Centenarians Dilemma

At PWM, we strongly prefer that all of our clients complete a retirement planning exercise so we can properly advise them in all their financial decisions. One of the key questions we need to estimate in developing the plan is how long they expect to live. The classic mistake is assuming that they are unlikely to live long, when in reality, the opposite is true. This estimation error typically first appears when analyzing Social Security options. Most Social Security recipients take benefits when they are first able, at age 62 with the idea that their ‘break-even’, when compared to waiting until age 70, occurs when they are 82 years old, and they are probably not going to live that long.

The actuarial statistics say otherwise. For a 62-year-old couple today there is a 50-50 chance that one of them will live to age 92. The longevity issue is becoming even more pronounced for babies born today. An article in Wharton Magazine last fall stated that a baby born today has a one in three chance of living to 100 years old and a female baby born today has a one in two chance of living to 100 years old. In short, individuals increasingly need to be ready for 100 year lives. While that may be a good thing, living to 100 becomes problematic for financial planners as that requires a client’s assets to support them for many more years in retirement.

Let’s take a closer look at the problem. In 1940, the year Social Security benefits began, life expectancy was 60.8 and 65.2 years for males and females, respectively. On average, for workers retiring at 65, there were relatively few years of retirement that required funding so very little planning was necessary.

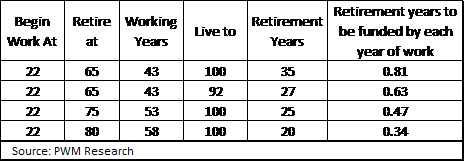

Today, if we start full-time work at college graduation, age 22, and retire at age 65, our working life will be 43 years. With a reasonable chance of living to age 92, we will need to fund not only the 43-year working life, but also 27 years of retirement. On average, for every year of work, we will also need to fund 5/8 of a year of retirement. For most Americans, that is simply not possible.

Part of the solution is delaying our retirement age. If we live to 100, we should also be able to be productive into our 70’s, and even our 80’s, in ways previous generations were not. The problem is that even if individuals retire at 80, extending the working life to 58 years, if they live to be 100, they would still have to fund a 20-year retirement. That still implies a need to fund 1/3 of a year of retirement for each year worked. This is a serious issue not only for individuals, but also for policy makers and pension fund managers.

While the standard for individuals used to be reliance on a corporate pension plan, that is no longer an option for many in corporate America, as we have shifted from defined benefit plans (pensions) to defined contribution plans, like 401k and 403b plans, and IRAs. This shift exchanges the benefits of a pooled retirement solution, for one where the retirement burden is placed on the individual, forcing them to be responsible for managing their own retirement assets, which most are ill-prepared to do. To make matters worse, financial education has not kept pace and retirement investment vehicles and products have become increasingly complex. That has led to a substantial failure in the system to date with little progress on a remedy.

Pension plans have the benefit of pooling risks, but even here, many are likely to be ill-prepared for a population that lives longer and longer. Participants in failed pensions have some government protection through the Pension Benefit Guaranty Corporation, but typically at some reduced payout and the PBGC is running out of money. The decision to accept pension annuity payments versus a lump sum payout is extremely difficult as you need to project the financial health of your employer 30 or more years into the future. In some cases, the pensions are secure, but in others, they are not. An incorrect decision can be devastating so these are very tough decisions. Here is an older CNBC story on the issue.

As life expectancies grow, policy makers need to consider innovative ways to make retirement achievable for those on the edge. This excellent Wharton Magazine article lays out several possibilities, including deferral of property taxes (to be made up upon death) and longevity bonds. Effective long-term solutions are yet to be determined, but many people can’t wait for those solutions to appear. Proper financial advice early in one’s working career, along with following a disciplined financial plan at all stages along the way, remains the best defense against facing an insufficiently funded retirement. Much like regular physical exams, individuals need to begin with a financial plan early in their career, and continually update it every few years, especially as circumstances change. Time is a critical benefit to mitigate a plan that is falling short of its goals, and like your health, much can be corrected if it is caught early.

Introducing the PWM MasterPlan

It is for this reason that we have created the PWM MasterPlan; a holistic, long-term framework that provides you clarity and direction in making correct financial decisions. If you do not have a plan, there is no better time than now to start. If you do have a plan that is outdated, let’s review it with you and update it accordingly. Either way, do not wait, time is money.

