Staying Focused on the Long-Term

The past few weeks have seen one blockbuster economic report after another. From the 916,000 jobs that were added in March, to retail sales jumping 9.8% month-over-month, these are some of the best economic numbers we could see in a lifetime. At the same time, much of this was anticipated due to the nature of last year’s shock and the natural recovery from the shutdown. As the stock market continues to reach new highs seemingly every week, how should investors interpret these economic numbers and stay focused on the long run?

It’s important to distinguish between a mechanical recovery from last year’s lockdowns, the effects of stimulus, and a sustainable acceleration in growth. Even if the economy were to simply return to pre-pandemic levels, economists would expect high growth numbers for a period as the world reopens. The fact that this has occurred swiftly is a nice surprise but hardly unusual. At the moment, consensus economic projections are for U.S. GDP to recover to pre-pandemic levels by the end of 2021.

Similarly, government stimulus to the tune of trillions of dollars would reasonably be expected to boost overall spending by individuals and businesses for a time. The latest jump in retail spending can be partially attributed to the timing of stimulus checks. However, without a further change in consumer and business attitudes, stimulus alone is not enough to sustain a long-term recovery.

These factors are important, and their contribution to the early stages of the recovery cannot be overstated. However, the more important question today is whether there will be a change in individual and corporate expectations that causes growth to accelerate – beyond the initial bounce-back and one-off stimulus bills. As markets rise ever higher, this appears to be what some investors expect.

This would have to go beyond pent-up demand – i.e., the purchasing of goods that were delayed last year – and could be a reaction to factors such as being stuck indoors for months. For instance, a household might choose to buy a nicer car than planned, or splurge more on an international vacation. Businesses might anticipate this behavior and seek to invest in future growth today, further boosting capital expenditures, hiring and wages. Whether we call this “animal spirits,” a multiplier effect or any other term, this is what would allow the recovery to transform into sustained growth.

So far, it is unclear if and when this will take shape. However, the stock market appears to be pricing in this possibility. The market is not always correct, but when it is, it appears to be prescient in hindsight. This has been the case over the past year when the market began to rebound last April even as most parts of the country were locked down for several more months.

