Bond Yields Raise Their Ugly Head

Most of the time, market commentary focuses on the stock market, but every so often, the bond market flexes its muscle and takes center stage. This week was one of those times and with good reason. The push-pull of more fiscal policy to help the economy and the inflationary pressures that it creates were the catalyst. Frankly, we are a little surprised this happened so quickly, as the Fed has been trying unsuccessfully to generate some inflation for many years now. We believe the reason for the fast reaction time is that we are looking at the prospect of much greater fiscal stimulus in the early years of the Biden Administration. It is important here to reiterate the differences between monetary and fiscal stimulus.

Monetary Stimulus is driven by the Federal Reserve. In times of stress, the Fed will lower rates to spur growth and, over the last ten years has been directly buying securities in the open market. When the Fed pays for those securities, it injects capital (stimulus) into the financial economy, with the hope that it will trickle into the real economy. The problem is that there has been very little trickle and lots of asset inflation (i.e., rising securities prices). Because of the lack of trickle, they have consistently begged Congress for more fiscal stimulus, a request that has been largely ignored.

Fiscal Stimulus is simply government spending. As an example, if Congress passes an infrastructure bill that will repair/replace old bridges and roads, that new spending is stimulating the economy via more jobs and more income, which naturally spreads through the economy. People with jobs spend money. This is what has been lacking for a long time, but has some promise of a rebound under Biden. The key difference is that fiscal stimulus affects the real economy (people, jobs) much more than the financial economy (markets).

The negative economic effects of the many financial bubbles we have experienced over the last 20 years has focused the Fed on avoiding another deflationary cycle, like the 1930’s. Deflation is difficult to overcome and is generally avoided by policy makers at all costs. As a result, the Fed has been hard at work attempting to create inflation (their target is 2%), but they have generally been unable to attain that target as the monetary stimulus has been stuck in financial markets. A large fiscal stimulus, on the other hand, has much greater potential to create the inflation the Fed desires, and potentially more than it desires. That has begun to spook the bond market.

