Taxes Are Headed Higher – Why You Shouldn’t Worry

- Past tax increases have NOT been associated with slower economic growth or a weaker stock market.

- The effects of infrastructure spending will serve as an economic offset to tax increases.

- The final result is expected to be watered down form Biden’s aspirational proposal.

Even the slimmest of legislative majorities is a strong incentive to propose big plans and this time around is no different. Ironically, much like President Trump, President Biden is actually seeking to implement his campaign promises, breaking a long political tradition of promising everything and delivering little. You can agree or disagree with the current and/or former President, but it is a refreshing political change to have politicians at least attempt to do what they say will do on the campaign trail.

While the intentions are good, we are much more concerned with results. Of course, we have no crystal ball, but we can take a hard look at the dynamics of this situation and handicap the outcome accordingly. After the Georgia Senate elections in January, we commented that the 50-50 split in the senate would make several Senators the key votes on legislation, with the most prominent being Joe Manchin of West Virginia, the blue Senator in the red State of West Virginia. Biden’s infrastructure plan and the associated tax proposal to pay for it (or at least some of it) has already raised Manchin’s visibility level nationally.

Candidate Biden’s tax intentions were well known even before he was elected, so the fact that the stock market had a hiccup on the day his proposal was unveiled was a bit of a surprise, specifically because the proposal was NOT a surprise. In any event, the shock wore off quickly, leading us to speculate that the correlation was coincidental. Nonetheless, it has sparked a wave of commentary on the implications of higher corporate and individual taxes.

