Only One Vote Counts in this Election

- Over the next few months President Biden may have the opportunity to nominate a majority of the Federal Reserve Board of Governors with the potential to fundamentally alter monetary policy and bank regulation. Like the Supreme Court, the Fed Board is comprised of seven of the most powerful, unelected people in the U.S. One of those seats is currently vacant, another announced retirement in December, and another’s term expires in January. Then there is Jerome Powell, the current Chair, whose term as Chair expires in February. If he does not continue as Chair, he is also likely to also resign. (The Governors are nominated by the President and must be confirmed by the Senate.)

- For the first time in our memory, potential candidates are being described in political terms, not economic terms. Historically, economic credentials have been the critical ingredient in choosing Fed Board members. That appears to be less true today. There is pressure from the progressive wing of the Democratic Party for appointments that will actively support the progressive agenda. Progressives have been disappointed in the handling of the Infrastructure and Build, Back, Better bills. This is a place where the President could throw a bone and nominate several progressives to the Board. This has the potential to alter the course of banking regulation as well as the economy. President Biden has already spoken with Fed Governor Lael Brainard, who is considered the most progressive member of the current Board, as a potential replacement for Chair Powell.

- A Brainard led Fed: Less inclined to raise interest rates; more inclined to regulate the banking industry. In terms of monetary policy, both Powell and Brainard are considered doves (i.e. lean toward maintaining lower interest rates). However, a more dovish Board would appear to be less likely to raise rates than the current Board. There is a larger distinction between Powell and Brainard in terms of bank regulation, where Brainard believes Wall St. excesses need to be reined in and her voting record backs that up. Since 2018 Brainard has voted against the Board majority 23 times and abstained four times, which is the most of any member.

- What it could mean for markets. Brainard is considered the most dovish of the current Board members. Under her leadership, we believe the market would anticipate a ‘looser for longer’ monetary policy, implying that the market would anticipate interest rate increases to be delayed relative to current expectations and supportive of further gains for stocks in the short term. The downside would be that the Fed would be more likely to make a policy mistake in responding to inflation by waiting too long to respond.

On the regulatory front, a Brainard led Fed would lean to tighter regulations on financial institutions as they attempt to adapt to banks that have large proprietary trading operations, as well as the rapid growth of the shadow banking sector (shadow banking being non-banks that act like banks, such as Rocket Mortgage), while making sure banks can meet appropriate stress tests.

The Great Inflation Debate

It’s hard to avoid inflation today, whether you are watching TV or shopping for dinner. The enormous financial response to the pandemic had the unintended consequence of spiking demand just as supply was constrained by the pandemic. This has led to a sharp imbalance, numerous product shortages and higher prices. The question is whether this will result in permanent price changes or will dissipate as supply and demand eventually come into balance. The initial thought was that the inflation would be transitory because the pandemic effect would wear off. Now, with months of worsening inflation data, markets are having second thoughts.

The case for temporary inflation:

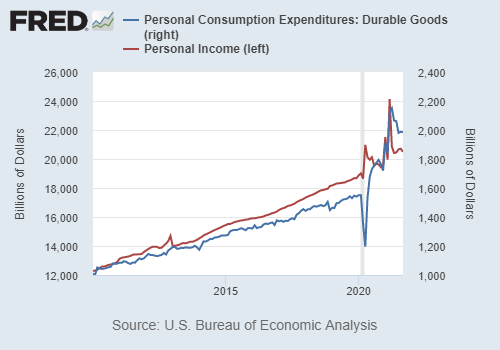

- Inflation was not a problem before the pandemic, and there is theoretically nothing about the pandemic that should make higher prices a permanent fixture. Once normal lives return globally, we essentially go back to where we started. There is some initial evidence that is happening. As shown in the chart below, personal income (red line) spiked as government support hit the streets, and that ‘extra money’ is presumably the reason for the spike in demand for durable goods (blue line). That has not yet come close to returning to trend, but it is moving in that direction. Transitory may simply take more time.

- There is some initial anecdotal evidence that the supply chain situation is improving. For example, this week GM indicated that most of its assembly plants in North America are now back to running regular production.

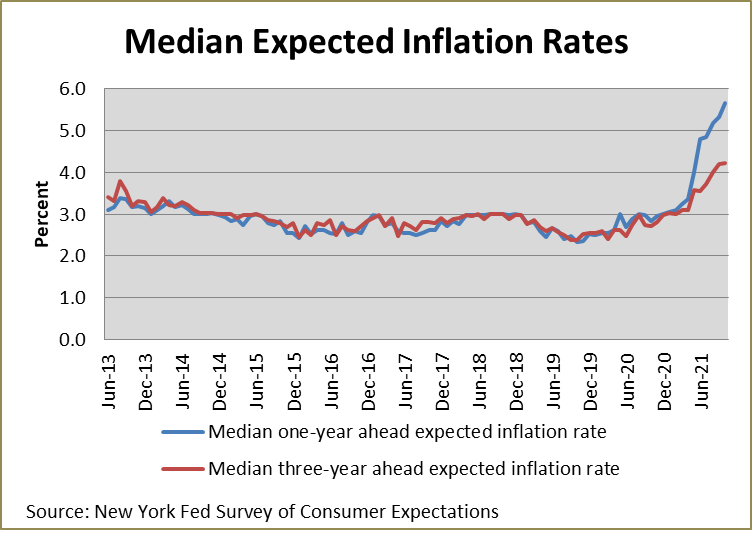

- Longer term inflation expectations (red line below) remain fairly well grounded and expectations are a critical element to an inflationary environment. The chart below is from the NY Fed this week.

