Stocks Remain A Prisoner of Interest Rates

- The stock market is following the bond market like a puppy. Rates down? Buy growth stocks. Rates up? Buy reflation stocks.

- U.S. growth estimates are rising, but they are falling in other developed markets.

- Unless something changes, rates are probably going nowhere.

The economic experience in the U.S. compared with Europe and much of Asia is very different. Although there are some risks of an increasing infection rate in the U.S. after Spring Break, a rapidly growing vaccination effort rate is mitigating that risk and confidence is building. Most are very surprised at the resiliency of the U.S. economy and growth estimates are rising. Meanwhile, Europe can’t make up its mind whether to lock down again, or not, and projections for economic growth are headed south. For now, that has helped to at least temporarily reverse the longer term down trend in the dollar.

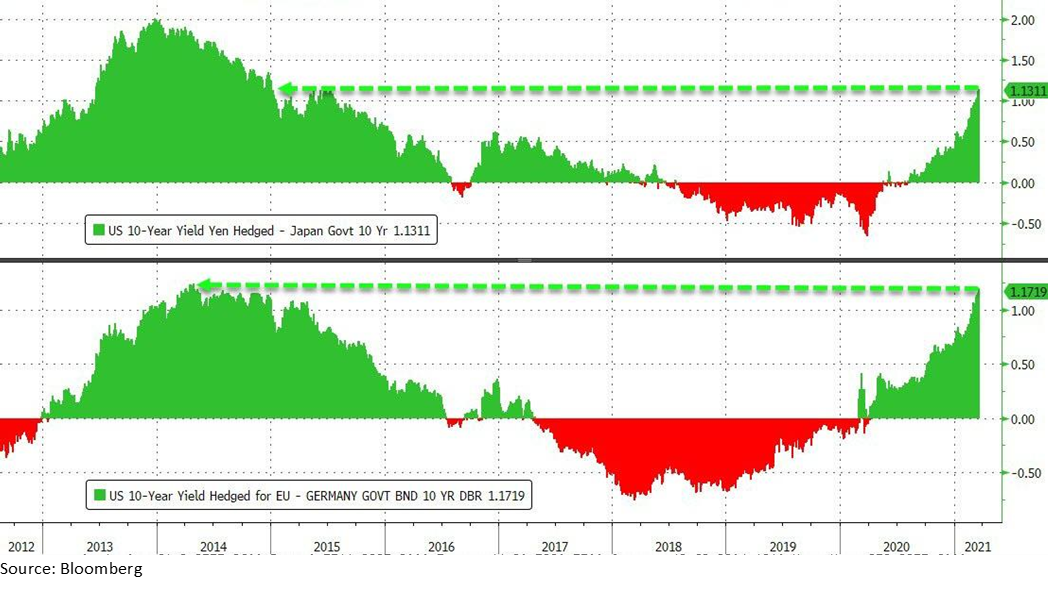

It has also served to increase the yield spread between U.S. Treasuries and other sovereign (government) debt. The result is that for the first time in several years, foreign investors have the opportunity to pick up yield with a hedged carry trade. (See chart at top of the following page.) Allow us to explain. A carry trade is when investors in one country, sell their currency, buy U.S. dollars, and then invest in U.S. Treasuries in order to earn a higher yield than they could earn at home. Of course, that would expose them to currency risk, but even after hedging out that risk, they can still earn more than at home. That demand should help to keep a lid on Treasury rates in the near term. But be aware that if Europe gets a handle on COVID over the next few months and growth estimates begin to rise there, this dynamic can reverse quickly, which gives the opportunity for upward pressure on U.S. rates to return. Bottom line, we look for interest rates to find their footing after a bone rattling rise over the last few weeks. This improves the chances for a cooperative stock market in the interim as the stock market typically frowns on bond market disruption.

In addition, the yield on the 10 Year Treasury Note is now back at a level in excess of the dividend yield on the S&P 500, which may also bring in some bond buying. (See chart below.)

Quarter End Rebalancing Could Cause Market Imbalances

- Pension funds and other large institutional investors regularly rebalance at the end of each quarter without much fanfare, but this one could be different.

- The rapid rise in rates (and the corresponding decline of bond prices), combined with a rally in stocks during the first quarter, could cause significant bond buying and stock selling.

- In addition, the stock market rotation could cause imbalances within equity sectors, with energy and financials picking up interest, and technology stocks being sold.