How to Interpret the Biden Stimulus Plan Debate

Congress is currently distracted by the Trump impeachment, which looks to us more of a side-show than anything, but it has, unfortunately, delayed consideration of the Biden Stimulus Plan. As a result, the stimulus debate rages on. In a nutshell, the Biden Administration says a pandemic is no time to be worried about spending too much, although some funds from the original stimulus remain unspent and economic activity, while not back to normal, is nonetheless, much better than was expected. Meanwhile, the conservative wing feigns some desire for fiscal control, as if there was some semblance of fiscal responsibility when Republicans were in control. In our view, this is just more made-for-TV politics and an unfortunate reminder that the idea of ‘healing’ remains just that, an idea. Any concrete attempts to heal are lacking. Forgive us if we are not surprised.

Nonetheless, this debate has contained hidden value for investors. It is no secret that the Federal Reserve has desired greater inflation for the last ten years, as we missed the 2% target with some consistency. Amidst the political mayhem, the FED has clearly stated in recent months that it would allow the economy to ‘run hot’ such that the longer-term average inflation rate would reach 2%.

We believe the Fed smells opportunity in the pandemic. As we have said many times previously, the FED is very efficient at getting money into financial markets, but is lacking the tools to get money into consumer pockets, i.e., the real economy. The pandemic changed that as we have already provided massive transfer payments directly to most Americans. This new stimulus package, wherever it settles, will undoubtedly supply even more transfer payments to a large swath of the population. The FED has been praying for some type of fiscal stimulus since the Great Financial Crisis of 2008-09. The problem is that it has taken too long for this to arrive and in the interim our debt problem has become increasingly massive. We are between the proverbial rock and hard place.

The reality is that there is no way for the FED or other central banks to ‘un-do’ this massive stimulus when the pandemic ends and the avenues that can return us to economic normalcy are now extremely limited. The current, and possibly last, solution is inflation. The words of former Fed Chair and now Treasury Secretary Janet Yellen, could not be more clear: We want inflation and we want it now. As part of the Administration, she can be a little bit more direct than she could as Fed Chair, but from virtually every corner of the FED and the Biden Administration, we believe the message is there – we will be doing everything we can to create inflation. That will be a painful adjustment, but not nearly as painful as deflation, especially considering the debt load that has been assumed by the US Government.

To some readers, inflation may seem like an unusual solution to our debt problem, so allow us to give an example. In the mid 1970’s you could buy a very nice house in this area for under $100,000. At the time, buying that house probably felt like a stretch, but inflation reduces the value of each dollar over time, making it easier and easier to pay off. By the early 1990’s, inflation had driven incomes much higher and it was therefore much easier to pay off that mortgage. As a country, the same is true with our debts. The recent advances in commodity prices, real estate, TIPs (inflation protected bonds), even Bitcoin, are outward evidence of the expectation of accelerating inflation.

We understand that periods of inflation can develop and persist, but we are not so bold to assume PWM can correctly forecast precisely when these changes will occur. That is the reason why our portfolios are diversified with permanent allocations to inflation hedges, like gold and commodities.

What We’re Reading

New poll shows 64% of people believe the stock market is rigged (5 min. video)

The ‘stonk’ bubble poses significant global risks

Dozens of former Republican officials in talks to form anti-Trump third party

Friendly fire erupts as economists spar over U.S. stimulus

SARS-CoV-2 Vaccines and Variants (Rockefeller University; 1.5 hr. video)

From dismal winter, some U.S. data starts to move higher

Biden warns China is going to ‘eat our lunch’ if U.S. doesn’t get moving

Economy will see a growth surge in 2021, says J.P Morgan (2 min. video)

Powell stresses commitment to full employment and low rates

Retirement Planning:

Five Easy Ways to Create a Budget

If you want a successful financial plan, you need a budget. But it doesn’t have to be complicated.

Tax Planning:

Use e-file with direct deposit for faster refunds

The IRS urged taxpayers to take simple steps to speed their tax refunds to avoid a variety of pandemic-related issues.

Estate Planning:

Does Your 401(k) Come with a Self-Directed Brokerage Account Option?

How to utilize and capitalize on self-directed brokerage accounts within your 401(k) plan.

Health:

How to maintain healthy HDL levels

Healthy ranges of HDL and how to raise HDL levels that are too low.

Entrepreneur:

How to Get Websites for Small Business Noticed

Small business owners need to think about how to get more visits to their websites. Here are some ways to do it in just an hour a day.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

401K, 403B, Biden Administration, CNBC, Federal Reserve, IRA, Life Expectancy, Longevity, Pension Plans, PWM Master Plan, Retirement Planning, Social Security, Stimulus Plan, Wharton MagazineArticles, General News, Weekly Commentary

By: Adam