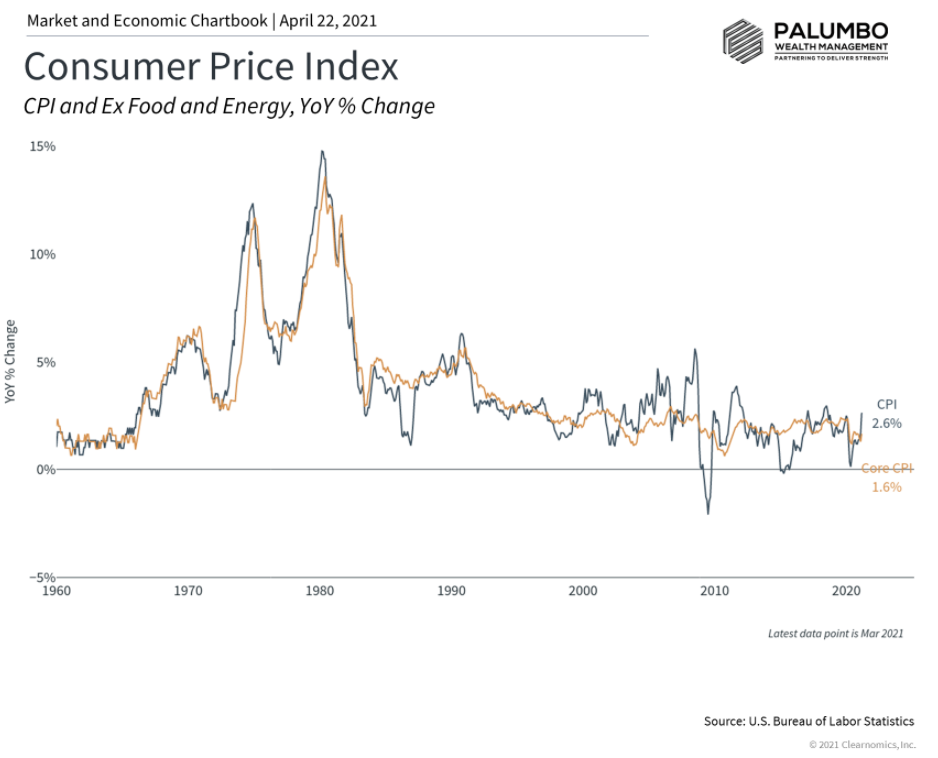

This is also the key to rising inflation expectations which the Fed has attempted to achieve for over a decade. Even with prices rebounding from last year’s lows, headline CPI rose 2.6% over the past year. This is an acceleration from recent history, but as measured by the Fed’s preferred inflation measure, inflation is still running under their 2% target. For now, inflation remains quite tame compared to periods of runaway inflation decades ago, but the trend remains higher.

Thus, the market is no longer just expecting a simple recovery but a continued acceleration in growth due to the economic reopening, government stimulus and excitement among consumers and businesses. Thus, while investors should continue to cheer positive economic news, they should also remain balanced and disciplined as the stock market continues to reach new highs. Below are three charts that highlight the challenges investors face as the recovery continues.

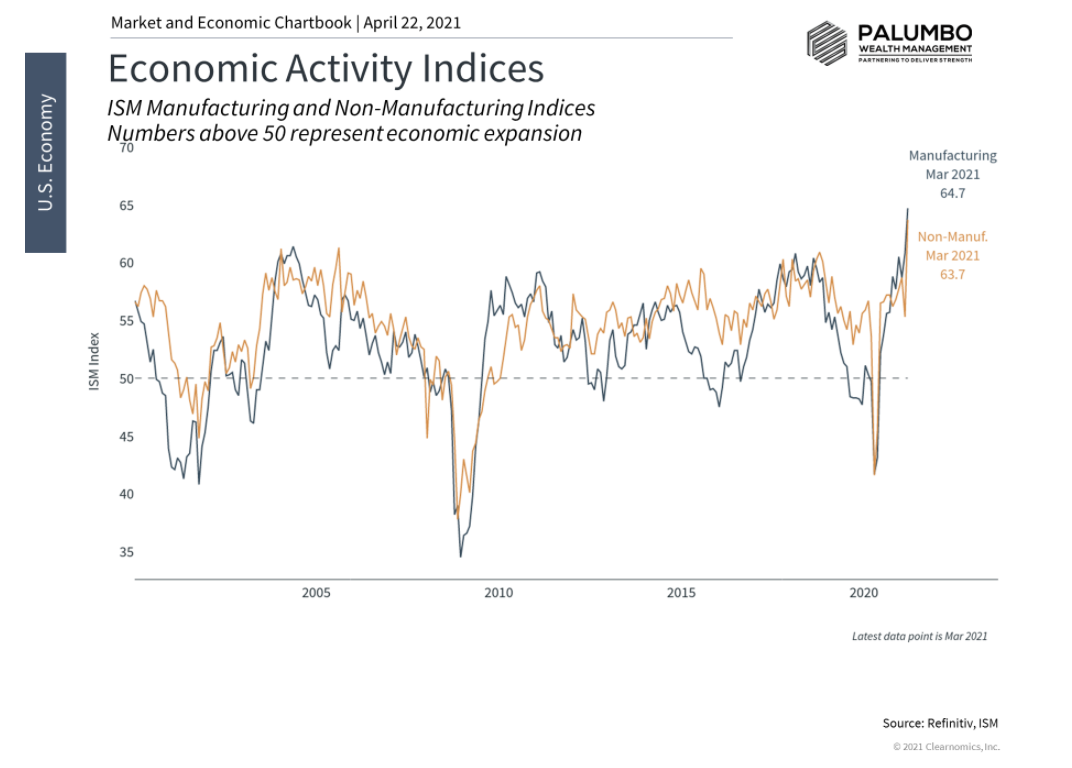

- Many measures of economic activity are at multi-decade highs

The ISM manufacturing index has reached its highest level since the early 1980s. Other measures, including the non-manufacturing index, are near historic highs as well. Across the board, there is clear evidence that economic activity is strong.

