Are Soaring Growth Estimates Already Priced In?

- GDP Growth is expected to soar based on vaccination progress, consumer recovery and an easy comparison with last year.

- With a fresh run of stimulus checks delivered, or about to be delivered, and pandemic fatigue rampant, it isn’t hard to imagine at least a mini-boom over the next several quarters, leading to improved earnings and higher stock prices.

- However, there are risks: 1) emergence of a new, dangerous variant; 2) a Fed that pulls back on monetary accommodation too soon, 3) higher interest rates, and 4) the stock market, a discounting mechanism, may have already factored the mini boom into prices.

It may not be the roaring 20’s again, but it sure looks like a roaring 2021. The combination of vaccine progress, massive stimulus, and a very easy comparison to the disastrous COVID economic impact makes GDP forecasts that are well above the pre-pandemic trendline an easy call. However, that doesn’t imply there is no risk to that forecast. Although U.S. vaccination progress is very good, it is less so in Europe and virtually non-existent in the third world. That matters because the longer this virus is roaming free, the better the chance that a variant finds its way around the vaccines. The simple fact is that the more COVID cases there are, the more variants there will be. There is simply no way to forecast if, or when, a more dangerous variant might appear, but the faster we get vaccines to the entire world, the better off we will be.

The Fed pulling back monetary policy too quickly seems implausible given the rhetoric emanating from the institution. The Fed appears fully committed to ‘lower for longer’ as it focuses on avoiding deflation at the risk of inflation, so we don’t see this as a viable risk, however, the bond market may have other ideas. We have seen hints of the bond vigilantes returning and demanding higher rates in response to the growth outlook strengthening and an open invitation for the return of inflation from the Fed. If the bond vigilantes return in earnest, that could force the Fed into a very serious hand of poker with the bond market and force the Fed to do something it has not done since WWII – Yield Curve Control. There are massive deficits to finance and with each day, it seems there are new programs proposed with little money available to pay for them. The Fed’s challenge will be to issue substantially more debt into the market than they ever have, while keeping rates down. That is a tall order. If they can’t keep rates down, that is a real risk to economic growth and the stock market.

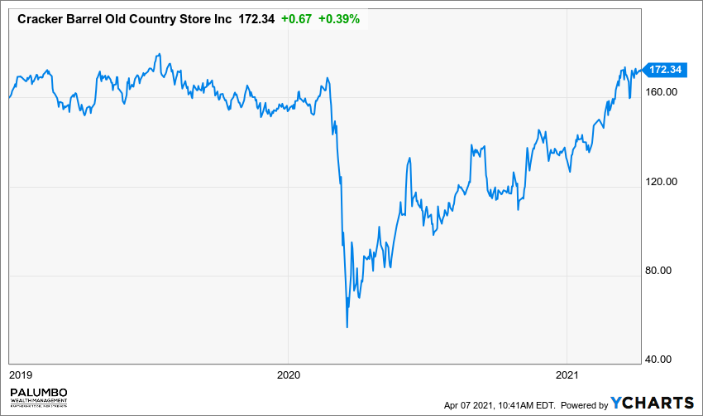

The idea of a rapid recovery as vaccines take hold is certainly not novel. Turn on the financial media for a few minutes and it is hard to avoid a segment discussing the coming recovery boom. It’s quite easy to get caught up in ‘recovery stocks’ but the question will be whether these stocks already reflect the recovery. There is no easy way to measure that, but we can provide some anecdotal evidence. We picked out 8 recovery stocks in various sectors and looked at the charts from January 2019 to see which of them have had the stock price recover back to their respective pre-pandemic levels. Of the eight we chose, all but one (Carnival Cruise Lines) has returned to their pre-pandemic level.

The eight we chose were: Marriott and Carnival Cruise Lines (Hospitality), Southwest (Airlines), Wynn Resorts (Gaming), Darden Restaurants and Cracker Barrel (Restaurants), Walt Disney (Entertainment), and Macy’s (Retail).