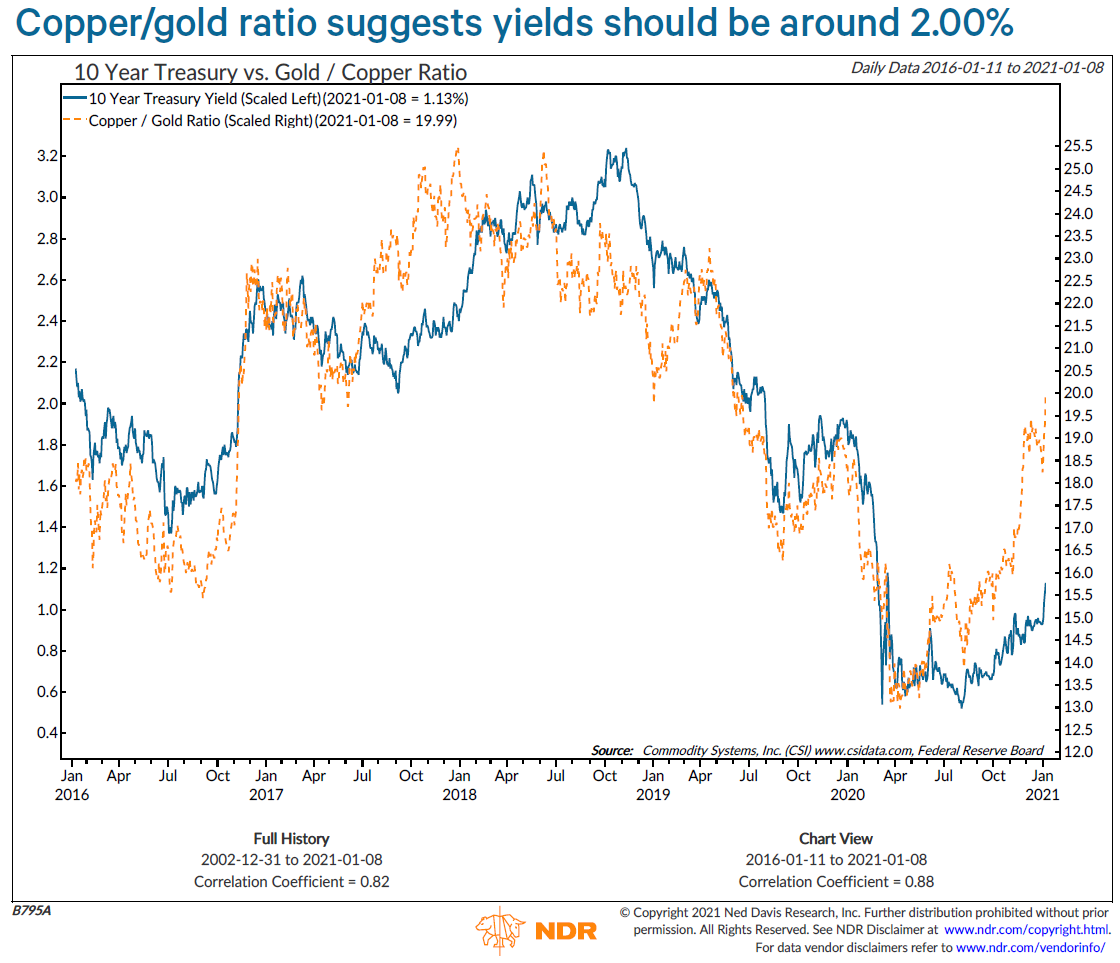

Interestingly, the 10-Year Treasury Bond Yield has historically been linked to the copper-gold ratio. The two have shown unusual correlation, but after the start of the pandemic, the two parted ways (See below). Of course, this divergence can correct in two ways (the copper-gold ratio declines or interest rates move higher), but if you believe that the copper to gold ratio is where the 10-Year rate should be, then the target rate is 2%, as compared with 1.10% as this is written. As can be seen in the chart, it can take some time for this relationship to settle out, however, it does consistently come together.

Of course, we don’t manage money based on making interest rate calls like this, but we want to understand the risks facing markets at any given point in time as it helps determine when we want to re-balance portfolios.

What we see now is that there needs to be significant new issuance of government debt to fund stimulus programs, and the U.S. is attempting to re-finance its debt into longer maturities, which will ease the burden of rising rates on our interest costs.

The 10-Year rate gave everyone a scare this week, but the Treasury auctions of new debt went extremely well, which has settled the bond market down. But make no mistake, large fiscal stimulus implies greater inflationary pressures and, more risk in the bond market. The offsetting factor is that the Fed does not want higher rates right now, they need a more durable economic recovery, so for the foreseeable future, the FED may act swiftly to keep a lid on rates if the increases proceed too quickly.

What are Hedge Funds and Why Should I Care?

Hedge Funds are some of the least understood investment vehicles, largely because they are not publicly traded, they can’t advertise and are available only to a limited group of investors. Yet, hedge funds are mentioned constantly in the financial media and some of the most famous investors are, or were, hedge fund managers. So, what exactly is a hedge fund?

The colloquial term ‘hedge fund’ is actually a misnomer. It is more correctly, a private investment partnership, and the first of these is attributed to Alfred Winslow Jones in 1949. Jones had a novel idea that stocks actually had two distinct risks – market risk (the tendency of stocks to move up and down with the market) and the specific risk of each individual stock. Jones bought stocks that he believed would rise in value and sold short an equal amount of stocks that he thought would decline in value. Doing this he theoretically neutralized (hedged) the market risk in the portfolio, and the portfolio performance was a function of his stock picking ability. This is called a market neutral strategy.

In 1952, Jones converted his fund to a private partnership and added an incentive fee (i.e. Jones would get not only a management fee, but also a portion of the profits from the strategy) and the first hedge fund was born. At the time, the name was very descriptive, but today, there are many ‘hedge funds’ that don’t hedge at all! Increasingly, investments of this type are called ‘alternative investments’ because they do not generally fit the mold of standard portfolios and the range of strategies has grown exponentially.

The lesson when looking at alternative investments is that you need to intimately understand the risks and potential rewards of the particular investment strategy. It is not a decision that should be made quickly without very careful deliberation. We stand ready to assist you with that process when you desire.

Have Hedge Funds Performed Well?

That is a difficult question as the dispersion of hedge fund returns is much greater than mutual funds. However, in general, hedge funds have not performed well over the last 10+ years. This is in sharp contrast to the roughly 20-year period prior to that when they performed extremely well, on average.

