Are the Bond Vigilantes Dead?

With all due respect to the Oracle (ORCL) mess this week, for us, the important news was in the bond market. The Fed rate cut announced Wednesday was a foregone conclusion by the time the week began. But somewhat contrary to logic, long-term bond rates were creeping higher. Were the bond vigilantes beginning to stir? (Bond vigilantes are investors that attempt to discipline governments for inflationary or fiscally irresponsible policies by selling bonds, which drives yields up and borrowing costs higher, forcing policymakers to change course.)

That is clearly not what the President, or the stock market, desires. If the economy is going to keep moving forward, having long term rates tick down is a prerequisite. Mortgage rates are keyed from the yield on the 10-year US Treasury Note. If mortgage rates are to come down, the 10-year Treasury rate must come down first, but that was not happening.

The Fed’s Message

On Wednesday, the Fed announced the expected 0.25% rate cut, which is the third such cut while inflation is running well above the Fed’s target. Once again, the Fed made it clear that this is a difficult period as risks to both the labor market and inflation exist. With only one tool, interest rates, in the toolbox, they can’t address both risks simultaneously. For now, the risk they intend to slay is the weakening labor market and Chair Powell made it clear that the next rate move, whenever it might come, is more likely to be down.

Complicating the situation further, the Fed also announced, “Reserve Management Purchases”. Without getting too technical, part of the Fed’s financial plumbing system includes repurchase agreements (known as repos). That market was showing signs of stress, which is necessitating the Fed to add reserves to that plumbing system, and they are doing it by buying Treasury securities.

You may recall numerous discussions on these pages about QE (quantitative easing), which is when the Fed buys treasury securities to reduce interest rates. (The FED buying drives demand/prices up, which moves yields down.) Although they claim these “reserve Management Purchases” are not QE, it is in essence the same process and by doing so, they are engaging in monetary stimulus to the economy and asset prices.

