Waiting for Godot

If you’ve been waiting for a correction, it’s been like waiting for Godot. The statistic of the week was that we have not had a 5% correction since last October. If that holds up for the rest of the year, it will only be the third time that has happened since 1980. The stock market finally gave us at least a hint of concern this week, but which direction the next step is going to be remains a mystery.

- The stock market is clearly overvalued, but overvaluation has never been sufficient to predict a correction. The overvaluation can remain in place (and in the current case, has remained in place) for a long time.

- Where can you hide? Phil was asked this question in his Bloomberg interview earlier this week. His answer, and the correct answer, is that there is no place to hide. Essentially all assets are overvalued and cash pays only a bit more than nothing.

- Don’t hide; stay invested. And stay diversified. Over the long run, that has been the better solution.

Why is the stock market suddenly concerned? The spread of COVID has clearly by-passed vaccinations (although vaccinations do appear to protect well against serious cases). The result is that business activity is clearly slowing down, especially in those sectors that have been relying on the economy reopening, like travel and Leisure. (See the ‘Beige Book’ link in What We’re Reading section below). In addition, there is little evidence yet that inflation is mitigating. Supply chain imbalances don’t appear to be letting up and if that continues, it would tend to support lengthening inflation concerns. Slow growth plus inflation, known as stagflation, is a tough investment environment.

Valuations are unequivocally high. The well-known Buffet Indicator, which is the US Stock Market Capitalization divided by GDP, is off the charts. Buffett posited that the stock market is fairly valued at 1X (100%) of GDP.

Buffett’s rationale is simple and elegant. Over the long term, the total value of the stock market should reflect GDP growth and this is borne out by the strong correlation of corporate profits and GDP. But the stock market does not correlate well with GDP. The reason is that valuations vary. If the stock market to GDP ratio is high, it can correct in two ways. Corporate profits (and GDP) can grow at a much faster rate to catch up to valuations, or valuations can correct to ‘catch down’ to actual GDP levels, the latter being much more likely than the former.

Measuring this is a bit inexact, but all current versions of the analysis come up with similar conclusions. The market is highly overvalued. The problem is that we could have made this same analysis, with the same conclusion, many times in the recent past, but in the interim the market has just become MORE overvalued!

The Buffet Indicator – Market Capitalization of stocks/GDP

The bottom line is that we have many ways to measure the valuation of the stock market, but there is no good way to time market moves. A more serious correction may be coming soon, and it may not. A diversified approach, like we use at PWM, allows us to stay in the game and not worry about trying to time the market.

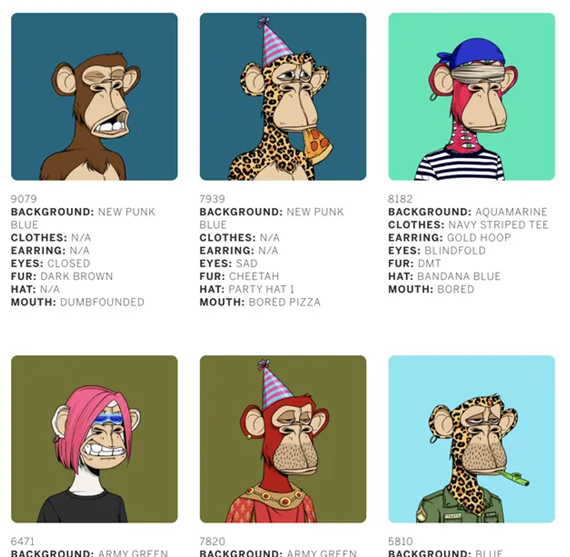

A Bunch of Ape NFTs Were Sold for $24.4 Million

There are many additional signs of market excess and this is one of them. A collection of 101 Bored Ape Yacht Club NFTs sold for over $24 million this week (see the images below from theverge.com) – Unbelievable! Maybe we are just too old to appreciate the value of NFT’s, but we also recall ‘scarce’ $5 beanie babies re-selling for thousands of dollars in the late 1990’s. Needless to say, they no longer sell at such premiums. The similarity is that the late 1990’s was also one of market excess, so excuse us if we are skeptical about the value of the apes.

