When it Absolutely, Positively Has to Be There…

Those old enough will probably recognize our title from the iconic Federal Express tagline ‘When it absolutely, positively has to be there overnight’. When the pandemic hit almost a year ago, one of the key words of the time was delivery. Groceries were delivered in record amounts, take-out food deliveries became the norm, Amazon and other web-based retailers overwhelmed UPS, FedEx and USPS with deliveries. We worried about deliveries of ventilators and N95 Masks and how are we going to deliver the vaccine? All of the above, and much more, absolutely, positively had to be delivered to get through this ordeal and for the most part, the deliveries eventually went through.

For the stock market, little has changed – delivery remains the critical word. Stocks have risen so spectacularly, the only way forward from here is for corporate America to deliver the anticipated earnings. There simply isn’t much room in valuations to propel the stock market higher without that. We need earnings. If Price/Earnings (P/E) ratios are too high, there are only two solutions, the P goes down, or the E goes up. When P increases, valuations increase, when E increases, valuations are justified…or not.

We only bring this up because of some of the non-sensical reporting that we have seen still arguing a year later about whether the recovery is V shaped or U shaped, as if any of that matters right now. The real point is that we have discounted a very rapid recovery and the support for that comes in the form of sales and earnings revivals that have generally been better than first predicted so far. That is due to:

- Fiscal stimulus. Transfer payments have kept personal income high despite shut-downs

- Our collective desire to get out of the house more, even in the face of COVID risk

- Businesses cutting costs. Difficult times simply require a greater emphasis on efficiency.

At this point the earnings picture continues to look good, but is not without risk.

The market has risen as high as it is, simply because the market has faith that corporate American can deliver strong earnings in 2021 and virtually all the evidence tends to confirm that. The pandemic has likely created some pent-up demand (some of which we may already be seeing as appliance sales have suddenly picked up) and those efficiency gains are beginning to flow through as well, so earnings have been better than expected. However, if markets are to have any hope of holding these lofty levels, that trend will have to continue.

The primary risk remains obvious: COVID has to continue to be gradually brought under control and anything that disturbs that trend is dangerous for the stock market. At the moment, the concern would be that a COVID variant is able to defy the vaccine and force us into another cycle of vaccine development and delivery could put a major crimp in 2021 earnings. For the time being, we need to continue to focus on the deliverables, and how they fit into the progress, or lack thereof, of the stock market.

While we watch these trends closely, we do not rely on forecasts to position our portfolios in expectation of short-term changes such as earnings cycles. We have built our portfolios to be diversified, with a portion of our allocations to be positions based on a variety of scenarios, with the expectation that a portion of our client portfolios will benefit from these dynamic environments.

Bitcoin, ESG and Virtue Signaling

The last few months have presented us with an odd combination of headlines. ESG fever is heating up and everybody is jumping on board in an effort to present themselves in the most favorable light, i.e., virtue signaling. At the same time, Bitcoin fever is heating up as well and many of those same companies are also jumping on board in an effort not to miss out on what might be the ‘next big thing’. In both cases, they fully understand that there is little or no penalty for making the same mistake everyone else is making, but the penalty is enormous if you erroneously fail to follow the herd – the lemming effect.

What makes this particularly interesting is the fact that these two positions appear to be diametrically opposed to each other. Bitcoin is a virtual ‘currency’ and therefore is often assumed to have a clean footprint, however, Bitcoin is ‘mined’ into existence with increasing amounts of computer power. This Bloomberg article estimates that Bitcoin’s annual energy consumption is estimated at around 77.8 terawatt-hours (a terawatt is a trillion watts). The estimated carbon footprint of Bitcoin mining is about 37 million tons of carbon dioxide, about the same as New Zealand (yes, the entire country). Other studies conclude the carbon footprint of Bitcoin is even higher, possibly explained by the fact that because Bitcoin is so power hungry, it is most profitably mined in areas with very low energy costs and few emissions regulations, which also explains why most Bitcoin is currently mined in China.

It seems ESG works when it is good for ‘me’, but when it doesn’t work for ‘me’, I just ignore it. We have no problem with rational ESG investing, we just have not seen much of it. ESG investing needs to mature if it is to be useful.

Another case in point is Tesla, a favorite of the ESG crowd. Tesla recently purchased $1.5 billion in bitcoin as a cash management tool. In our humble opinion, using an asset that is as volatile as Bitcoin is better labelled as a cash “mis-management” tool. Investing corporate cash in such a speculative instrument has long been shunned by most public corporations. While many Tesla shareholders may not be concerned, they should be.