Rebalancing of pension funds, insurance company assets, and even target date funds happen regularly, usually without much fanfare. Much has changed since December 31, so there could be a few surprises at the end of March. While the stock market has had a nice rally in Q1 with the S&P 500 up about 4% as of this writing, bonds had one of their worst quarters on record with interest rates substantially higher than 3 months ago. As institutions rebalance their portfolios, that could produce substantial stock selling and bond buying into next week.

Indeed, the beginning of the rebalancing process may be evident this week as interest rate increases subsided, even in the face of substantial Treasury auctions during the week. Meanwhile, stock market rallies have consistently been halted with waves of selling, as discussed in this Financial Times story.

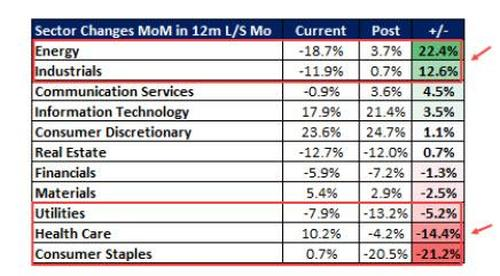

What the FT doesn’t discuss is the sector rotation that has occurred in the stock market and how that might affect what stocks are bought and sold. As regular readers of these pages know, energy has been far and away the best performing sector in the first quarter. Thus, the weight of energy in indexes has shifted higher and that could produce greater interest in energy shares over the coming days, as shown at right in a table from JPMorgan. Industrials could also see some buying while Health Care and Consumer Staples and to a lesser extent in Utilities, appear vulnerable to selling pressure. We caution that this type of analysis can play out in unexpected ways as this is not the only factor affecting stocks. However, with the prevalence of 60/40 investing by pensions funds, insurance companies and many ETFs growing, this could be an increasingly important factor at the end of each quarter.

Rebalancing portfolios is a critical part of investment management. Pension funds and other institutions do it on a scheduled basis, giving traders an opportunity to benefit. At PWM, we rebalance opportunistically when our portfolios venture too far from their targets.

Another Supply Chain Wake-Up Call

- A 200,000 ton container ship remains stuck in the Suez Canal.

- Hundreds of tankers and container ships stranded or forced to navigate around the Cape of Good Hope.

We have yet to hear how a 200,000-ton container ship somehow ran aground diagonally across the canal, but at the moment, that really doesn’t matter. There it sits, and the CEO of the Dutch company was quoted in the Daily Mail saying “We can’t exclude it might take weeks, depending on the situation.” Supply chains are already having difficulty keeping up with the pace of COVID recovery and this only exacerbates the current shortages. As of Friday morning, there were some 237 ships reported as waiting for the canal to re-open. This has the potential to be highly disruptive to global trade. The New York Times reports that if this problem persists for two weeks, it could strand as much as one-quarter of the containers that would normally be in European ports.

Although it may seem unimportant at the moment, it places additional pressure on the ‘just-in-time’ supply chain regimen in the wake of COVID and the 2011 Fukushima earthquake. Combine that with increasing tensions between the West and China, and it is clear that supply chains need to adjust. Our perspective is that this is likely to be a long and potentially disruptive process. See the New York Times story in the What We’re Reading section below for more color on the subject.

What We’re Reading

Why it is getting harder to assess value in financial markets

Intel CEO: Semiconductor shortage will take ‘a couple years’ to fix

Fmr. BlackRock exec: ESG investing doesn’t have any social impact (5 Min. Video)

Target-Date Funds Exploit Their Investors’ Long Time Horizons. Here’s How.

What are NFTs and why are some worth millions?

How much to worry — and not worry — about inflation

In Suez Canal, Stuck Ship Is a Warning About Excessive Globalization

Weekly jobless claims tumble to lowest level in more than a year

Cold weather depresses U.S. consumer spending; inflation is muted

Retirement Planning:

How to make up lost ground if you got a late start saving for retirement

Some investors take on greater risk in an attempt to get bigger returns. But there’s a simpler, more prudent way.

Tax Planning:

Five Smart Ways To Get The Most Tax-Free Retirement Income

When people enter retirement, they are often shocked at how much they still have to pay in taxes each year.

Estate Planning:

Three Things You Didn’t Know You Could Include in Your Estate Plan

Estate plans, much like the people who create them, are all unique.

Entrepreneur:

Senate extends pandemic assistance for small businesses for 2 months

Calls to extend the PPP deadline have grown since the Biden Administration in February announced changes to the program weeks before it was set to end.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Asia, Equities, Europe, Evergreen, Financial Times, Interest Rates, JP Morgan, Rebalancing, Sector Rotation, Supply Chain, Treasuries, US, USDArticles, General News, Weekly Commentary

By: Adam