Markets Are Fickle – BofA Fund Manager Survey

- Perceived risks are shifting away from interest rates and inflation. The latest concern is ‘Peak Economic Growth’ implying that things can’t get much better.

- When all the experts and forecasts agree – something else is going to happen.

- The time to re-balance portfolios is approaching.

Last week we asked if strong economic growth estimates were already priced into the Market. This week we have a similar question based on the most recent (April) Bank of America Fund Manger’s Survey. We thought some of the responses to the survey were quite revealing and here we present the three charts that most caught our attention.

Economic Growth as a ‘Tail Risk’

First, for those unfamiliar with the term tail risk, it is the risk of an ‘unlikely’ event. Without getting too mathematical, the analysis is generally done using a normal bell curve (think back to your statistics class). A normal curve is based on truly random investment returns but they are not random. What that means is that that these unlikely events are actually more likely than statistics would imply. This is called a ‘fat tail’ because the tail of the distribution is larger than normal. So, when ‘tail risk’ is discussed, it is in terms of the unlikely event that is most likely to occur.

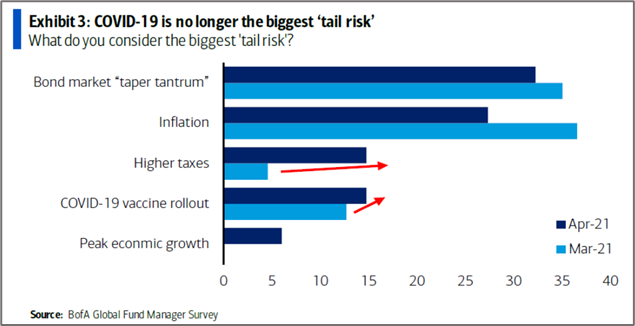

The chart above shows that the tail risks causing the most concern is the bond market (rising interest rates) and inflation. Of course, these two are closely related. Although rising interest rates and inflation remain the primary concerns, those concerns are receding. The items of growing concern are taxes and the vaccine roll-out (red arrows) and new to the list “Peak Economic Growth.” That might sound like an odd risk, but extraordinary stimulus cannot continue forever. Without the prospect of still more stimulus, we may not be far from peak growth. In that case, we have nowhere to go but down, and that would not likely be received well by the stock market.

This sentiment could be a flash in the pan, but if fund managers are getting more worried just as growth is accelerating, it’s a sign that we could be approaching an inflection point.

When all the experts and forecasts agree – something else is going to happen

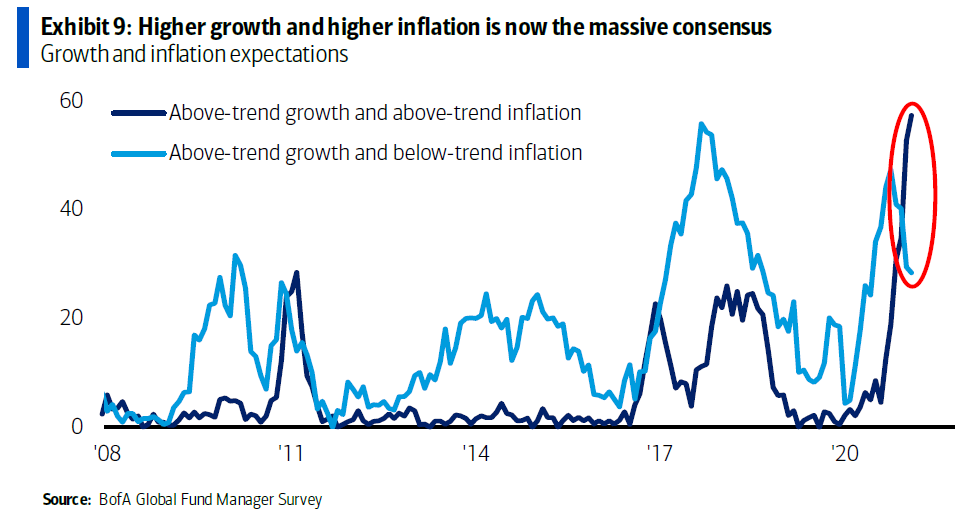

This is one of Bob Farrell’s 10 market rules. (Bob Farrell was a well-respected market strategist at Merrill Lynch for many years.) Bob’s rule immediately came to mind when we saw the BofA chart below which shows that above trend growth and above trend inflation are now the ‘massive consensus’ (red circle). The chart also reminds of the last massive consensus around 2018 called for above average growth and below average inflation, which turned out to be incorrect as growth remained anemic.

Strong growth and increasing inflation currently appear to be the easy call, but it now appears too easy, and that is a risk. Certainly, a bad COVID mutation, as well as higher interest rates, could put a crimp on growth, but the consensus thinks these are highly unlikely events. Despite the apparent confidence in the growth-inflation outlook, we can’t help but think that ‘something else’ will happen.