Economic Impact is Expected to be Minor

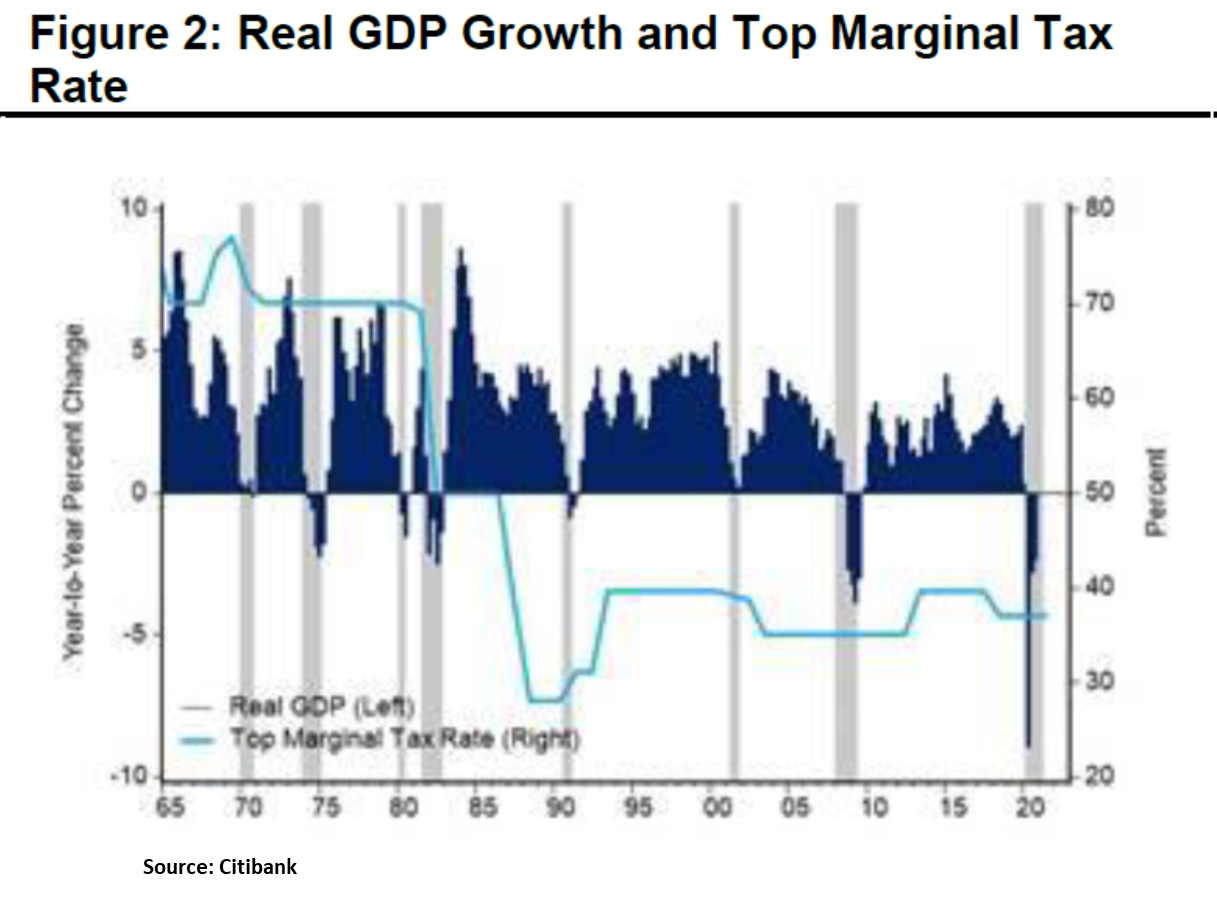

Economic concerns, relative to the tax increase, are real, but probably overblown. Taxes certainly affect investment decisions by corporations and individuals, but it is far from the only factor, or even the largest factor. Citibank research produced the following chart indicating little correlation between GDP growth and the top marginal tax rate historically. (We apologize for the quality of the graphics, which are poor on the original.)

Going back to the 60’s and 70’s, the top marginal tax rate was 70% or higher, yet GDP growth was actually higher than in the recent past. The slowing growth we have experienced over the last 30-40 years has many causes, but high marginal tax rates do not appear to be one of them.

What is clear from the chart is that economic growth in the U.S. has become increasingly problematic, particularly over the last 20 years. From that perspective, raising taxes could conceivably put a further crimp on economic growth.

The offset to that negative growth impact is that the tax increase is being used to implement a potentially massive infrastructure plan. Even with higher taxes, it is hard for us to imagine a scenario where infrastructure spending is not substantially larger than any tax increase.

In terms of economic growth, the ultimate reaction to the combination of fiscal spending and tax increases will be a function of how much of each is actually passed by Congress. An anemic infrastructure plan combined with an aggressive tax increase, would quite clearly imply a net economic negative; while an aggressive infrastructure plan combined with an anemic tax increase would likely promote faster economic growth. The proof of the pudding is in the eating.

What Should We Expect?

We should not expect anything like the Biden tax proposal to pass and one of the key reasons is Senator Manchin. This CNN interview with Senator Manchin makes it abundantly clear that he has no intention of voting in favor of the legislation as proposed, nor is he in favor of using the reconciliation process to push legislation through Congress with no Republican support.