- China and other countries continue to produce goods at a very low cost, which has been driving force of the disinflation of the last 20 years. It is arguable that this effect is waning, but it is not radically changing and the disinflationary effect remains.

The case for more permanent inflation:

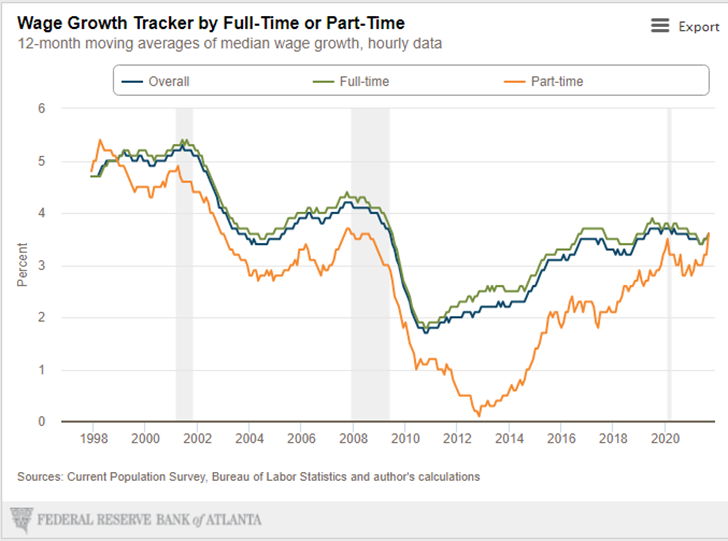

- In order for inflation to be persistent, wages must also grow and wage increases are very difficult to reverse. Without a doubt, the minimum wage has been rising, but on an overall basis, that will barely move the needle. There is some anecdotal evidence of rising wage pressure, mostly in the form of the current strikes at Deere and Kellogg, as well as a unionization effort at Starbucks in Buffalo, but unions do not have the same clout today as during the 1970’s inflation. Statistically, wages do appear to be growing a bit more rapidly, as shown in the chart below, but at this point they are not keeping pace with current price increases. If wages continue to rise, inflation will become more permanent.

- Aside from wages, rents are also very sticky, meaning they are not very flexible on the downside. Rents, along with housing prices have been rising and are beginning to filter into official inflation statistics. Some of that could be a function of the migration from cities to suburbs during COVID, so the data is somewhat less convincing, but rents are an area to watch to gauge the longer term impact of inflation.

- The avalanche of money being diverted to ESG funds is inflationary. The target is to increase the cost of capital to ‘dirty’ companies, and that has reduced investment on those industries, especially oil, gas and coal. Now we are beginning to face serious energy shortages in China and Europe, and, thus far, to a lesser extent in the U.S., energy prices are rising. It is likely to be an expensive winter relative to recent years and our ability to expand production is limited.

The Bottom Line

Inflation will likely be a mix of transitory and persistent, which may well be what the Fed desires. It is important to remember that the Fed was struggling to get inflation up to 2% for years before the pandemic. For better or worse, we expect the Fed to maintain its present course through the end of the year. What happens from there may hinge on the changes about to occur on the Fed Board of Governors.

What We’re Reading

GE Will Split Into Three Units, Ending Conglomerate for Good

Why Low Food Inventories Continues To Push Prices Higher

Home prices are now rising much faster than incomes

U.S. consumer prices jump 6.2% in October

Strong jobs report shows economy back on track for further growth

Consumer sentiment hits 10-year low while workers quit jobs in record numbers

Democrats at odds over SALT changes

Betting markets see Powell’s reappointment as a bit less likely

Retirement Planning:

Medicare vs. Medicare Advantage: How to Choose

Decoding Medicare health insurance plan options can be daunting for Medicare beneficiaries.

Tax Planning:

What You Should Know About Beneficiaries

By designating beneficiaries, you have the final say over who receives your “death benefit.” If you don’t choose one, your state determines it.

Health:

30 Classic Thanksgiving Recipes That Deserve a Comeback

Written records indicate that the earliest Thanksgiving featured deer, seafood, and fowl, along with crops like beans, pumpkin, squash, and corn.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Build Back Better, Federal Reserve, Inflation, Jerome Powell, Lael Brainard, Permanent Inflation, President Biden, Supply & Demand, Transitory InflationArticles, General News, Weekly Commentary

By: Adam