Of the eight we chose, only one has failed to clearly reach all pre-pandemic levels (Carnival Cruise Lines). Wynn and Macy’s have effectively returned to pre-pandemic levels and the remainder are well above the pre-pandemic level. These companies were among the most impacted by the pandemic and their respective recoveries clearly give credence to the idea that recovery has already been baked into stocks.

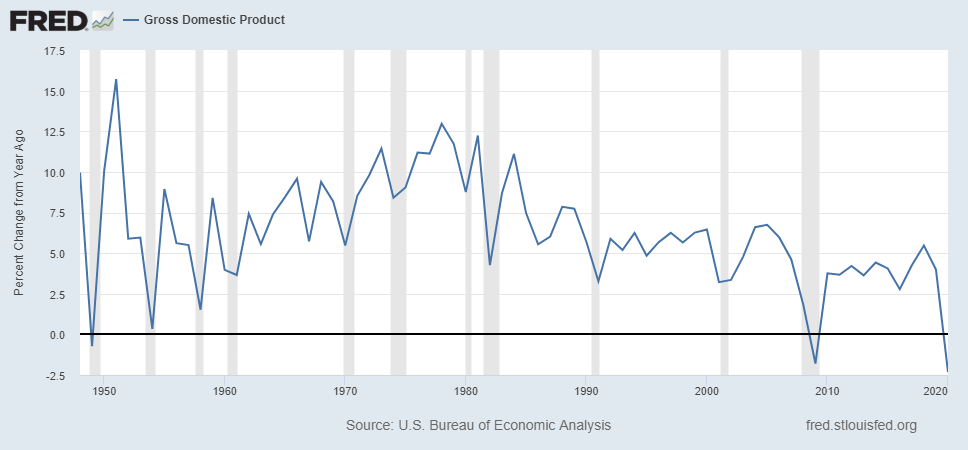

In our view, that implies that for stocks to continue meaningfully higher we must increasing believe that economic growth (i.e., GDP) in the post-recovery period is going to be higher than the pre pandemic trendline. Nominal GDP growth has been in a decline since roughly 1980 and was hovering between 2.5% and 5% for most of the last 10 years. (See chart below.) That implies that we need GDP growth to head back toward 5% and higher. Certainly, growth expectations for this year are well above that range, but the real question is what to expect in 2022 and 2023, as the surge effect of the end of the pandemic wanes. That should begin to become clearer as the year progresses.

