The Great Inflation Debate

- The Fed (and others) believe that the current inflationary trend is transitory.

- Others believe that this is the beginning of a great inflationary surge.

- There are valid reasons for BOTH positions.

Inflation is the great unseen tax on your savings. It degrading the purchasing power of your dollars. Parts of our portfolios are designed to deal with inflationary trends with the intent of maintaining your purchasing power if and when inflation comes. We do this because inflation is fickle. You never really see it coming and if you wait until it arrives in earnest, you have probably waited too long, which is the crux of our discussion today. Inflation is in the news; it’s obvious in the grocery store; but is this the start of a great inflation surge that should concern all investors? Or is it simply the temporary aftereffect of a very rapid rebound in consumer demand following the inventory and production sapping effects of the pandemic? Once the productive capacity of the economy catches up with this demand, inflation should no longer be a worry. The honest answer is that it’s hard for anyone to really know, thus the need to always be prepared.

The Case for Transitory Inflation

The case for transitory inflation is simple: supply chain disruption is temporary; therefore, inflation is temporary. Covid created a negative demand shock as we huddled in our homes, but it also impacted our ability to produce as manufacturing plants closed globally due to the outbreak. Due to the enormous stimulus, we are now experiencing a positive demand shock but inventories are low and our productive capacity has not recovered as quickly as demand. The U.S. has been gravitating toward a service economy for many years, but the end of the pandemic has caused a temporary shift back in the direction of durable goods. Thus, we have shortages throughout the economy, which of course cause price increases, but once these shortages are cured, inflation is likely to return to previous levels. We experienced a similar situation following WWII. When the war ended, it created a massive positive demand shock, which could not be quickly met by an economy geared for wartime production, which helped to drive inflation higher. By the 1950’s inflation had calmed down.

One of the key reasons to believe the current inflation is transitory is the high level of unemployment that remains. It is said that the cure for high prices is high prices, because that will reduce demand. That is true enough, as long as wages are not also inflating. The crux of the argument is that it is difficult to create persistent wage inflation when unemployment is relatively high.

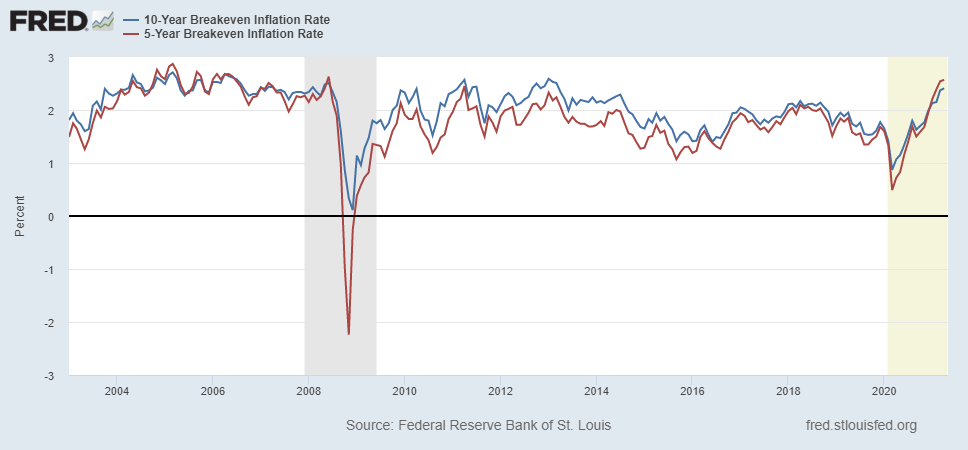

At this point, the market appears to be in agreement. The chart below shows the 5-year (red) and 10-year (blue) breakeven inflation rates. Notice that the 5-year rate is typically below the 10-year rate. This is because inflation is unknown and over time, the risk of inflation increases. Recently, the 5-year inflation breakeven has moved above the 10-year breakeven, implying that there is more inflation expected over the next five years than over the next 10 years, implying that short-term inflation is expected to be transitory. This will be an interesting chart to watch in coming months as it can give us an indication of changing attitudes toward inflation.

