Stepping Back

- Stocks are expensive and inflation combined with low rates increases risk in bond portfolios.

- We’ve been spoiled by unusually high returns for a long time. It’s time to temper expectations.

- Alternative Investments can help manage risk and produce reasonable returns.

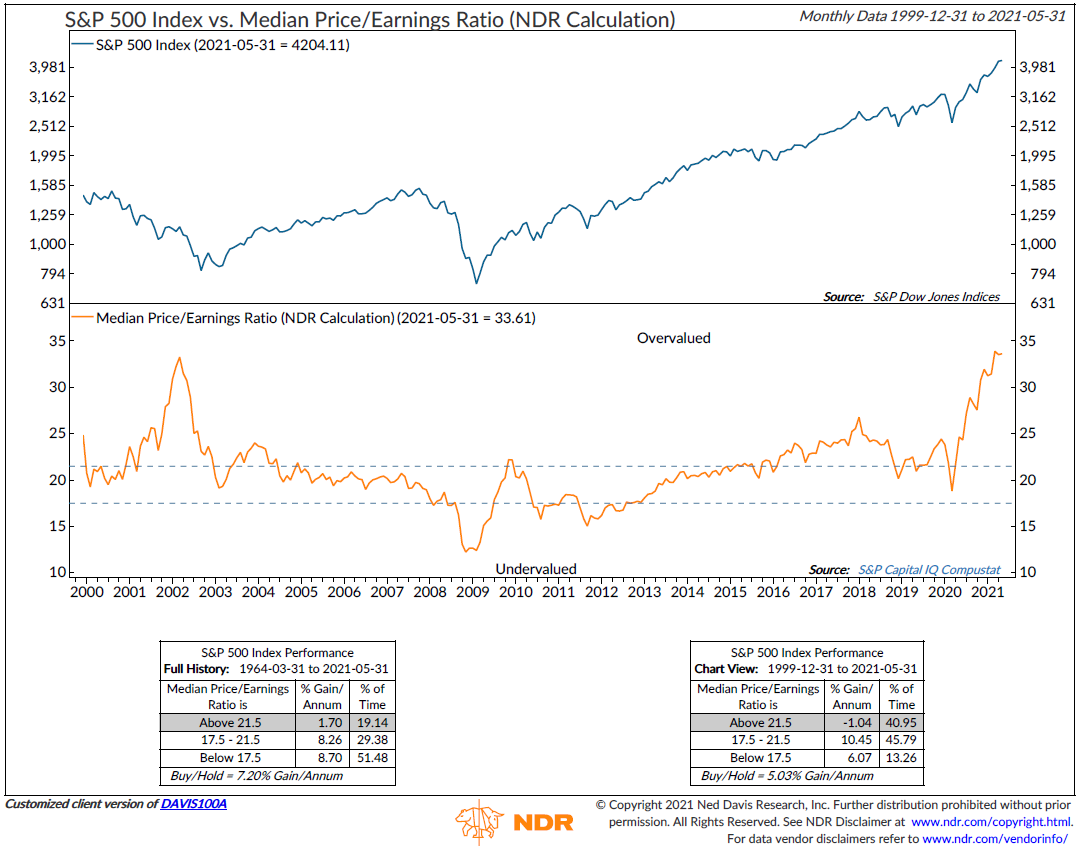

It’s very easy to get caught up in the day-to-day, week-to-week action in markets, and that requires a discipline to occasionally take a step back and look at the bigger picture. This is one of those times. The chart below shows the S&P 500 Index as well as the Median Price/Earnings Ratio. At a P/E of roughly 34, the stock market appears massively over-valued. In fact, just to get back to the 57-year median valuation, the index would need to decline about 48%.

Understand that does not imply that the market will go down that far. It simply means that the market has gotten ahead of itself. Earnings growth is very strong, which brings the valuation down, but the level here is so high, that future returns from this level should be expected to meet the double-digit stock market returns of the last few years.

We can’t value the bond market using P/E ratios, but it should be clear that with rates as low as they are, bonds produce very little income, and should rates increase, bond prices decline. Inflation, even if transitory, can easily pressure bond returns.

Alternative investments are just that, an alternative, and they have different characteristics than traditional investments. And with that we’d like to introduce Ed Hannon. Ed is an alternative investment expert and former head of investment due diligence for Merrill Lynch’s $20 billion Hedge Access platform and is PWM’s alternative investment consultant. Below, Ed provides an overview of alternative investments.

Alternative investment strategies such as hedge funds, managed futures funds, and private equity funds typically have more degrees of investment freedom than mutual funds or individual investment accounts. They often offer advantages such as the ability to use leverage, invest in less liquid securities, and invest both long and short.

One of the biggest advantages of alternative investments is the fact that they can generate profits based on their exposure to non-traditional risk exposures, or “betas.” Traditional investment strategies rely heavily on market direction in order to generate returns – put simply, they make money when markets rise, and lose money when markets fall. A traditional manager’s returns will be driven largely by the performance of the market. An investor who takes long positions in Coke and Pepsi may generate returns based on their individual performance but will also have significant exposure to the level of stocks in general. For example, a sharp drop in the S&P 500 Index would likely have a negative impact on both positions.

On the other hand, a hedge fund manager has the ability to make relative value investments, such as taking a long position in Coke and a short position in Pepsi, or vice-versa. If the positions are structured correctly, the hedge fund manager’s gains or losses will be largely based on the relative performance of Coke vs. Pepsi, rather than the direction of the market.

In this way, alternative investment managers can build portfolios that exhibit low correlation to markets with positive expected returns. The objective is to reduce the overall market correlation of an investor’s portfolio, which should reduce return volatility and generate better results over time.

What We’re Reading

Senate Passes $250 Billion Bipartisan Bill to Boost Tech Competitiveness

Consumer Prices in U.S. Top Forecast, Stoking Inflation Concern

U.S. Consumer Sentiment Rises in Early June; Inflation Expectations Ease

Consumer Perception of Homebuying Conditions Worsens

Congress wants to make more changes to the U.S. retirement system

Half of the pandemic’s unemployment money may have been stolen

In a world first, El Salvador makes bitcoin legal tender

Lower Returns and Greater Turmoil to Test Stock Investors

Inflation Or Deflation → China or US Goods?

Reflation trade prompts investors to look away from US

Retirement Planning:

Congress Is Considering Several Retirement Security Bills. What to Know.

Several retirement security bills are now under consideration by Congress in the latest effort to overhaul the nation’s retirement system.

Tax Planning:

Retroactive Effective Date for Capital Gains Tax Increase Is A Bad Idea

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

Health:

What Does Vaping Do to Your Lungs?

It seems pretty clear that using e-cigarettes, or vaping, is bad for your lungs. But research about exactly how vaping affects the lungs is in the initial stages.

Entrepreneur:

Goldman Sachs CEO Encourages Small Businesses To ‘Stay The Course’

The banking behemoth has provided training and financing to 10,000 entrepreneurs who have collectively generated $14 billion in revenue and employed more than 200,000 workers over the past 10 years.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Alternative Investments, Bonds, Correlation, Equities, Hedge Funds, Inflation, Managed Futures, Ned Davis Research, Price/Earnings, Private Equity, Returns, Risk Management, S&P 500, Short SellingArticles, General News, Weekly Commentary

By: Adam