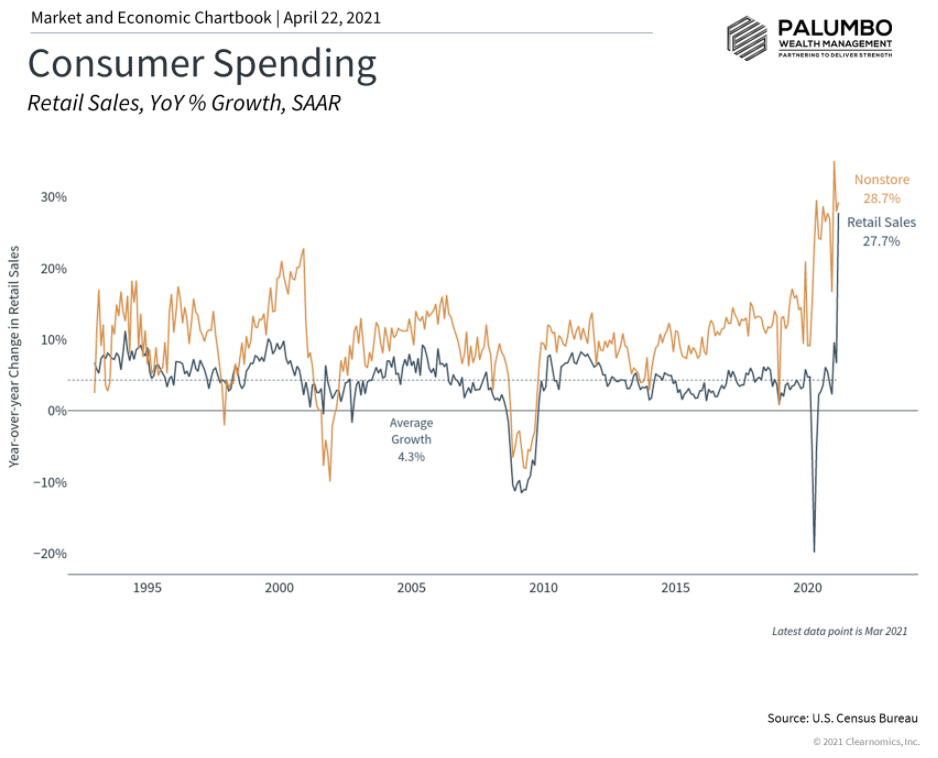

- Consumer spending is at historic levels

Recent retail sales numbers show that consumer spending rose at the highest pace in history. It jumped 9.8% in March compared to February which constitutes a 27.7% increase from the year before. While there are some “base effects” when comparing to last year, the timing of stimulus checks and the continued reopening of the economy have contributed to these strong numbers.

- Inflation has risen but is still tame

Despite these historic economic gains, inflation is still relatively muted. Headline CPI rose 2.6% over the past year – higher than in recent memory but is still tame compared to historic peaks. While the rate of inflation could continue to rise over the next year or two, there is no evidence yet that this will translate into runaway inflation.

The bottom line? The economic recovery is strong but this has pushed the stock market toward historic valuation levels too. Investors should stay invested and remain disciplined as the cycle evolves.

What We’re Reading

Lumber Prices Soar, But Logs Are Still Dirt Cheap

Biden to float historic tax increase on investment gains for the rich

Over $200 billion wiped off crypto mkt as bitcoin plunges below $50k

Labor mkt is heating up as fewer people seek unemployment benefits

Investors plough money into US inflation-protected bond funds

U.S., other countries deepen climate goals at Earth Day summit

U.S. manufacturing, new home sales underscore booming economy

Stocks Are Higher as Economic Data Beat Forecasts

Retirement Planning:

Pandemic-Battered Workers Change Retirement Plans – to Work Longer

Life often doesn’t comply with plans to retire later, a survey of retirees and workers finds.

Tax Planning:

The Best Gifts for Kids Who Aren’t Your Own

Instead of handing them toys they won’t play with for very long, contribute to their financial futures.

Personal Finance:

Don’t’ Settle for any old plastic. Choose a credit card that provides maximum rewards for your spending habits.

Health:

How much fruit in the diet is too much?

Fruit can and should be part of a balanced diet. Because fruit’s fiber and liquid content help someone feel full, most people should not need to worry about eating too much fruit.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Capex, Consumer Spending, CPI, Economic Growth, Economic Outlook, GDP, Inflation, Long-Term Investing, Recovery, Retail Sales, Stimulus, WagesArticles, General News, Weekly Commentary

By: Adam