Back to the Future

- Inflation is an enemy we have not seen for a long time.

- Housing inflation can be particularly harmful because housing is about 17% of GDP.

- Building costs are rising rapidly. Existing home prices are rising rapidly. Unless incomes rise rapidly too, we are headed for a fall.

Last week we discussed the evidence for the current inflation to be persistent or transitory. There are good arguments on both sides, which to us implies that some items will be transitory and others not, thus some increase in inflation will be persistent. The unanswered question is how persistent and that is where markets have been laser focused.

Our thinking is along different lines. A few of us have been around long enough to remember the last great inflation, so that has spurred plenty of discussion. One of the things left out of the current inflation debate is the tendency of recessions to follow inflationary spikes. This should not be surprising. Inflation would be indicative of an overheating economy and the typical Fed response would be to raise interest rates, which would slow the economy and push us toward a recession. We find it interesting that the current debate is centered on when the Fed will raise rates, rather than on the result of the Fed raising rates. We strongly suspect that once the Fed does finally raise interest rates, the recession discussion will begin in earnest. We don’t know when that point is, but we think it is worthwhile to take that step ahead of schedule.

The last two economic downturns were unlike the recessions of the past. Crazy leverage in the housing market threatened the financial system in 2008 and a pandemic caused the most recent downturn. Back in the ‘old days’ the Fed caused recessions by pushing back on ‘too rapid’ economic growth by raising interest rates. They always seemed to raise them too far and keep them there too long, creating a worse economic outcome than what was necessary. This time, we may well be heading back to the future – an old-fashioned recession. We are not saying it necessarily happens soon, but we are heading in that direction. Here’s why:

- Upward Pressure on New Home prices: Two years ago lumber was trading at about $300-$350 per thousand board feet. As this is written, the price is $1,600. Lumber costs are adding over $30,000 to the cost of an average new home. Two years ago copper, another key commodity in house construction, was trading at about $6,000 per ton. Today it is over $10,000 per ton. (See “Lumber costs have added $36,000 to the price of a new home” in What We’re Reading below.)

- Upward pressure on existing home prices: There is simply no supply on the market. When COVID hit, the supply of existing homes for sale plummeted and it has not recovered. There was great fear of having strangers contaminate your home while viewing the house. How much of the current supply shortfall is related to this is up for debate. (See “Every Metro Area Experienced Home Prices Rise” in What We’re Reading below.)

- Upward pressure on interest rates: Market rates have already begun to react in anticipation of the Fed having to face the inflationary trends. The Fed has promised to hold off on rate increases as long as some segments of society are still under great stress, but that cannot last forever. The market will ultimately force the Fed’s hand if they are unable to react independently.

This combination is reflected in the University of Michigan Sentiment Survey, released Friday, which recorded the weakest home buying sentiment since 1983!

Without some correction in commodity prices, and existing home prices, the only solution is if income growth can keep pace. Incomes have certainly risen during the pandemic, but that is largely due to government transfer payments. The real question is where incomes are headed once the pandemic is behind us. If incomes fail to keep pace with rising home prices and interest rates, the housing market could fade quickly leading to an old-fashioned, 1970’s style recession.

We can’t help but think that we could be on a collision course, although this might well be a slow-motion train wreck. We see no reason for this to pan out quickly, or fade away quickly, and that is precisely why we favor a balanced approach to investing with a diversified portfolio. We do not believe the market can be timed with any consistency.

Inflation Data Shocks Markets

- Investors think in terms of long-term trends, but on the margin, markets are ruled by traders, who react to each new data point, whether it fits their particular narrative or not.

- The surprising inflation data this week did not fit the investors narrative, but investors appear unperturbed.

- Traders, on the other hand, must account for the possibility that the investors narrative is incorrect, and as a result, markets move.

