Inflation Wins, The Penny Loses

The old saying “It’s not worth a penny” implied that something was worthless. I guess even a penny isn’t worth a penny anymore. This week marked the end of an era when production of the penny (which costs four cents to make) ceased production permanently. The penny is still legal tender, to the dismay of copper collectors that have hoarded old pennies in hopes that they will lose status as legal tender, allowing them to be legally melted down for a nice profit. At this point, pennies will gradually become harder and harder to find, as they collect in jars and jugs, an almost unusable relic of the past.

There is another old saying which appears on the verge of obsolescence. “Find a penny, pick it up, all day long you’ll have good luck.” When I was a kid, finding a penny was indeed good luck. I was 20% on my way to a free Hershey bar! Today, I’d have to find at least 149 more pennies to get the same result. Fortunately, I no longer rely on luck to feed my sweet tooth.

Is it Inflation or Dollar Debasement?

It’s easy to blame inflation over the years. Prices just keep going up, but prices are not the real problem. The problem is that the value of your money keeps declining. But that wasn’t always the case. If I had been around in 1930, that Hershey chocolate bar would still cost the same nickel it did when I was a kid. Everything has changed in my lifetime, so what happened? The answer is President Nixon, who in 1971 ended the Bretton Woods currency exchange regime and took the U.S. ‘temporarily’ off the gold standard. Since then, a lot has changed and not all for the better.

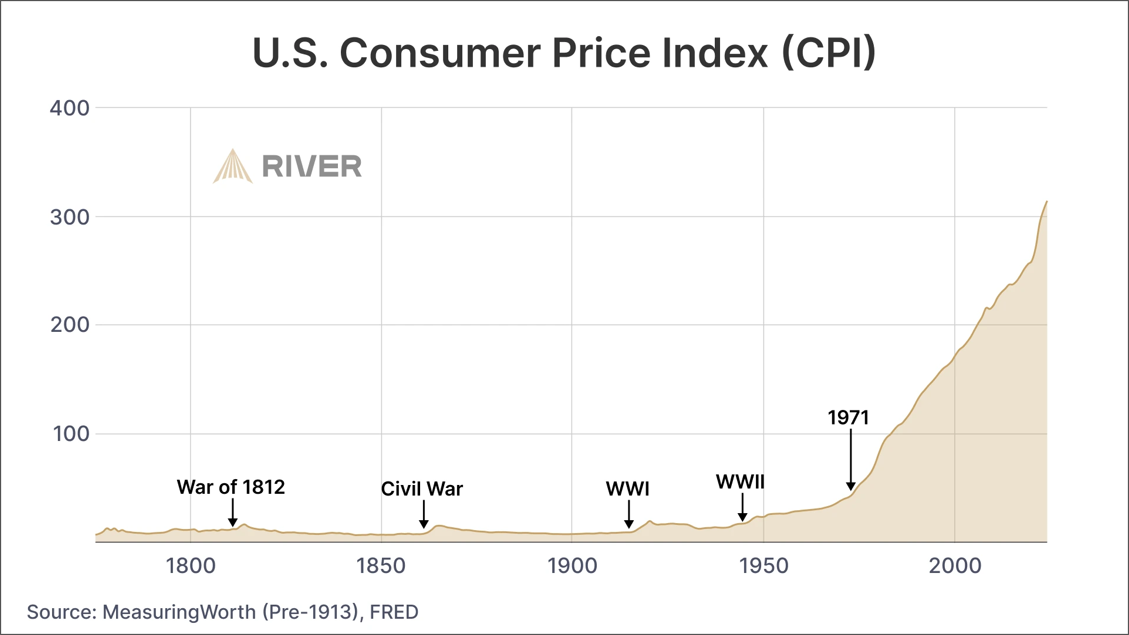

Other than war times, inflation had remained relatively tame since the birth of the republic. The 20th century turned into the age of war with two World Wars, the Korean Conflict, and the Vietnam War. Wars are inflationary and in the early 1970’s, the Vietnam War was becoming an inflation problem in the states. Central banks around the world were taking note and rather than hold depreciating dollars as reserves, they chose to take advantage of the Bretton Woods exchange rate mechanism to exchange their dollars for gold. Slowly, but steadily, the U.S. was being drained of its gold reserve. Nixon was forced to end that exchangeability into gold, pushing the U.S. into a totally fiat currency system (fiat meaning a currency not backed by some physical commodity).

