Georgia Produces a Blue Ripple

The Democrats have won both Senate seats which substantially changes the mathematics in Washington. The Senate is now a 50-50 split, with VP-Elect Harris the tie braking vote, but this is certainly not a carte blanche for Democrats. Much of the legislation listed below will require 60 Senate votes for passage.

The important change here is that the Republicans will no longer be setting the agenda for the Senate. This improves the chances of passing the Biden agenda. An all-blue or all red government compromises the usual checks and balances in the legislative branch, but any heavily left-leaning legislation will likely bring Democratic Senators from solidly Red states into play, specifically Senators Manchin from West Virginia and Tester from Montana.

The bottom line is that middle-of-the-road legislation has the best chance for passage and on many of the topics below, we see common ground which makes passage of these items more likely than not in our view. Here are some of the salient areas of legislative focus and their implications, which we expect to see over the next two years:

- Higher Tax rates for the Wealthy and Corporations – There is now a much better chance that corporate tax rates will rise, naturally reducing corporate earnings. Not good for stocks.

- More Fiscal Stimulus (the good news) – A Democratic Congress can circumvent the blocks to fiscal spending by Republicans. In our opinion, this is a good news/bad news story. The good news is that more money will likely be available to individuals and small businesses to get us through the pandemic. Good for stocks.

- More Fiscal Stimulus (the bad news) – Massive fiscal stimulus pushes us that much closer to debt monetization (i.e., we simply print money to ‘pay-off’ the debt). Historically, this is something the FED has been unwilling to even consider, but the massive scale of debt already outstanding being layered with additional debt could force their hand. This creates inflation risks. Bad for bonds and stocks.

- Growing Inflation Threat – The corollary to more stimulus is inflationary pressure. Real pressure will take some time to develop, but expect markets to look forward, as they always do, and anticipate inflation. The evidence of this should be visible in gold, silver and bitcoin prices, as well as interest rates.

- Interest Rates Pressured Higher – The bond market generally acts as the adult in the room in financial markets and the prospect of substantially more money printing will not go unnoticed. That creates pressure for rates to rise as investors demand more protection from inflation risks. In fact, since the Georgia Senate election, interest rates are already markedly higher. This could create a huge problem for the FED as higher rates work directly against what the FED is trying to achieve with low rates! The primary question here is whether the FED will react by implementing Yield Curve Control, as it did during WWII, to move rates back down.

- Increased Regulation – After four years of Trump cutting back on regulation, we expect that trend to reverse, especially around environmental issues, big technology and potentially too big to fail banks, depending on how much clout the far left is able to exercise within the Biden administration.

- Infrastructure/Green Spending – We expect an attempt at a large infrastructure bill targeted to modernize our core infrastructure, which we view as something that is long overdue. Green spending could be stand alone or tied into an infrastructure bill. We envision a substantial risk/reward here. If enacted in a thoughtful way, this could be very positive, but there is a great risk that we throw money at ‘everything green’ and wind up wasting much of it.

- Cannabis & Sports Betting – No one is really talking about Cannabis in this election, but all this spending implies that Congress will be looking for places to tax. Cannabis is a great un-tapped target for taxation, which could provide a great impetus to legalize the business on a national scale. At a local level, sports betting is also a large untapped tax source in New York and other states. Although not a national issue, we would not be at all surprised if sports betting spread to more states as a means to increase revenue.

- China – One very big question is how this administration will handle the China relationship. If you believe that we are in an economic war with China, this may well be the most important issue the Biden administration will face over the next four years, and the direction the Biden administration wants to take is not yet clear.

An Investment Sage Offers Advice on “Bubbles”

We are always on the lookout for commentary from those elite investors that have a lifetime of experience and are willing to share their views with us from time to time. With the start of the new year, we have the latest missive from Jeremey Grantham. For those of you unfamiliar with Jeremy Grantham, he is a Warren Buffet era value investor and an astute student of financial markets. Whether you agree or disagree, he is always well worth reading.

As long-time students of Grantham, we were taken by the title of his January 5 letter – “Waiting for the Last Dance – The Hazards of Asset Allocation in a Late-stage Major Bubble”. The analysis here is as blunt as we can recall from Mr. Grantham and the first paragraph of his executive summary says it simply:

“The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.”