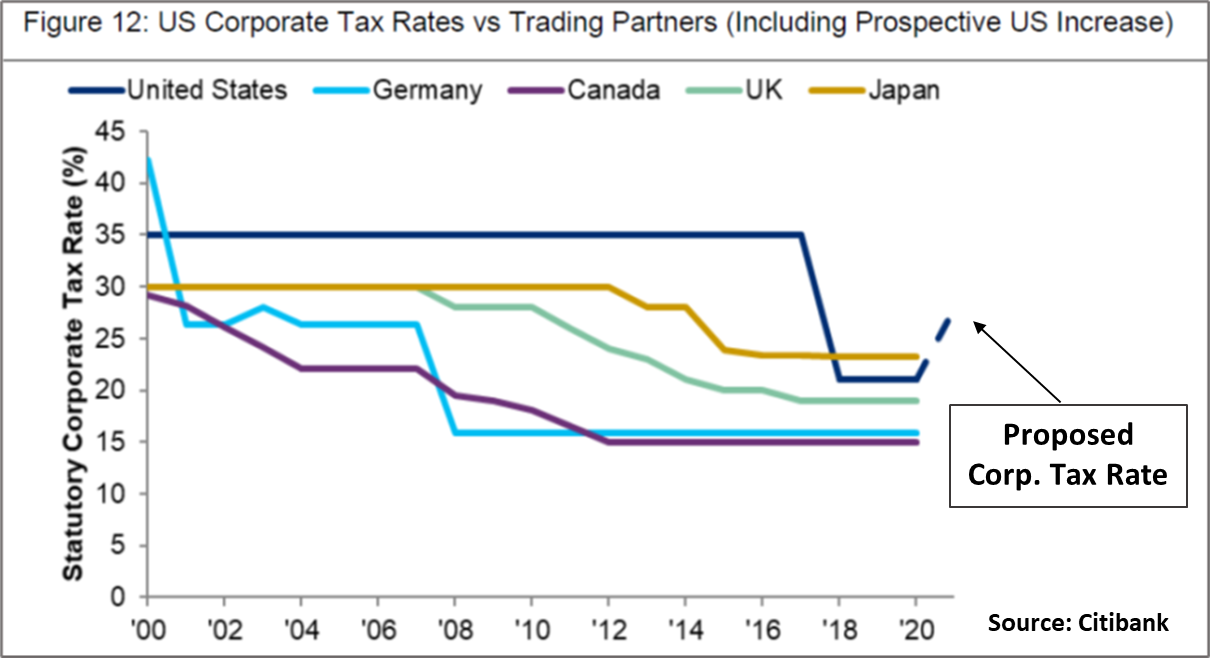

So, will taxes be raised? We think the odds are something on the order of 99%, but not to the extent of the Biden proposals. We believe corporate taxes are likely to settle in the 25% area, up from 21% currently. Why? We need to stay competitive in a global economy and many other developed countries tax rates are actually lower than our current 21%. (See chart on the next page).

On the personal side, look for the capital gains tax to increase too, but not to the proposed 39.6% rate. We suspect that a 28% rate is a more realistic place for a compromise to be realized, and that is only for those making over $400,000 annually. As seen in the interview, Senator Manchin appears to be more interested in closing existing tax loopholes before he can support large tax increases.

At this point it is not clear if the Biden plan will change the current 20% tax rate on qualified dividends. Should the capital gain rate be materially higher than for dividends, it would 1) favor dividend paying stocks, and 2) reduce the level of buybacks as dividends would then become the most tax efficient method to return capital to shareholders. We note that buybacks have been an important source of demand for stocks for many years and a reversal of that trend could have negative consequences for the stock market. We suggest that as these plans are rolled out, it will be important to understand how dividend income will be taxed as compared with capital gains.

