Here’s how long workers wait for a company’s 401(k) matches to become theirs

Vesting schedules can be a harsh reality to some 401k plans. Fewer than 1/3 of companies provide immediate access to company matches.

Estate Planning:

House Democrats’ plan drops repeal of a tax provision for inheritances

The House recently took out a proposed levy on inherited property at death that it included in it’s original tax plan.

Tax Planning:

Income, Estate, Capital Gains Tax Hikes & Retirement Crackdown

The House is finally releasing details on how it will fund it’s $3.5T Social Policy Plan. Here are some of the tax hikes you may see.

Health:

The Pandemic Routines These Families Want to Keep

The pandemic has taught us many ways we can adjust our lives, these families want to continue some of these routines to manage their day.

Entrepreneur:

Business On A Budget? Try These Eight Easy Tips For Getting Free Publicity

Growing your business is all about reaching as many consumers as possible. Here are some cost-effective ways to do so without breaking the bank.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Airlines, Charting, Delta Variant, Economic Growth, Federal Reserve, GDP, Government Shutdown, Hotel, Inflation, Market Timing, Travel, UnemploymentArticles, General News, Weekly Commentary

By: Adam