We recommend reading the entire Grantham letter, but we’ll summarize it for you here.

Overvaluation

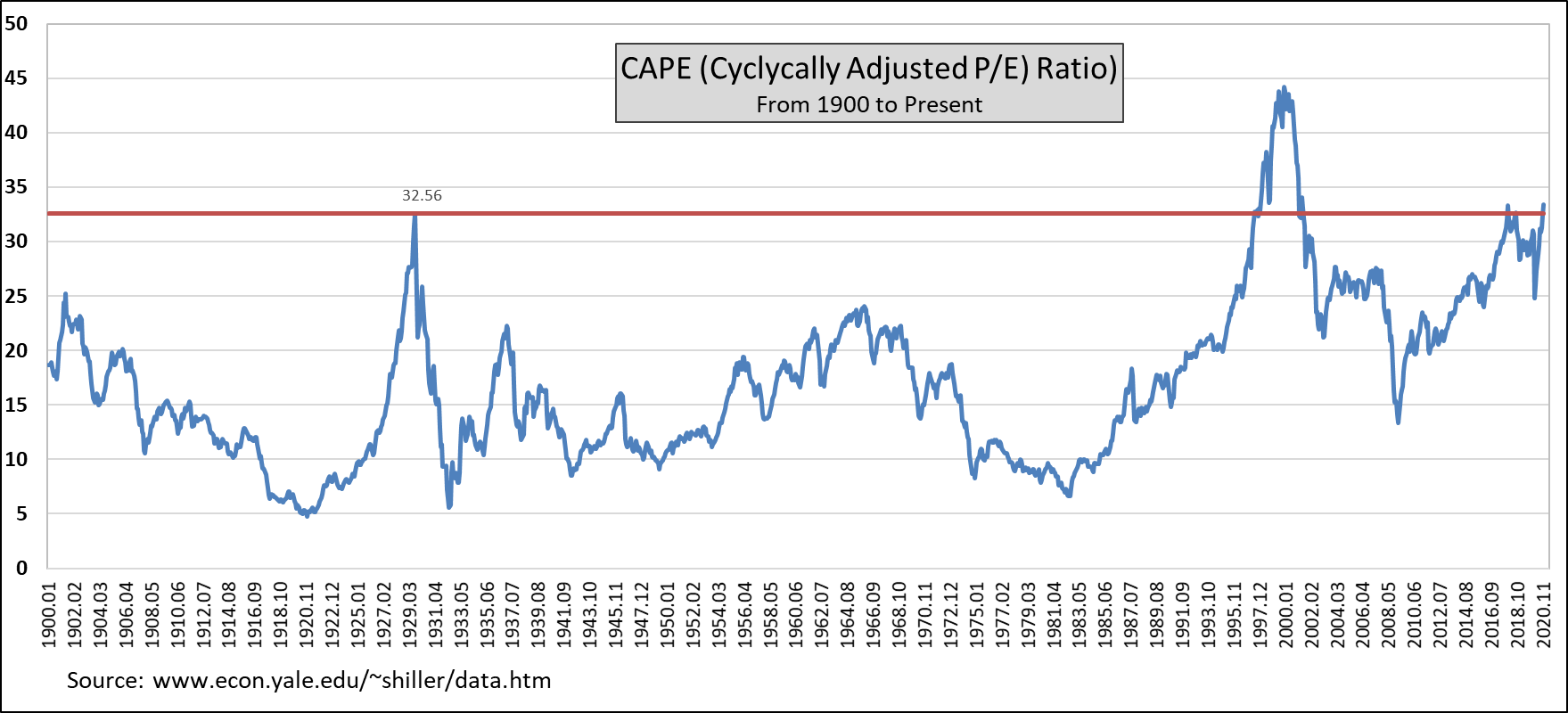

Several weeks ago, we discussed Nobel laureate Robert Shiller’s CAPE ratio to describe the overvaluation of the market relative to historical norms. We have re-produced that chart below.