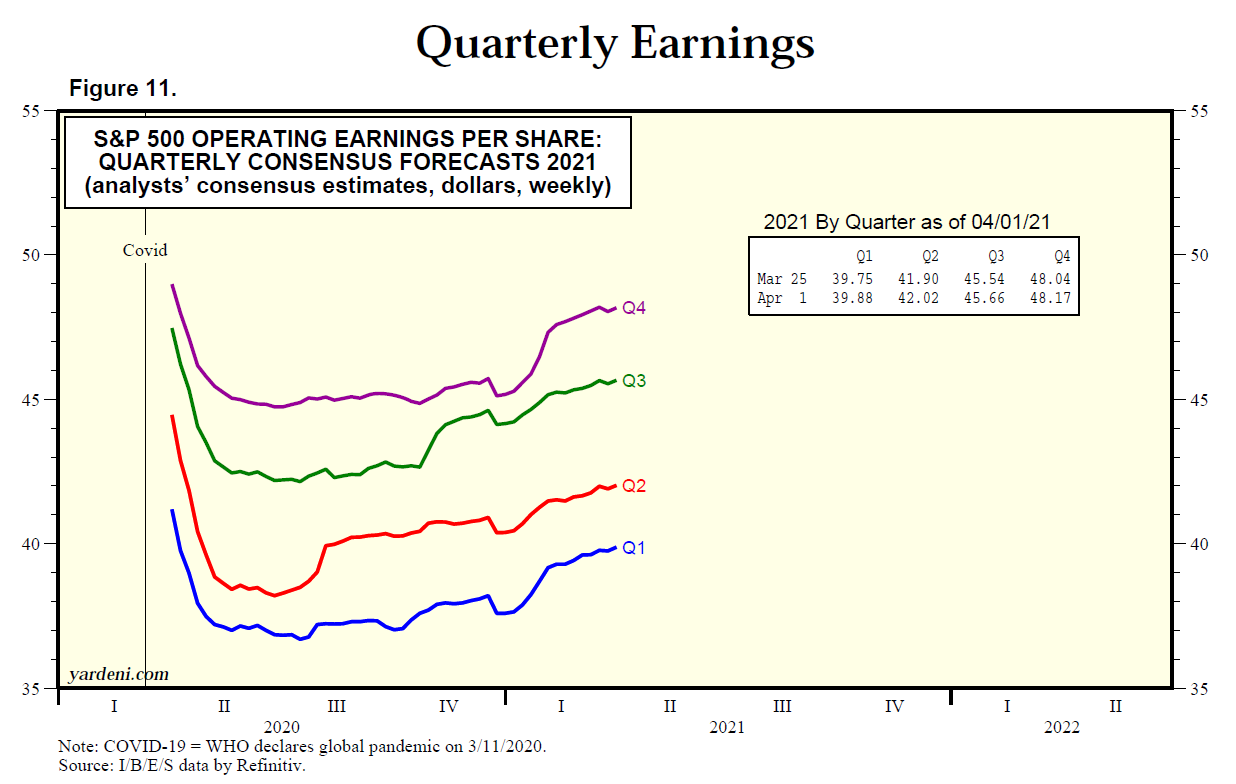

On a near term basis, the market gets its first test next week when first quarter earnings reports begin. As shown in the cart below, courtesy of Yardeni Research, even at the depth of the pandemic, earnings estimates for 2021 were already beginning to rise. It’s now time for those projections to become reality.

It’s also clear from the chart that Q1 is just the beginning with sequential earnings increases expected through the year. How well (or poorly) earnings hit the mark should go a long way to defining just how well (or poorly) the stock market will perform in 2021.

The stock market is a discounting mechanism, meaning that it reflects all available information, including everything known up until now, as well as the potential future events. For now, the expected future for earnings is rosy and that is evident in stock prices. When unexpected developments occur, the market discounts this new information very rapidly. For now, expectations are high, and we will begin to see if those expectations can be met beginning next week.

What We’re Reading

Why Shortages of a $1 Chip Sparked a Global Economic Crisis

Breakingviews – Path out of global tax combat is slowly emerging

U.S. plays down expectations for Vienna Iran nuclear talks

U.S. Senate Banking chair presses Wall Street banks on Archegos ties

U.S. weekly jobless claims rise again, but labor market recovery gaining steam

Mapping the World’s Key Maritime Choke Points

New York’s wealthiest look for exits as state readies hefty tax increase

Moderna vaccine antibodies last at least 6 months

Researchers identify five new cases of ‘double mutant’ Covid variant in California

Global air and trucking demand is exceeding capacity (2 min video)

Bitcoin Evolves From Tulips Into A Geopolitical Weapon As US Warned Again

$2.1 Billion for Undocumented Workers Signals New York’s Progressive Shift

Retirement Planning:

Let’s Update Discussions Around Retirement Planning

The world has changed quite a bit — yet there hasn’t been a corresponding shift in the retirement planning conversation or its considerations.

Tax Planning:

New York’s wealthiest look for exits as state readies hefty tax increase

The budget passed by state lawmakers and headed to Gov. Cuomo’s desk would likely have New York City’s executives end up with combined local and state personal income tax rates that are higher than for wealthy California residents.

Health:

New Variants of Coronavirus: What You Should Know

The new variants raise questions: Are people more at risk for getting sick? Will the COVID-19 vaccines still work?

Entrepreneur:

10 Simple Ways to Improve Your People Skills

Much of your success in life hinges on your ability to understand and interact with people.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Carnival Cruises, Cracker Barrel, Darden Restaurants, Disney, Earnings, Economic Growth, Ed Yardeni, Estimates, Federal Reserve, GDP, Interest Rates, Macy's, Marriott, Quarterly Data, Risk Management, Southwest Airlines, Stimulus Checks, Wynn ResortsArticles, General News, Weekly Commentary

By: Adam