Don’t Count Your Chickens…

There was a lot of talk about infrastructure this week and much of it was rather confusing. First the Senate passed the $1 trillion bi-partisan infrastructure bill, which addresses traditional infrastructure spending, like roads, bridges, broadband, community redevelopment, etc. That was followed shortly thereafter by passage of a $3.5 trillion budget resolution that included all of the Biden Administrations expanded infrastructure proposal, pushing both measures to the House. That left everyone looking for the beneficiaries and there were a bunch. Nucor rose 17%, Caterpillar rose 6% and United Rentals rose 9% this week. Although markets responded like this was a done deal, they probably should not count their chickens before they hatch. Passage of all or part of these proposals will likely be significantly more difficult.

KEY FACTS

- Funding for the bipartisan $1 trillion bill would be about 25% from unspent COVID relief funds, but other funding was more nebulous. The Congressional Budget Office estimated that the bill would increase net spending by $315 million and raise revenue by only $50 billion. Despite some opposition based on this, the Senate was able to pass the bill.

- The Senate followed this by passing a non-binding budget resolution for the $3.5 trillion Biden plan along party lines, but the key word here is non-binding. In effect, what the Senate achieved was to open the door to using the reconciliation process (which only requires a majority vote) for the Biden plan.

- Moderate Democrats are pushing for a stand-alone vote on the bipartisan bill, but the more progressive Democrats in the House are refusing to vote on the infrastructure bill until the full budget proposal is approved.

- The size of the spending package also presents challenges to passage in the Senate with Senators Manchin (D-WV) and Sinema (D-AZ) having difficulty with the $3.5 trillion price tag, arguing that there is no need for this much funding into an economy that is on the verge of overheating. Nonetheless, each voted to advance the budget resolution.

Despite the markets positive reaction to congressional actions, neither plan appears to be a shoe-in. Without a consensus within the Democratic party, ultimate passage will be very difficult. This is a significant test on Biden’s ability to bring his party together.

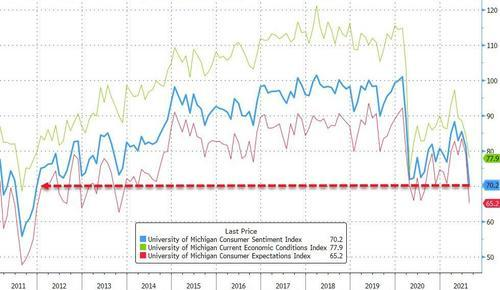

The August U Mich Consumer Sentiment Index Collapses to 70.2, Lowest Since 2011.

There has been an ongoing debate about interest rates with one side believing that interest rates were far too low given the growth in the economy, and the other declaring that the bond market is telling something very different about the future (i.e., slower growth) than appears logical. These crosscurrents were apparent in the news all week, but on Friday interest rates were down big as the U Mich consumer sentiment index surprisingly fell below pandemic levels! The Economic Conditions and Consumer Expectations Indexes also had sizable declines and also to levels not seen since 2011. Although the bond market clearly viewed this news as material, the stock market seemed unperturbed and waffled near unchanged all day on Friday.

Source: Bloomberg

Richard Curtin, chief economist for the University of Michigan’s Surveys of Consumers described this month’s decline in consumer confidence as “stunning” and widespread across income, age, educational and even political subgroups in every region of the country. He stated in a release “Over the past half century, the Sentiment Index has only recorded larger losses in six other surveys, all connected to sudden negative changes in the economy,” Two of those were in the fairly recent past — April 2020 amid the pandemic and October 2008, at the start of the Great Recession.

Highlights from the IEA Oil Market Report – August 2021

The Michigan Consumer Sentiment Survey was not the only sign of potential economic weakness. The International Energy Administration released its flagship Oil Market Report for August this week. Here are some excerpts from that report:

“A new OPEC+ deal struck last month will go a long way to restore (oil) market balance. The immediate boost from OPEC+ is colliding with slower demand growth and higher output from outside the alliance, stamping out lingering suggestions of a near-term supply crunch or super cycle. Oil prices offer more evidence. A recent rally has lost steam on concerns that a surge in Covid-19 cases from the Delta variant could derail the recovery just as more barrels hit the market. Brent futures slumped from a high of $76.40/bbl in early July to around $70/bbl at the time of writing.”

“Global oil demand estimates have been revised lower since last month’s report, in part due to the inclusion of more complete historical annual statistics… Growth for the second half of 2021 has been downgraded more sharply, as new Covid-19 restrictions imposed in several major oil consuming countries, particularly in Asia, look set to reduce mobility and oil use.”

“Meanwhile, global oil supply is ramping up fast. In July, producers boosted output by 1.7 mb/d, as Saudi Arabia ended voluntary curbs and the North Sea bounced back from maintenance. Supply is expected to rise further after the producer bloc agreed a deal on 18 July that aims to raise production by 400 kb/d a month from August until the remaining cuts are phased out.”

“Global oil inventories have been falling sharply… Stock draws could persist for the remainder of the year assuming sanctions continue to shut in Iranian crude.”

“But the scale could tilt back to surplus in 2022 if OPEC+ continues to undo its cuts and producers not taking part in the deal ramp up in response to higher prices.”

Our Take: The more important news here is that the Delta variant is having a negative effect on global economic activity and that case is supported in the commentary above. While there some early evidence that the COVID surge in the largely vaccinated United States and Western Europe could be close to a turning point. The question is whether less vaccinated Asia remains vulnerable for a while longer, which carries risks for the growth and inflation outlook in the U.S. Slowing growth in Asia would likely find its way to our shores and as the primary source of supply, current shortages could be extended, pushing inflation pressures higher. Thus, the risk that is not being discussed much is a stagflationary trend that could pressure asset values. For more detail, see Real-Time Data Suggest Asia’s Economy Already Feeling Delta Hit; China coronavirus infection closes shipping terminal at massive Ningbo Port and Stocks struggle for another record as consumers show ‘stunning loss of confidence’ in the links below.

What We’re Reading

Stocks struggle for another record as consumers show ‘stunning loss of confidence’

Real-Time Data Suggest Asia’s Economy Already Feeling Delta Hit

China coronavirus infection closes shipping terminal at massive Ningbo Port

How would Biden’s infrastructure plan work?

Hold onto those value stocks, says Citi

The Last Wave For Delta Variant?

Is America Heading for Zero Population Growth?

China Crackdown is About Political Control

Biden skips victory lap after jobs report, warns of economic peril from rising Covid

Strong jobs report could prepare the Fed to dial back its bond-buying program

Retirement Planning:

Life Insurance Has A Lot Of Benefits And Benefactors After Retiring

Life insurance is a critical component of financial planning. It is something to consider before retiring, but there are advantages to having life insurance after retiring.

Estate Planning:

Estate Planning vs. Will: What’s the Difference?

An estate plan is a broader plan of action for your assets that may apply during your life as well as after your death. A will, on the other hand, dictates where your assets will go after you die.

Tax Planning:

Two expensive mistakes people make with their IRA savings

While IRAs are a great tool for retirement savings, they also have a number of rules and regulations that can be quite hard to understand.

Health:

How to Debloat: 8 Simple Steps and What to Know

There are plenty of simple strategies you can use to quickly beat the bloat.

Entrepreneur:

Nine Positive Indications That You Could Make the Switch to Entrepreneur

Most people think success depends on first having that innovative and unique idea, but I beg to differ.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Budget, Energy, Infrastructure, Interest Rates, Oil, Oil Market Report, OPEC, U Mich Consumer Sentiment IndexArticles, General News, Weekly Commentary

By: Adam