Peak Growth and What Comes Next

- Economic growth has been extraordinary, albeit from a very low, pandemic-induced base, and concerns of inflation have been front and center.

- We are starting to see talk of ‘peak growth’, meaning that we could be exiting the early part of the economic cycle (i.e., early, fast recovery) and we are now moving into ‘mid-cycle’ (i.e., stable recovery)

- Markets look confused, but this is just the next step in recovery. Although life is getting back to normal, but the economy is far from it.

Markets have been more than a little confused (and confusing) lately. In simple terms, here is how we see the current situation:

- The economy is recovering very rapidly due to a number of factors, the vaccination rate is high in the U.S.; there is pent up demand for goods and services; and fiscal stimulus has allowed consumer balance sheets to be unusually healthy for the early stages of a recovery.

- Globally, the pandemic is still creating and sustaining bottle necks in the supply chain, which perpetuates shortages and causes price dislocations (inflation). For example, there is no reason for a 2-year-old pick-up truck to sell for more than the original sticker price, but today, that is often the case.

- The question economists and analysts are grappling with is what the economy will look like 12 to 18 months from now. In particular, will economic growth be above the average 1.8% growth over the last 20 years? Or, will we simply return to that average?

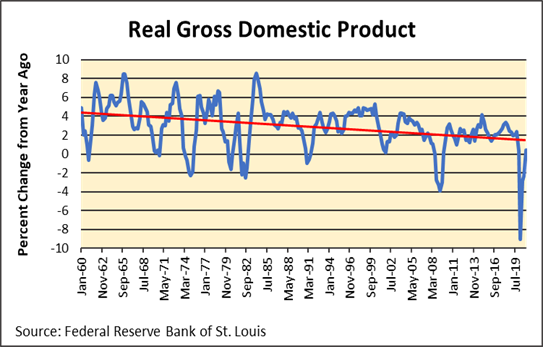

The answer to the question matters because if real GDP growth (i.e., growth adjusted for inflation) reverses a long term down trend (red trendline in the chart below), that could be a meaningful catalyst for increasing inflationary pressure and higher interest rates. On the other hand, if we revert back to the 1.5% to 2% growth we have generally experienced since the turn of the century, we are likely back in a scenario where inflation and interest rates stay low and policy concerns will drift back toward deflation.

You might wonder why this question is so difficult for economists. There are several reasons:

- The pandemic response (lock down) was a drastic, self-inflicted economic bust. In that regard it was unlike any other economic decline in modern times. It was sudden and it was severe, as can be clearly seen on the chart.

- The economic response (monetary and fiscal policy) was also extraordinary. It is likely the first time that aggregate incomes have risen during a recession, no less a very deep recession.

In short, this was an economic experience unlike any other. There is no play book to follow or any experience that is similar. Normally when exiting a recession, incomes and production begin to recover roughly in synch. Today, we have production declines while household income is actually higher. That implies that demand and supply are out of synch, an unintended consequence of our economic response to the pandemic. Production has trouble keeping up with demand, causing shortages and prices begin to rise, producing the current inflation. This situation has economic prognosticators all over the map and markets continue to get whipsawed as one point of view briefly gains over the other and vice versa. It’s hard to figure out what happens next: rising inflation, or a simple correction of supply and demand.

What to Watch…

…And we don’t mean Netflix. The underlying question is whether the massive dislocations caused by the pandemic (supply chain disruption, work habit disruption, etc.) and the response to the pandemic (monetary and fiscal policy) result in some permanent change, logically in the form of inflation. There is no question that inflation is already here. A short walk through a grocery store or a visit to a restaurant will make that evident. The question is whether this upward price pressure is ‘sticky’. In other words, will the price increases hold, or will they revert when we are truly back to normal? This is the ‘transient’ vs. ‘persistent’ inflation debate that has been ongoing and the answer to the ‘transient’ vs. ‘persistent’ question is – Yes. In other words, the question is not whether inflation will be transient, the question is how much of it will be transient.

- The Case for Transient Inflation: It’s not hard to see that over the long run, used cars can’t be priced at the level of new cars. When chip supply catches up, and when pent up demand is satisfied, we have every reason to expect used car prices to revert back to normal. This is clearly transient.

- The ‘Jump Ball’ Case: On the other hand, when large companies like Procter and Gamble, raise prices, they will do their best to make those prices stick. The ultimate success of those pries increases depends on our collective response. If enough consumers change their buying habits in response to price changes, that pressures those companies to reverse or reduce their increases. These may or may not be transitory.

- The Case for Persistent Inflation: We think the thing to watch most carefully is wages. Once wage increases are given, it is very hard to reverse them. If wage increases pick up momentum, that is a very persistent inflationary pressure in the economy. At this point, our take is that it is not at all clear what the outcome will be, but so far there is little evidence of a persistent inflation.

What We’re Reading

Car chip supply to increase in Second half of 2021

Powell says it’s ‘very, very unlikely’ the U.S. will see 1970s-style inflation

Jobless claims hold above 400,000 for the second week in a row

‘We have a deal,’ Biden says after meeting with Senate infrastructure group

The Unintended Consequences Of Punishing Big Oil

WHO estimates COVID-19 boosters needed yearly for most vulnerable

Microsoft challenges Apple’s business model with Windows 11 operating system

How Synthetic Biology is Redesigning Life

U.S. Lumber Prices Seen Extending Losses as Sawmills Ramp Up

Shrinkflation Is an Economic Monster Worth Watching

Consumer Sentiment Improved in June

‘Dragon Man’ skull may be new species, shaking up human family tree

Retirement Planning:

How to discover your best spending rate in retirement

There’s a lot of unknows and if there hasn’t been detailed planning or a high-level overview, someone might enter retirement with a lot of stress and anxiety.

Estate Planning:

What Are the Odds You Will Need Long-Term Care?

For an average healthy 65-year-old couple, there’s a 75% chance that one partner will require LTC, according to HealthView Services.

Health:

10 Realistic Ways to Eat Less Processed Food

Reducing your intake of highly processed foods is one of the most effective ways to improve your health and enhance the quality of your diet.

Entrepreneur:

Smart Strategies Entrepreneurs Should Leverage To Protect Their Personal Wealth

Entrepreneurs are often so laser-focused on growing their businesses that they neglect or jeopardize their personal finances.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Economic Cycle, Economic Growth, GDP, Inflation, Interest Rates, Persistent Inflation, Recovery, Transient InflationArticles, General News, Weekly Commentary

By: Adam