That’s right. $24 million for 101 digital pics of apes, including the ones you see above. If you’re confused, welcome to the club. What’s going on? We found the Q&A that follows (also from theverge.com) to be helpful.

What is an NFT? What does NFT stand for?

Non-fungible token. “Non-fungible” more or less means that it’s unique and can’t be replaced with something else. For example, a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible. If you traded it for a different card, you’d have something completely different. You gave up a Squirtle, and got a 1909 T206 Honus Wagner, which StadiumTalk calls “the Mona Lisa of baseball cards.”

How do NFTs work?

At a very high level, most NFTs are part of the Ethereum blockchain. Ethereum is a cryptocurrency, like bitcoin or dogecoin, but its blockchain also supports these NFTs, which store extra information that makes them work differently from, say, an ETH coin. It is worth noting that other blockchains can implement their own versions of NFTs.

What’s worth picking up at the NFT supermarket?

NFTs can really be anything digital (such as drawings, music, your brain downloaded and turned into an AI), but a lot of the current excitement is around using the tech to sell digital art.

You mean, like, people buying my good tweets?

I don’t think anyone can stop you, but that’s not really what I meant. A lot of the conversation is about NFTs as an evolution of fine art collecting, only with digital art. (Side note, when coming up with the line “buying my good tweets,” we were trying to think of something so silly that it wouldn’t be a real thing. So, of course, the founder of Twitter sold one for just under $3 million shortly after we posted the article).

Do people really think this will become like art collecting?

I’m sure some people really hope so — like whoever paid almost $390,000 for a 50-second video by Grimes or the person who paid $6.6 million for a video by Beeple. Actually, one of Beeple’s pieces was auctioned at Christie’s, the famou—

Sorry, I was busy right-clicking on that Beeple video and downloading the same file the person paid millions of dollars for. But yeah, that’s where it gets a bit awkward. You can copy a digital file as many times as you want, including the art that’s included with an NFT.

But NFTs are designed to give you something that can’t be copied: ownership of the work (though the artist can still retain the copyright and reproduction rights, just like with physical artwork). To put it in terms of physical art collecting: anyone can buy a Monet print. But only one person can own the original.

No shade to Beeple, but the video isn’t really a Monet.

What do you think of the $3,600 Gucci Ghost? Also, you didn’t let me finish earlier. That image that Beeple was auctioning off at Christie’s ended up selling for $69 million, which, by the way, is $15 million more than Monet’s painting Nymphéas sold for in 2014.

Whoever got that Monet can actually appreciate it as a physical object. With digital art, a copy is literally as good as the original.

And now you know what an NFT is, and an idea of just how crazy the financial world can become.

What We’re Reading

Beige Book: Businesses are feeling stronger inflation and paying higher wages

Are We in a Housing Bubble? (11 min. video)

Toyota cuts output again on shortage of chips, parts

What if China’s Property Crackdown Goes Overboard Too?

U.S. Ports See Shipping Logjams Likely Extending Far Into 2022

Real yields on European junk bonds go negative for first time

ECB to slow bond-buying as Europe’s economy improves

Fed Presidents Kaplan, Rosengren to sell individual holdings due to ethics concerns

2022 Mercedes-Benz EQS Writes Its Own Rules

Why The Tesla Plaid’s A Waste of Money (24 min. video)

Retirement Planning:

Four ways to manage retirement health care costs.

Experts estimate that an average 65-year-old retired couple in 2021 would need about $300,000 in after-tax savings earmarked for health care costs in their post-work life.

Estate Planning:

Worried about inheritance tax? Read this if you’re a beneficiary, executor or trustee

To avoid probate, many individuals and married couples of means set up revocable trusts to hold valuable assets including real estate and financial accounts.

Tax Planning:

Beware of the Tax Traps in Retirement

As you plan for retirement, it’s vital to keep in mind that the government has numerous ways to tax you, and that it can move the goalposts. That could be a significant problem if you are unprepared.

Health:

Best Foods That Boost Your Memory After 40.

These are the foods that help our memory, cognitive function, and overall brain health.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Art, Blockchain, COVID, Cryptocurrency, High Valuations, Inflation, Market Correction, NFT, Overvalued, Supply Chain, Warren BuffetArticles, General News, Weekly Commentary

By: Adam