‘Short Treasuries’ Hits the ‘Most Crowded Trade’ List

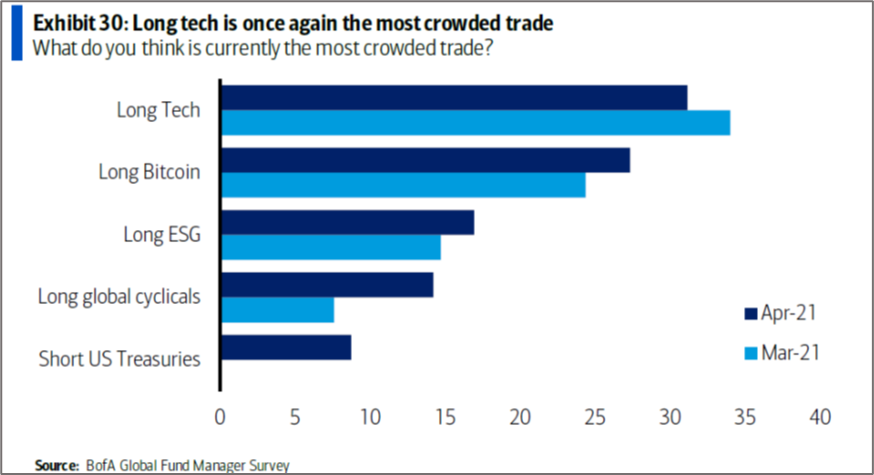

This is another case where the newcomer to the list draws our attention. It’s no secret that technology stocks have been the most crowded trade for a very long time, although it is significantly less crowded today than it was a few months back. (Crowded trades are those trades that are the most popular.) The thought here is quite simple. When trades get too crowded, there is ‘no one left to buy’ and price momentum stops.

Bitcoin and ESG investing are clearly in the ‘craze mode’ and are becoming increasingly crowded trades. Long cyclicals (betting on recovery and rapid growth), is the #4 on the list and also looking more crowded than a month ago. All of the above make sense in light of the current outlook (but also makes Bob’s rule more likely to be correct). The newcomer on the list is Short U.S. Treasuries. To explain, being short is bet that prices will decline, rather than rise. In the case of bonds, that means a bet that interest rates will rise further. All of this is very much in line with consensus thinking, so in that sense it is not surprising, but making the most crowed trade list begins to set the stage for a reversal (that is, interest rates decline).

So how does this affect you?

Glad you asked. The stock market rally combined with a difficult bond market has increased the stock exposure in our portfolios and reduced the bond exposure. All of the above have us considering when to re-balance portfolios to bring those allocations back into line by selling the things that have been up and buying the things that have been down in order to bring the portfolio allocations back to target. As investment returns tend to revert to the mean, this re-balancing is intended to improve portfolio returns.

Short Take:

Insider Buying and Selling

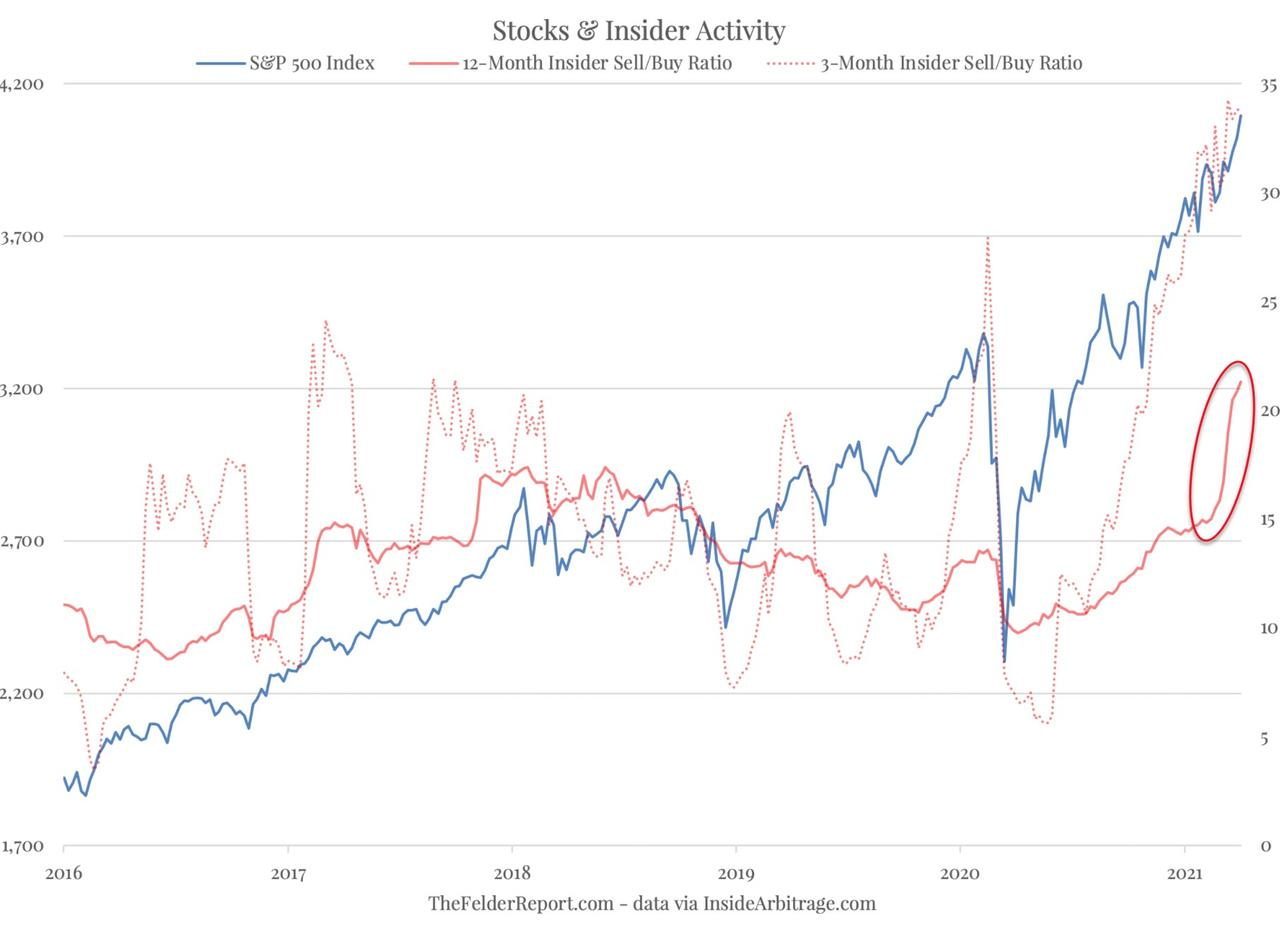

In theory, no one knows more about a company’s prospects and valuation than its executives. This has made watching insider buying and selling of stocks an interesting pastime for many market watchers. The Felder Report believes the best data is not on individual companies, but on aggregate insider buying and selling. They note that the 12-month insider Sell/Buy ratio (red circle) is moving up (i.e. much more selling by insiders than buying).

Short Take:

Growth vs. Value Investing

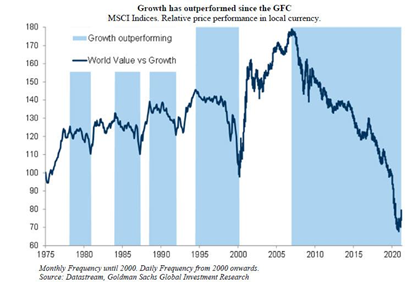

We found the chart at right in Greenlight Capital’s first quarter investor letter. (David Einhorn, CEO of Greenlight, is a well-known value investor.) What is clear from the graph is that since the housing crisis of 2007-08 and the beginning of extraordinary policies taken by the Fed, growth investing has been dominant. Why? Because low interest rates and slow GDP growth put a premium on growth stock valuations driving outperformance by growth stocks for the last 10+ years. Einhorn believes value is finally making a comeback.

What We’re Reading

Ex-FDA Chief Sees ‘Struggle’ To Vaccinate More Than Half U.S. Population

I’m Young and Healthy. Why Should I Get the COVID-19 Vaccine?

The Periodic Table of Commodity Returns (2021 Edition)

The Massive Impact of EVs on Commodities in One Chart

Purchasing Power of the U.S. Dollar Over Time

U.S. retail sales post largest gain in 10 months; weekly jobless claims fall

Consumer Prices in U.S. Advance by Most in Nearly Nine Years

Small Business Owners Struggle To Find Qualified Workers

How Hedge Funds Lost Their Way and Why They’ll Come Back (Blmbg, Sub. Req’d)

There’s a NJ deli doing $35,000 in sales valued at $100 million in the stock market

Coinbase: supersize listing rests on bitcoin price

Retirement Planning:

Keep Your Retirement Plan on Track

Staying flexible and being prepared to change course are two attributes that every good plan needs.

Tax Planning:

2021 Tax Reform Expected to Be Substantial and Far-Reaching

A primary focus in Washington, D.C., for the next seven months or so will be expected changes to the tax code.

Estate Planning:

Are Changes Afoot for Estate and Gift Taxes?

With the current administration and composition of Congress, the short answer is “yes.”

Health:

Why can’t I stay on track and stick to a diet?

It’s crucial to work on your mindset when trying to make healthy habits part of your lifestyle.

Entrepreneur:

A Tax-Preparation Checklist for the Self-Employed

For entrepreneurs, tax time twice the pressure of having to manage both personal and business taxes.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Bank of America, Economic Growth, Growth Investing, Growth vs. Value, Inflation, Insider Activity, Interest Rates, Rebalancing, Short Selling, Stock Market, Technology, Treasuries, Value InvestingArticles, General News, Weekly Commentary

By: Adam