Assets labelled “Cash and Marketable Securities” on a public corporation’s balance sheet is theoretically designed to provide the corporation immediate and known liquidity for potentially less certain economic times, and is usually invested in a very safe and liquid investment. Assuming this type of risk with what should be almost riskless assets would concern me as a Tesla stockholder. Of course, that doesn’t mean that Tesla will lose money on the transaction. Poor decisions do not always have poor outcomes. An additional factor here will be what could happen to Tesla’s reported earnings, which will now be more complex to decipher due to the addition of Bitcoin on the balance sheet. It will be interesting to see how Tesla’s accountants and the investing community decides to handle these gains or losses and how those changes might affect the income statement and reported earnings at Tesla. At a minimum, we would expect any losses to flow through to earnings each quarter, almost assuredly adding volatility to Tesla’s earnings.

The Bond Market Isn’t Buying It

No commentary this week would be complete without some comments on interest rates. Whatever the stock market is buying, the bond market wants nothing to do with it.

- Economic data continues to be generally good to very good

- More fiscal spending from a Democratic Washington is very likely

- The Treasury announced that it will scale back it’s $1.5 trillion cash pile, sending additional hundreds of billions of dollars into the economy.

While stocks may like the flood of liquidity, the bond market is less sanguine. A flood of liquidity could push even more downward pressure on short-term rates, threatening the possibility of negative short-term rates in the US. for the first time and creating a potential threat to money market funds. (See this link for more detail.) This will force the Fed to jump through several more hoops to keep everything in order, and the potential consequences are not clear.

The more obvious risk is that as the economy re-opens, the velocity of the massive increase in the money supply will move higher and present a growing risk of inflation. While money supply has continued to expand, the velocity of the money has remained stagnant. To the extent that changes, it would likely create intermittent, but very real and measurable pressure on long-term rates.

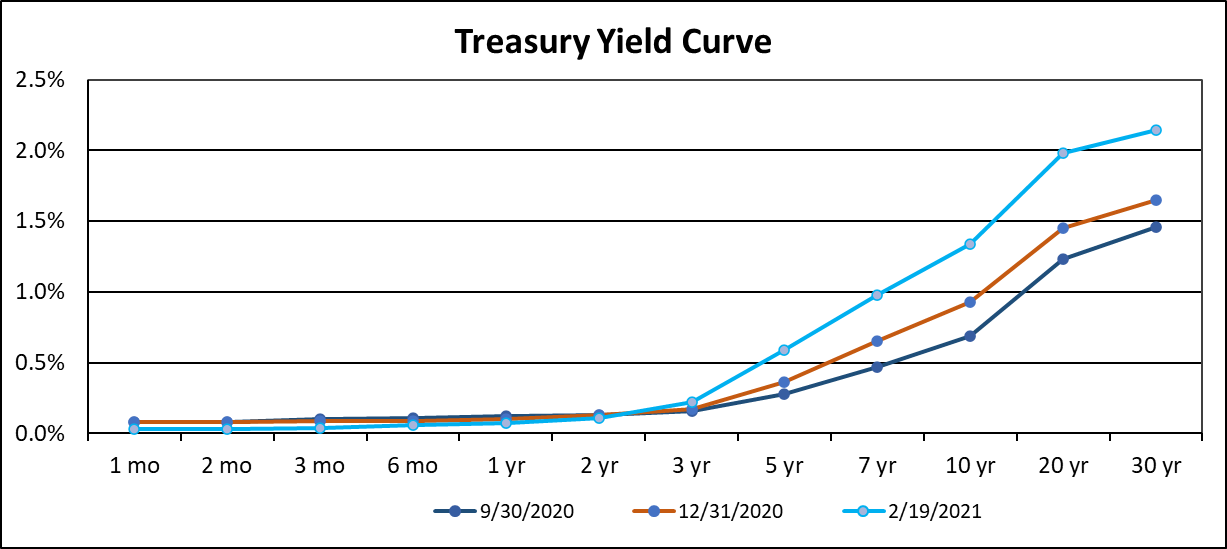

Back at the end of the third quarter of 2020, the 10-year was trading at 0.69%. By the end of the year, it was up to 0.93%, with a concern about crossing over the 1% barrier. Six weeks later, we’re at 1.34%, having passed the ‘next barrier’ of 1.25%.

It’s a similar story for the 20- and 30-year bonds, which are now back at or above their level before the pandemic hit, with the 30-year bond at 2.14%. These changes may not seem like very much, but in the world of fixed income, these are very rapid and very substantial moves. And these changes are not only occurring in the U.S. UK Gilts and German Bund yields have also risen alongside U.S. Treasuries.