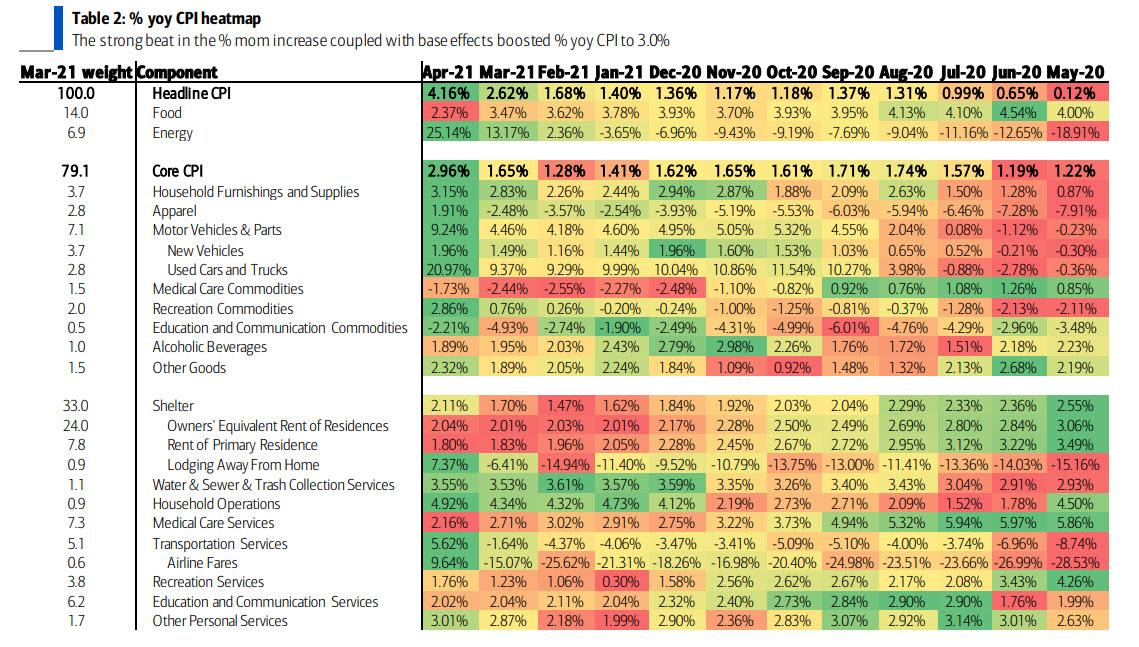

Last week we spoke of transitory inflation vs. a more permanent surge in inflation. The inflation data this week, which showed the Consumer Price Index (CPI) rising 4.16% from last year raised concerns that this inflationary episode is more of the permanent kind and markets reacted accordingly, as stock and bond prices declined sharply on Wednesday. We took a harder look at the data to draw some conclusions of our own and that data is in the heat map below (from BofA Research) which shows year over year price changes. What stands out in the data is that there were a couple of very large increases that deserve some deeper thought, in particular Energy, which rose 25.14% and Used Cars, which rose 20.97%.

We believe the increase in energy is purely a base effect (i.e., the point of comparison is the ‘base’). Last year at this time, oil prices had plunged, so despite the fact that crude oil is selling at roughly the same price as immediately before the pandemic, the small base created by the pandemic makes the increase appear quite large. If crude prices were $80 and headed higher, we’d have legitimate concerns, but oil has simply returned to where it was and that is not an inflationary event.

Used car prices also rose dramatically. The reasons in this case are a bit less clear, but we note the following:

- New car prices rose less than 2%.

- The chip shortage has reduced new car production.

- The pandemic has created a continuing fear of mass transit, increasing the demand for cars.

It is possible that the pandemic effect on the use of cars could be somewhat permanent, but it is hard to argue that higher used car prices are permanent, or that used car prices will continue to rise when new car prices are fairly stable. Thus, we see this effect as temporary also.

So how did these two items impact the inflation number? Well, using the weights from March 2021 (April weights are not yet available.) these two items contributed about 56% of the 4.16% rise in the CPI in April. Without these two items, CPI would have risen an estimated 1.84%.

Inflation is something we need to keep a close eye on, but at this point, there is little that says a persistent inflationary surge is happening. However, these base effects and the continuing supply chain issues will likely keep headline inflation on the high side for some time to come.

What We’re Reading

US recovery could be upended if Fed’s bet on ‘transitory’ inflation proves wrong

Mississippi River Reopens, Freeing Over 1,000 Stuck Barges

Remember the Nifty Fifty? (Oldie, but goodie)

Why investors should look past this week’s inflation data

Virtually Every Metro Area Experienced Home Prices Rise in First Quarter of 2021

Lumber costs have added $36,000 to the average price of a new home

Antimony: A Mineral with a Critical Role in the Green Future

U.S. Economy Is Evolving. So Should the Fed

Gold’s Headwind Turns Into a Tailwind

Why Is The White House Timid On Trade?

This Face Changes the Human Story. But How?

Retirement Planning:

Is A Roth IRA Conversion Right for You?

I tell clients with money in traditional IRAs not to get too in love with their balances, as it’s not theirs just yet.

Tax Planning:

How Biden’s tax plan may spark more charitable giving

Biden’s proposal may make some charitable giving tactics more attractive.

Health:

Got Back Pain? How the Superman Exercise Can Help

There are a handful of easy-to-perform movements that can help relieve some tension and aches.

Entrepreneur:

An Entrepreneur’s Guide To Strengthening Personal Finances

As an entrepreneur, it is easy to overlook your personal finances as you only focus on your venture.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Building, CPI, Economic Growth, Federal Reserve, Home Prices, Housing, Inflation, Interest Rates, New Cars, New Homes, Persistent Inflation, Portfolio Diversification, Shortages, Transitory Inflation, U Michigan SurveyArticles, General News, Weekly Commentary

By: Adam