Severing the connection to gold stopped the exodus of gold from the U.S., but it also freed the government to create money at will for whatever purpose. The rest, as they say, is history. The chart below tells the story as the Consumer Price Index (CPI) has been in a sharply upward trajectory ever since. The endless money printing simply erodes the value of the dollar, which we experience every day as higher prices.

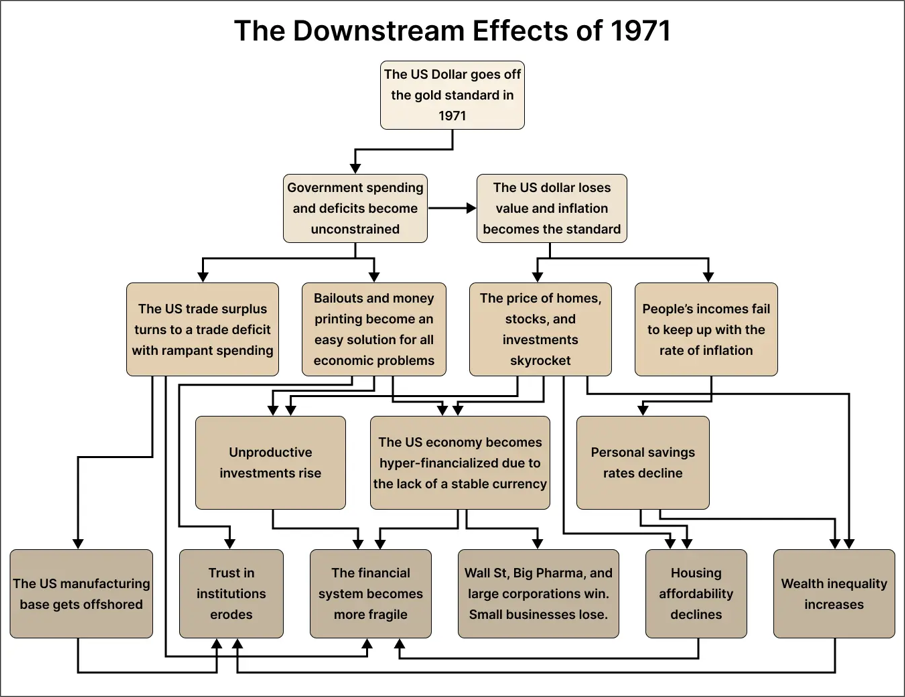

I recently went back and listened to a 1979 interview by Phil Donohue with Milton Friedman, a Nobel winning economist. What was striking was that discussion focused on many of the same economic issues we face today – affordability, wealth disparity, government spending and regulation, healthcare costs, free markets, and free trade. You’d think that 46 years later, we’d have figured out at least some of these problems! But that is not the case, and the root cause goes back to President Nixon’s decision to go off the gold standard. I found the following chart on River.com, a firm that, not surprisingly, describes itself as a ‘Bitcoin-only financial institution’. The evidence suggests that the problems created in1971 largely remain and many have become worse.

Today’s 2% inflation target may seem benign, but it implies that the government is targeting to reduce the value of your dollars by 2% each year. At that pace, your money is worth half as much in 35 years.

Is the Fed abandoning the 2% inflation target?

There is now increasing chatter that the Fed may be forced to adjust their inflation target to 3%. That may not strike you as a big deal, but it cuts the value of a dollar in half in about 23.5 years – 11.5 years faster! If you want to retire at 60 or 65 and expect to live another 30-35 years in retirement, this debasement of your dollars becomes a very real challenge. It’s the reason that ‘money in the bank’ is not very attractive because it appears doomed to provide returns that can’t keep pace with inflation, which simply means that you gradually lose purchasing power even as the dollar amount in your account appears to grow.

Unfortunately, this curency debasment (inflation) is a “fact of life” that we do our best to incorporate into our planning process as well as our investment strategy. Our clients are long-term investors and desire to at least maintain their lifestyle into retirement.

Have a great week!

What We’re Reading

-

Trump is considering exempting some food imports from tariffs

-

Hot tech stocks are tumbling: Why Tesla, Palantir, Nvidia, and others are leading a market sell-off today

-

I trusted AI instead of an agent to buy a home. I saved around $7,000 in fees.

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

currency debasement, Fed, Gold, Gold Standard, Inflation, Inflation Hedge, inflation target, Milton Friedman, pennyBy: Adam