The problem with valuation, as Grantham says, is that “Predicting when a bubble breaks is not about valuation. All prior bubble markets have been extremely overvalued, as is this one. Overvaluation is a necessary but not sufficient condition for their bursting.”

Explosive Price increases

Explosive price increases are too numerus to list. Grantham points out that “there are 150 non-micro-cap companies (that is, with market capitalization of over $250 million) that have more than tripled in 2020, which is over 3 times as many as any year in the previous decade.” The late year surge in Bitcoin is another excellent example, rising 268% since October 1.

Frenzied Issuance

Late bull market runs are also marked by massive new issuance. When valuations are high, the desire to raise capital becomes obsessive. Grantham points out “In 2020, there were 480 IPOs (including an incredible 248 SPACs) – more new listings than the 406 IPOs in 2000.”

We discussed SPACs (Special Purpose Acquisition Companies) back in October. As a refresher, SPACs are often called ‘blank check’ companies, because they are a shell with no operations. The SPAC raises money which is designed to be used to acquire some yet to be determined operating company. SPAC’s raised $82 billion in 2020!

Speculative Investor Behavior

A recent Bloomberg story had these tidbits supporting Grantham’s view

“Quarantined at home, at least 8 million people opened new accounts in the first nine months of the year across brokerages including Charles Schwab Corp., E*Trade Financial, TD Ameritrade Holding Corp. and Robinhood Markets Inc., all of which permit a version of free trading.”

“I’ve never had so many friends text me asking which beaten-down stocks to buy,” Jessica Rabe, co-founder of DataTrek Research, wrote to clients. “They were not fearful about losing money. They were afraid of missing out on the large snapback.”

Grantham also points out that “The volume of small retail purchases, of less than 10 contracts, of call options on U.S. equities has increased 8-fold compared to 2019, and 2019 was already well above (the) long-run average.”

Grantham concludes “For the first 10 years of this bull market, which is the longest in history, we lacked such wild speculation. But now we have it. In record amounts… including Hertz, Kodak, Nikola, and, especially, Tesla. As a Model 3 owner, my personal favorite Tesla tidbit is that its market cap, now over $600 billion, amounts to over $1.25 million per car sold each year versus $9,000 per car for GM. What has 1929 got to equal that?”

Grantham’s message is loud and clear, but if we can’t know when bubbles burst, what are we supposed to do? Our answer continues to be to stay the course. A very diversified portfolio provides ballast to steady the ship when the big waves roll in, so we stick to a methodology that attempts to balance risks so all our eggs are not in one basket.

What We’re Reading

Where Is Alibaba Founder Jack Ma?

Why Markets Boomed in a Year of Human Misery

How Security Failures Enabled Trump Mob to Storm U.S. Capitol

The 10 Ways Renewable Energy’s Boom Year Will Shape 2021

The $1.7 Trillion Dot.Com Lesson

U.S. Labor Market Recovery Stalling; Trade Deficit Widens Sharply

Is Your Stimulus Check Taxable?

Day Traders Put Stamp on Market With Unprecedented Stock Frenzy

Leaving Hong Kong – As China cracks down, a family makes a wrenching decision

U.S. Economy Loses Jobs as Pandemic Pummels Restaurants & Bars

Wall Street Wary of ‘Frothy’ Socks, Bubbly Bitcoin

Retirement Planning:

How Much Money Do You Need to Retire?

Weigh these four factors to get a better handle on how much money you will need to retire.

Tax Planning:

10 Biden tax plans that will sail through a Democratic Senate and how to prepare

President-elect Joe Biden’s tax plans are unlikely to suffer from any lack of bipartisan support.

Health:

Can We Be Happier? — yes, but it’s not about wealth or GDP

A growing body of research shows that any number of things are more important to happiness than income.

Entrepreneur:

Six New Year’s Resolutions For Entrepreneurs And Small Businesses

Make New Year’s resolutions to ensure you aren’t taken by surprise by anything in 2021.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Asset Valuation, Bubble, China, Democrats, Election, Georgia, Green Energy, Inflation, Infrastructure, Interest Rates, Jeremy Grantham, Regulations, Republicans, Senate, Speculation, Stimulus, Taxes, Warren BuffetArticles, General News, Weekly Commentary

By: Adam