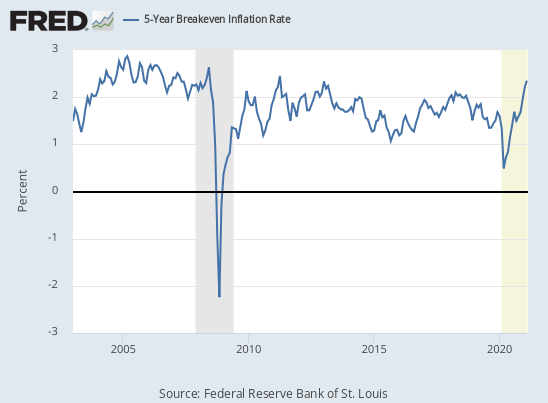

The reason for these increases, in our view and around Wall Street, is that we may be on the verge of re-awaking the inflation tiger and any increase in inflation will naturally require a higher yield to pay for that risk.

But here is the conundrum:

- Substantially rising rates will tend to stall any recovery, and certainly the Fed does not want that to happen.

- The Fed is nonetheless desirous of more inflation, which has, on average, failed to hit its target for many years.

- With massive amounts of debt now in the economy (over 100% of GDP), inflation appears to be one of the few, if not the only, viable remedy for our debt problem. Strong economic growth and consistent accelerating productivity would also help, but they have been absent for many years.

The 5-Year breakeven inflation rate is 2.35% at this writing, which is back to levels expected before the great recession in 2008-09. With the FED targeting 2% inflation, and willing to let inflation ‘run hot’ to get the longer-term inflation average up to 2%, there may still ample room for the bond market to run rates still higher based on inflation concerns.

So how will the Fed react? Our guess is that first and foremost, the Fed will defend the recovery, and that means at some point, rates will hit a level that the Fed is unwilling to cross. At that point, it would likely consider either jawboning the rate plateau, or if that didn’t work, they would implement a form of Yield Curve Control (YCC) to put a lid on long-term rates. During WWII, when we also implanted YCC, that level was about 2%. Time will tell if that level remains an appropriate rate target. That implies a laissez-faire attitude toward inflation, and greater interest in real assets and less interest in financial assets, a trend already somewhat evident in the commodity rally.

If the Fed chooses not to act and rates continue to rise, it has the capacity to put a major crimp in equity markets and all risk assets. Bond returns have been negative year-to-date 2021, but a further rise may incite a reversal. Only time will tell.

While PWM takes a long-term view, we have been closely monitoring the changes in the bond market. As you know, we have spoken about our concerns about rising rates, and the potential for higher inflation going forward. While we have maintained our U.S. Treasury exposure in all portfolios, we have on the margin, lowered the duration of the Treasury exposure in the middle of last year, strictly for risk management purposes. As you may know, duration is a measure of a bond’s price change based on a given change in interest rates. The longer the duration, the more responsive a bond is to a move in interest rates. Lower bond duration reduces the negative effects of a given rise in rates. In effect, we have reduced the effect of higher rates as a short-term risk management action. We are watching the market closely to determine when to re-establish a longer-duration posture in the future.

What We’re Reading

Bitcoin poses no threat to the dollar, Fed’s Bullard says

US bond sell-off stirs warnings over stock market strength

Facebook Blocks News in Australia in Warning for the World

Big Freeze Seen Inflicting $50 Billion in Damage.

Yellen says tax hike would pay for part of Biden infrastructure plan

Fed says risks of U.S. business failures ‘remain considerable’

A Tale of Two Carbon Prices to Shape Biden’s Climate Policy

Fed Will Likely Raise Rates Next Year Says Larry Summers (2 min. video)

Seeing Tip of the Iceberg With Bitcoin: Binance CEO (5 min. video)

Flintstones Had Better Monetary System Than Bitcoin: Roubini (4 min. video

Biden Team Downgrades Saudi Crown Prince to ‘Recalibrate’ Ties (3 min. video)

How The IRS Knows You Owe Crypto Taxes

Retirement Planning:

Are You Prepared for Health Care Costs While in Retirement?

The average 65-year-old couple in 2020 will need $295,000 in today’s dollars during their retirement, excluding long-term care, to cover health care expenses.

Tax Planning:

Two Tax Strategies Real Estate Investors Should Know

Estate Planning:

State Legislators Eye Revenue from Inheritances and Gifts with New ‘Heirs Tax’

Among other things, the bill would tax inheritances in excess of $250,000, exempting retirement and pension funds.

Health:

Studies have identified a risk of coffee raising a person’s serum cholesterol levels, although it may depend on the brewing method.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Bitcoin, Bond Market, Cryptocurrency, Delivery, Earnings, ESG, Federal Reserve, FedEx, Fixed Income, Interest Rates, Price/Earnings, Speculation, Stimulus, Treasuries, UPS, Yield CurveArticles, General News, Weekly Commentary

By: Adam