Stock Market Implications

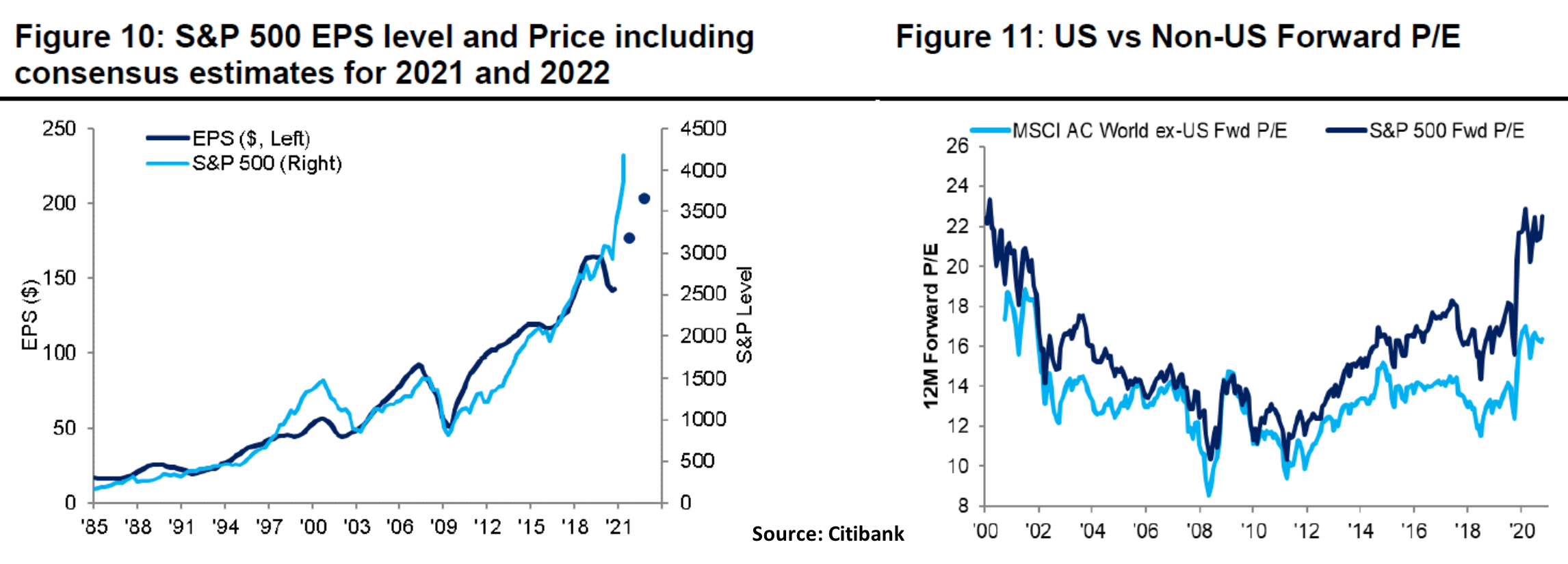

Historically, tax increases have not had an outsized impact on the stock market, although it has been a very long time since tax rates were as high as currently proposed. The Clinton tax increase of 1993 had an initial kneejerk reaction much like we saw when the Biden plan was announced, but by the time the Clinton increases were enacted, the stock market response was actually positive. Nonetheless, what happens this time is around is up for substantial debate. As shown below, based on forward P/E ratios, the market appears ahead of itself as well as markets outside the U.S. It may be that this is the excuse the market needs to take breather.

What We’re Reading

Texas Gains House Seats, N.Y. Loses as Census Hands Edge to GOP

The Dumbest Tax Increase (WSJ, subscription required)

Inflation Likely to Accelerate: A Non-consensus View

How the Fed may ace, or flub, its inflation call

Transportation Sec’y Buttigieg on finding a bipartisan agreement on infrastructure

Troubling trends are bubbling up in the housing market

Renewable Energy Boom Risks More Blackouts Without Investment in Reliability

Cooperman sees stock market lower a year from now

Fed holds interest rates near zero, sees faster growth and higher inflation

Consumer-fueled economy pushes GDP to 6.4% first-quarter gain

Retirement Planning:

Inflation And Retirement Investments: What You Need To Know

Even in normal times, anyone who’s planning for retirement or is already retired worries about running out of money. The potential for rising prices only adds to that baseline of anxiety.

Tax Planning:

Here Are The Biggest Winners And Losers In Biden’s Individual Tax Plan

Heirs and hedge fund managers might take a hit, but tens of millions of families and lower-paid young singles will come out ahead with fatter tax credits.

Estate Planning:

What ‘Non-Financial Assets’ Should Be Included in Your Estate Plan?

Health:

BioNTech expects Covid vaccine data on kids ages 5 to 11 as early as end of summer

In late March, Pfizer and BioNTech began a clinical trial testing their vaccine on healthy 6-month to 11-year-old children.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Corporate Taxes, GDP, Infrastructure, Marginal Taxes, Stock Market, Tax Implications, TaxesArticles, General News, Weekly Commentary

By: Adam