The Case for an Inflationary Surge

The case for an inflationary surge is less clear-cut, but not without its merits. We would summarize the key components of this argument as follows:

- Central Bank attitudes toward inflation have become increasingly lax. Since the Great Financial Crisis (GFC), which brought fears of bank failures and 1930’s style deflation, the Fed has been unsuccessfully attempting to get inflation back to its 2% target. Recently, they have endorsed an even higher inflation rate such that a long-term 2% average can be produced.

- Fiscal policy has gone from a standing start to warp speed in a very short time. Since the GFC, the Fed has encouraged congress to help with the heavy lifting of economic recovery by using fiscal policy, a request that has been rejected until the pandemic. We now have fiscal policy on steroids with trillions of dollars being thrown around like chump change.

- Globalization has peaked. The Biden Administration has maintained much of the protectionist policies of the Trump Administration and the already strained U.S./China relationship is worsening. On-shoring manufacturing is good for the U.S. from a strategic viewpoint, but we manufacture very little today for a good reason – our costs are relatively high. Increased on-shoring implies higher prices.

- Wage pressures are building. Although the unemployment rate remains high, businesses are having difficulty finding the required labor to re-open. This became more obvious this week as 42% of small businesses report an inability to find labor, yet the employment gains this week were a mere 266,000, when expectations were for over 1 million new jobs to be added. There are many potential reasons for this: 1) Emergency unemployment benefits discourage work; 2) Pandemic fear is holding back potential applicants; 3) Pandemic closures have pulled women out of the work-force to be at home with the kids. Whatever the causes, if the wage increases become permanent, it tends to ingrain inflation. (For more color on this, see “What We’re Reading” below.)

Financial pressures are not insubstantial either. Our deficits are enormous and while we are the richest country in the world, that does not imply we can afford everything. Our debt is now at a level where our ability to grow our way out if this debt is limited at best and non-existent at worst. Inflation erodes that debt burden making inflation a somewhat welcome event, from a policy perspective. The alternative is a collapse in asset prices where debt is re-structured (think 1929).

As we have stated several times on these pages in the past, the big difference today is that the additive effect of fiscal stimulus on the rapid pace of monetary stimulus from the Fed is that the money is (finally) reaching beyond Wall St, (asset prices) and is being extended to Main St. and that is potentially a very powerful and inflationary change

What We’re Reading

Just About Everything Costs More at American Grocery Stores

Strategist breaks down the market reaction to the surprising April jobs report

‘Job Paradox’ Baffles Economists as U.S. Employers See Shortage

With 8 million Americans out of work, why are more companies not filling jobs?

Biden says corporate tax rate should be between 25% and 28%

No plan to shoot down Chinese rocket

The Disturbing Conflicts of Interest in Target Date Funds

Bridgewater on Bubbles (1 hour podcast)

Get ready for the new workplace perks

Retirement Planning:

Are You Still Chasing the Almighty Dollar, Even Though You Have Plenty to Retire?

Many have saved enough money to retire comfortably. Yet too many worry about their money running out and want more. Maybe it’s time to ask yourself “How Much Is Enough?”

Tax Planning:

How The Senate’s Rules And Precedents Shape The Tax Law

Senate procedures, particularly those for budget reconciliation, mold the tax laws that are created or altered in that process in critical ways.

Health:

How Food May Improve Your Mood

Studies suggest that the foods we often crave when we are stressed or depressed, as comforting as they may seem, are the least likely to benefit our mental health.

Entrepreneur:

Harnessing the three Gs mantra as a small business owner.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

10 YR Inflation Rate, 5 YR Inflation Rate, Dollar Purchasing Power, Federal Reserve, Inflation, Transitory Inflation, WagesArticles, General News, Weekly Commentary

By: Adam