Tapering is Not a Fashion Statement

There’s been a lot of talk about tapering lately and we’re not talking about the slim fit that is the style for men these days, we’re talking about the Fed’s balance sheet. Here’s what you need to know.

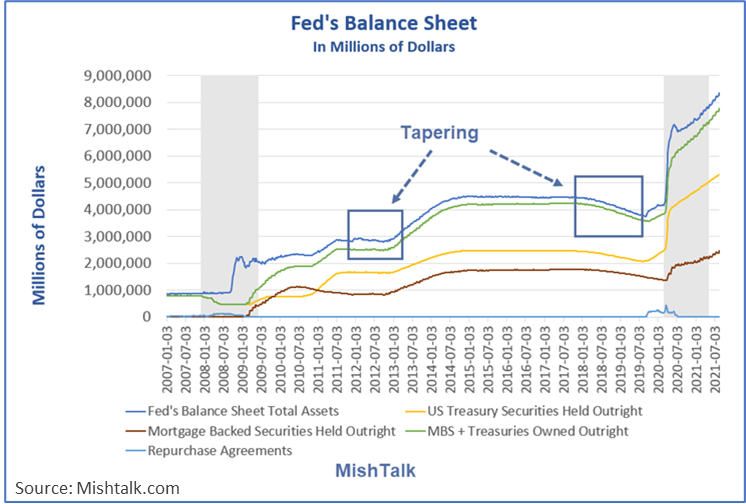

- For most of the period from late 2008 to today, the Fed has been on a buying spree of various assets, particularly Treasuries and mortgage-backed securities. In the process, it has increased the size of the Fed balance sheet from approximately $1 trillion to over $8 trillion today.

- More demand typically results in higher prices, other things being equal, and that implies that this Fed buying spree has been a significant driver to the incredible rise in asset values over the last 12+ years.

- Tapering simply means that Fed is going to reduce the size of this buying spree, with the intention of ending it completely at some undefined point in time.

- In the past, efforts to taper (see the chart below) have resulted in ‘taper tantrums’, meaning that markets came a bit unglued when the Fed tapered. The implication is that other things being equal, less demand should lead to lower asset prices and so the market reacts poorly to tapering.

- The Fed appears ready to start tapering, the question is how far will this go before the market pushes back with another ‘taper tantrum’.

- We can only guess, but we suspect it won’t take long. At that point the more important question will finally be asked.

- Will the Fed cave and resume purchases in response to the tantrum?

We, like everyone else on Wall St., can only guess at the answer, but we will make the following observations/arguments:

- The Fed has a strong desire to ‘normalize’ its behavior in markets, despite the difficulties in doing so. The implication is that at some point, like any good parent, it must ignore the tantrum of the unruly child and act anyway.

- Although unfilled jobs actually outnumber the unemployed, the unemployment rate remains quite high. The Fed does not want to put a crimp on the re-employment of these people, so tapering now would not align with their desired result.

- Inflation is running hot, which argues for tapering sooner rather than later, but the Fed has argued that most inflation we see now is transitory.

Fed Chair Powell spoke on Friday at the annual Jackson Hole Symposium and essentially said the following:

- Inflation targets have essentially been met; Fed will remain on guard for signs of a more permanent inflation.

- Employment continues to improve, but the spread of Delta presents risks for that trend.

- The timing and pace of tapering (when it comes) has no influence on the timing and pace of potential interest rate increases.

Our conclusion is that the table is now set to begin tapering, but the statement on Friday is clearly attempting to head-off a repeat of past taper tantrums. The success of this messaging will become clearer when the taper actually begins. For now, the stock market appears pleased by the tone of Chair Powell’s statement – neither too dovish nor too hawkish.

There is some initial evidence that the Delta surge could be easing in the areas that were earliest hit. If that trend continues and school openings do not create another resurgence, we can expect a tapering announcement sooner rather than later.

Is the Delta Surge Ending?

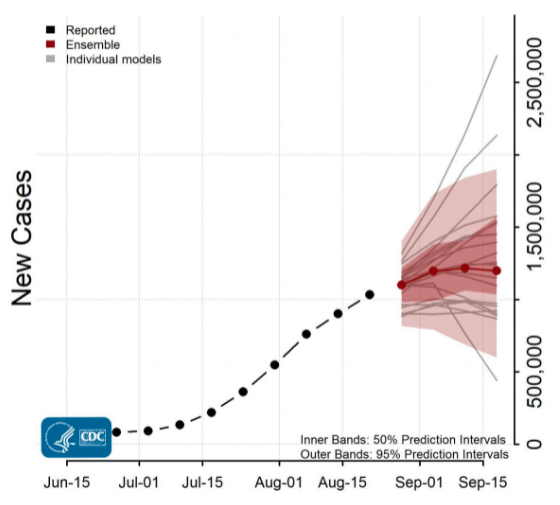

Some pundits are projecting an end to the Delta surge based the number of cases rolling over in the states hit earliest. Of course, schools are, or are about to, re-open and this variant appears to affect kids more readily than the original, so it’s hard to draw conclusions just yet. Below is the latest from the CDC based on 20+ models from the scientific community which show that it’s pretty much a toss-up.

It’s hard to know what to wish for. From a health perspective, we clearly want this recent surge to subside. From an economic viewpoint, if the surge declines here, but worsens in largely unvaccinated Asia, it could magnify and prolong supply chain issues, which would logically magnify and prolong inflation issues. That does not create a desirable result for the economy or markets.

As always, it is an unpredictable world. Predicting the future is not easy and predicting it consistently is impossible, which is why we stick to our plan, and leave the predictions to others.

What We’re Reading

How Would Fed Tapering Impact Markets?

The World Economy’s Supply Chain Problem Keeps Getting Worse

Fed’s Kaplan concerned about inflation and risk; wants to announce taper in Sept.

In This Housing Boom, Mortgages Are for Losers

Remembering Charlie Watts (short video)

Remember When September Was Going to Be the Return to Normal? (Bloomberg)

Map Explainer: Key Facts About Afghanistan

More terrorist attacks likely as Afghanistan withdrawal deadline nears

Biden eviction moratorium shot down by Supreme Court

Judge blocks Florida governor’s order banning mask mandates

Retirement Planning:

Planning on a Long Retirement? Rethink Your Equity Exposure

New research from Dimensional Fund Advisors shows why retirees should be more conservative when it comes to too much equity exposure in their retirement funds.

Estate Planning:

How To Create A Multigenerational Estate Plan

Does your estate plan pass the multigenerational test?

Tax Planning:

More states enacting SALT limit workarounds

Following enactment of the state and local tax deduction limitation in the Tax Cuts and Jobs Act in 2017, many states began looking for structures to circumvent the limit.

Health:

How Sugar Addiction Affects Your Body

Sugar addiction is a real thing and it has some very real health concerns.

Entrepreneur:

Why It’s So Important to Articulate Your Brand Values

Defining your values can (and should) be the foundation of everything you do.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Balance Sheet, Buy-Back Assets, CDC, Delta Variant, Employment, Federal Reserve, Inflation, Jackson Hole Symposium, Jerome Powell, Taper Tantrum, Tapering, TreasuriesArticles, General News, Weekly Commentary

By: Adam