Valuation, Not Stories, Ultimately Determines Investment Returns

- Richard Bernstein, CEO of Richard Bernstein Advisors (RBA) wrote an excellent article in the Financial Times this week with the title above. We can’t reproduce that article, but we found a more detailed RBA report that we’ll summarize here. If you are interested, we recommend the full report which can be found in the links in the next section.

- A fundamental rule of investing is that returns are highest when capital is scarce. In the long run, the supply and demand of capital will be the primary determinant of investors’ returns.

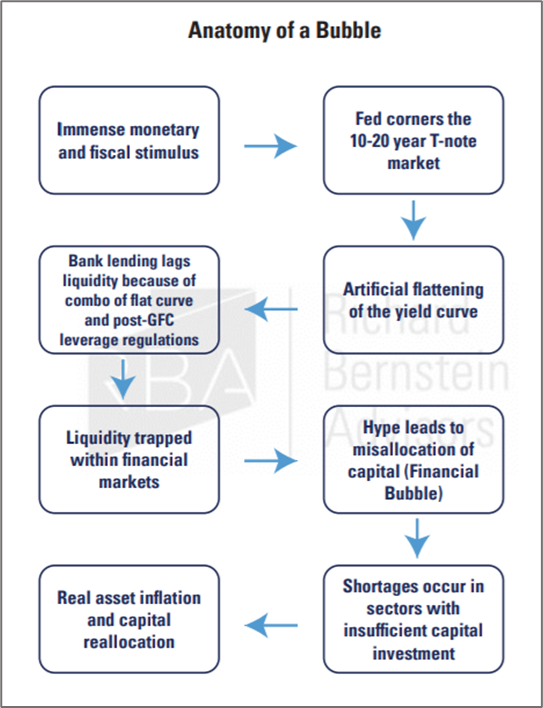

- Bubbles form when capital is abundant and is therefore misallocated. RBA identifies the anatomy of a bubble in the following graphic.

- US monetary growth, which has been on a historic run since the pandemic began, has generated tremendous liquidity of capital in the financial system, driving interest rates lower which in turn provides weak incentives for financial institutions to lend. The result is that this excess capital has been trapped within financial system and supported bubbles. Bubbles then grow based primarily on hype. Bernstein states: “Investors become very myopic during bubbles, and believe there is little in which to invest other than the bubble assets.” But history shows that valuation, not hype, determine investment returns.

- Although we have been taught these lessons before, as in the tech bubble of the late 1990’s, investors seem to have forgotten. During the tech bubble, innovation and disruptive technology themes dominated, and the promise of that period largely became reality. However, valuations were so high that if one bought the Nasdaq Index in December 1999, it took nearly 14 years to break even despite the widespread adoption of the technologies of the era.

- Bubbles create real economic damage because the financial markets grossly misallocate capital when bubbles exist. Too much capital flows into the bubble, but the rest of the economy is starved for capital on a relative basis. We believe the current global energy crisis is a prime example.

- Bernstein states that this misallocation of capital is reflected in sector performance over the past several years. Since the end of 2018, only three of the 11 global sectors have outperformed the MSCI All Country World Index: Technology, Communication Services (dominated by Facebook and Google) and Consumer Discretionary (dominated by Amazon and Tesla). This narrow performance suggests that opportunities are abundant in other sectors.

To Everything There is a Season

- Don’t let the temporary deal to extend the debt ceiling fool you. The deal on the debt ceiling will only last a few short months as Congress will have to re-address the issue by early December (current estimate is Dec. 3). By all appearances we will face another self-induced crisis around Thanksgiving.

- The extension of the debt ceiling allows the Democrats a short period to pursue the infrastructure and Build, Back, Better (BBB) legislation. The current thinking is that the $3.5 trillion price tag for BBB will have to be reduced.

- The key question is precisely how that will be done. Progressives do not want to eliminate anything and that could lead to a scenario where the full plan is laid on the table, but for a limited period of time, which of course, would reduce the price.

- That strategy is designed to force Congress to not renew the presumably popular programs at that time. That will be difficult to do, especially if timed to an election cycle.

- This could actually accelerate spending into an economy that is ill-equipped to handle it. The global economy, including the U.S., is spending at a level well above pre-pandemic levels. At the same time, production capacity is still restricted by the pandemic. This has created supply chain disruptions and numerous shortages. Any accelerant to spending could exacerbate that situation and make inflation a worsening problem. Inflation, of course, would hurt the little guy much more than the wealthy, and work against everything the Democrats are trying to achieve. This may not be the season for more spending.

What is the Fed Thinking?

- The poor employment headline on Friday could lead some to believe that the odds of the Fed tapering bond purchases sooner rather than later are diminished. But a closer look at the report indicates that the bulk of the shortfall was government workers, more specifically, teachers. Private payrolls increased by 317,00, which is pretty good number and leisure and hospitality added some 74,000 jobs. In addition, prior jobs data was revised upward. In short, the jobs data was not nearly as bad as the headline number suggested. We suspect the taper (Fed reducing bond purchases) remains on schedule.

- Ironically, a taper might be just what we need to dampen demand a bit (i.e. promote slower growth) and give the supply chain a chance to catch up.

What We’re Reading

Anatomy of a Bubble (Bernstein)

What’s in Democrats’ $3.5 Trillion Budget Plan—and How They Plan to Pay for It

Democrats Wrangle Over How to Shrink $3.5 Trillion Proposal

Facebook is misleading the public on hate speech, violence, misinformation

Oil settles above $81 with OPEC+ sticking to output increase

Permanent or Transitory Inflation: An Analytical Framework

Lawmakers have a deal on a short-term debt ceiling increase

Gas Market’s Wild Ride Shows Some Machiavellian Traits

Global Energy Crisis Is the First of Many in the Clean-Power Era

Why market forecasts matter to long-term investors

China PCR Purchases Spiked in Months Before First Known Covid Cases

Here’s where the jobs are — in one chart

Ireland agrees to global tax deal, sacrificing prized low rate

Retirement Planning:

The Education Savings Face Off: 529 Plans Vs The Roth IRA

With so many ways to pursue a higher education or increased expertise in a trade, craft, or industry, more and more parents are asking what the best way is to save for future education costs.

Tax Planning:

The October tax extension deadline is fast approaching

The tax extension deadline is approaching, but there’s still time to skip extra penalties and fees.

Health:

The 50 Best Ways to Boost Your Metabolism

If you’re wondering how to increase metabolism, we’ve rounded up the 50 best quick and easy ways to rev your fat-burning furnace to help you reach your weight loss goals that much faster.

Entrepreneur:

What Every Aspiring Entrepreneur Can Learn From Christopher Columbus

Next week we observe Columbus Day. Say what you will about the man’s skills as an explorer, one thing we can all agree on is that Christopher Columbus was a gifted pitchman and entrepreneur.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Bubble, Congress, Debt Ceiling, Federal Reserve, Infrastructure, Interest Rates, Investment Return, Liquidity, Richard Bernstein, Tapering, Weekly CommentaryArticles, General News, Weekly Commentary

By: Adam