Although it is difficult to quantify, we believe that this change is directly related to the direct intrusion of the Fed and other central banks into asset markets since the Great Financial Crisis (housing crisis) in 2007-08. The Fed, and other central banks direct participation in financial markets, was started as a method to inject capital into a wobbly financial system and stabilize markets. The problem is that this has never really ended. As we have discussed in the past, the Fed is very limited in the ways it can get money into the hands of the public, but very efficient in getting money into the hands of the financial sector. This is a primary reason for the growing wealth gap in the US. Be that as it may, we also view it as a primary reason that performance of hedge funds and other active managers has been lackluster.

Although not all hedge funds actually hedge, many of them do. In an environment were virtually all asset prices are being pushed up by central banks, hedging just doesn’t work very well. It only hurts performance. Actively managed mutual funds have the same issue. Stock selection matters little if everything is going up, and this has helped fuel the rise of the index fund. These trends have limits. For any market to function normally, the process of price discovery is essential and only active management can provide that. The implication is that that as indexing becomes more popular, markets actually become less efficient. Eventually, that spells opportunity. Whenever markets get back to some semblance of normal, with no central bank interference, we would fully expect hedge fund performance and active management performance to improve.

How Hedge Funds Are Used in Portfolios

The key advantage of hedge funds offer is that they offer a variety of sophisticated strategies that are not correlated to traditional asset classes. For this reason, they are increasingly being grouped into a category referred to as alternative investments. Alternatives would include hedge funds, structured investments, etc. Depending on the strategies being used, they can moderate portfolio risk and return, or accentuate risk and return, depending on the investor’s desires. The long-term attractiveness of these strategies has led to a growing list of ETFs and mutual funds that attempt to replicate the strategies of these private investments. Some strategies, like long-short equity, can be easily tailored to an ETF or mutual fund product. However, distressed debt funds as an example, can be highly illiquid, and for that reason, are less suitable for ETF’s or mutual funds.

Hedge Fund Rules of the Road

Hedge funds can only accept investments from ‘accredited investors’ which generally means you must have a net worth over $1 million, excluding your primary residence, or earned income of over $200,000 ($300,000, if married) for each of the past two years.

Hedge fund managers can pick and choose who they want to be their partners. Just because you want to invest doesn’t mean they have to accept you. In addition, most hedge funds have high minimum investment requirements. Generally, the bigger the fund, the bigger the minimum investment. Access can also be gained via an intermediary that has purchased an allocation from the manager.

Expect high fees. The ‘standard’ fee is a 2% management fee and a 20% (of any profits) incentive fee. The more successful funds can be even higher than that and newer funds lower. If you gain access through an intermediary, expect to pay the intermediary too.

What We’re Reading

Here Are the Major Parts of the $1.9 Trillion Biden Relief Plan

Visualizing China’s Dominance in Rare Earth Metals

Chevron Invests in Carbon Capture Startup Blue Planet Systems

The Other Virus that Worries Asia

Moderna Developing 3 New mRNA-based Vaccines for Seasonal Flu, HIV and Nipah

Oil ‘Supercycle’ Expected at the End of this Year, Analyst Says (3 min. Video)

Here’s (Almost) Everything Wall Street Expects in 2021

A Prominent Bond Bull Says Treasuries Rally Isn’t Over Yet

Bitcoin Is Unlike Any Other Bubble We’ve Seen So Far (4 Min. Video)

Jerome Powell Sees Long Road Ahead for Jobs Market

Retirement Planning:

These Retirement Expenses Could Bust Your Budget

While some of your retirement expenses may be fairly predictable, here are a few that could end up being much costlier than expected.

Tax Planning:

Tax Rules That Could Make or Break Retirement

Taxes don’t go away once you retire, and if you’re not preparing for them, they could wreak havoc on your retirement plans.

Estate Planning:

Estate Planning: The Simple Checklist for NY Residents

An easy-to-understand checklist of the most important aspects of estate planning.

Health:

Physical activity is good for your concentration – here’s why

For people looking to improve their concentration, exercise is often recommended as the antidote.

Entrepreneur:

Three Lessons That Impact Any Entrepreneur’s Journey

Your road to success will be paved with cracks and potholes.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Alternative Investments, Bond Yields, Congress, Copper, Debt, Federal Reserve, Fiscal Stimulus, Gold, Hedge Funds, Inflation, Monetary Stimulus, NDR, Portfolio Diversification, Risk Management, Stimulus, TreasuriesArticles, General News, Weekly Commentary

By: Adam