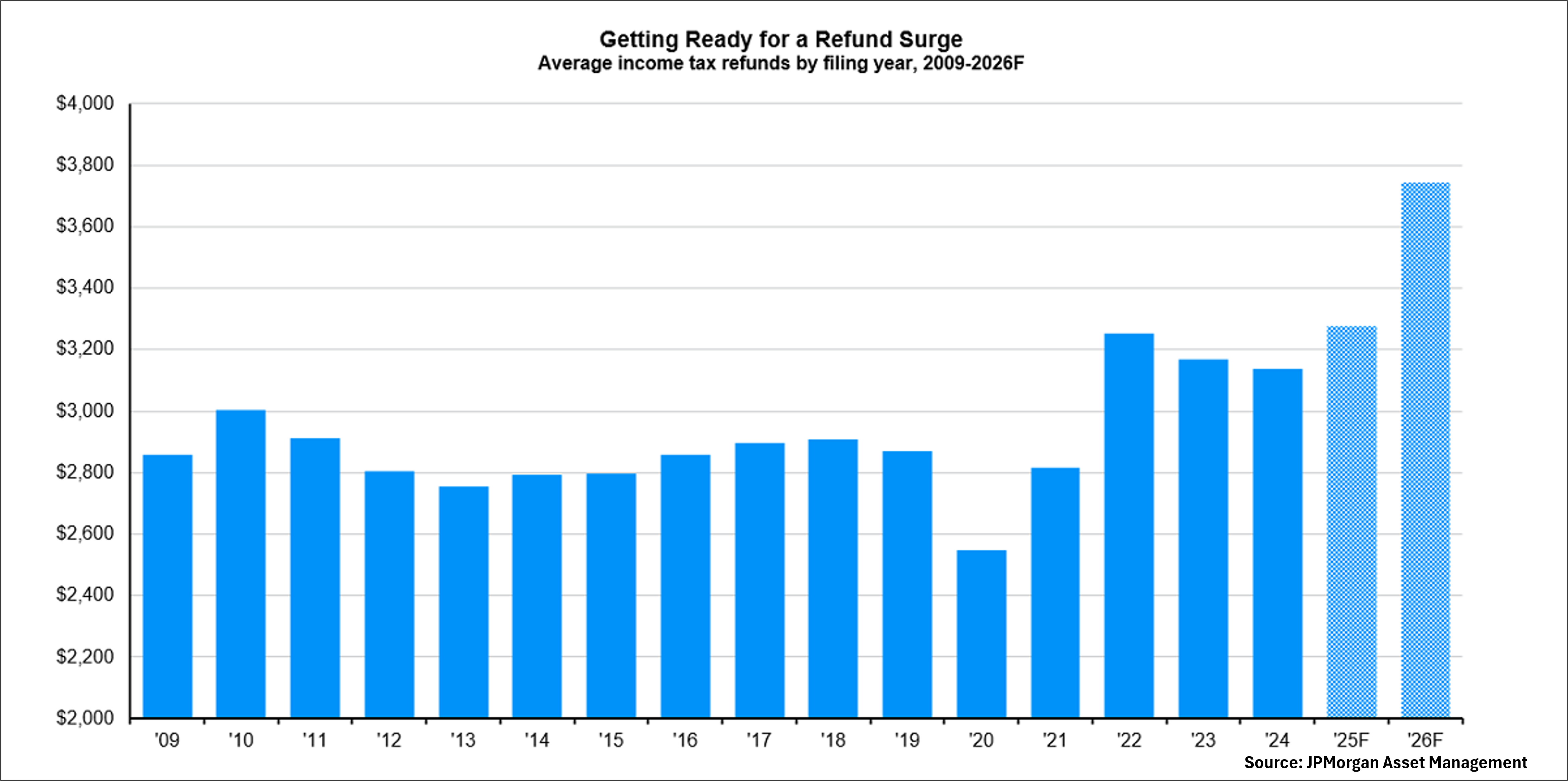

With the start of the new yar, fiscal stimulus is also expected to be on the rise as the impact form the One Big Beautiful Bill begins to hit. Early 2026 is expected to produce a surge in individual tax refunds (see chart below). This influx of cash into consumers’ hands is expected to turbo charge economic growth which should be supportive of stock prices and economic activity in the short run.

Might Inflation Reignite?

Inflation and bonds do not get along. Inflation erodes the value of the bond payments and that would normally be expected to produce higher long-term rates (as compensation for the added inflation risk of holding a bond).

The combination of fiscal and monetary stimulus may be good for forecasted economic growth, but it is also potentially an invitation for accelerating inflation. That invitation becomes more meaningful when the Fed has made it clear that they are prioritizing the labor market weakness over inflation.

The question is if/when the bond market – the vigilantes – will push back. The bond market was clearly telegraphing some concern prior to the Fed rate cut, but the two trading days since the Fed rate cut have been a roller coaster.

On Thursday, all the bond market concern appeared to quickly fade as long term rates fell hard and bonds rallied. However, that quickly reversed on Friday, leaving the bond market undecided on how it perceives the risk of an inflation revival.

At the end of the week, we are right back where we started. The vigilantes aren’t dead, but neither are they back in action. Keep an eye on the 10-year and 30-year treasury bond yields. If they continue to move higher, it will be an increasing headwind for the stock market. If long rates stay flat to down, the stock market trend leans higher based on the expected stimulus into 2026.

Have a great week!

What We’re Reading

-

The Fed’s entering its unknown era, and that’s bad news for investors

-

Investors fear Time just jinxed the AI stock-market rally

-

November Data Shows Strong Year-Over-Year Growth in First Half of Holiday Season

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

10-year treasury rate, bond vigilante, Fed, Fiscal Stimulus, FOMC, Inflation, Interest Rates, Lowering Interest Rates, Monetary Stimulus, Raising Interest RatesBy: palumbo