Will Gold Continue to Glitter?

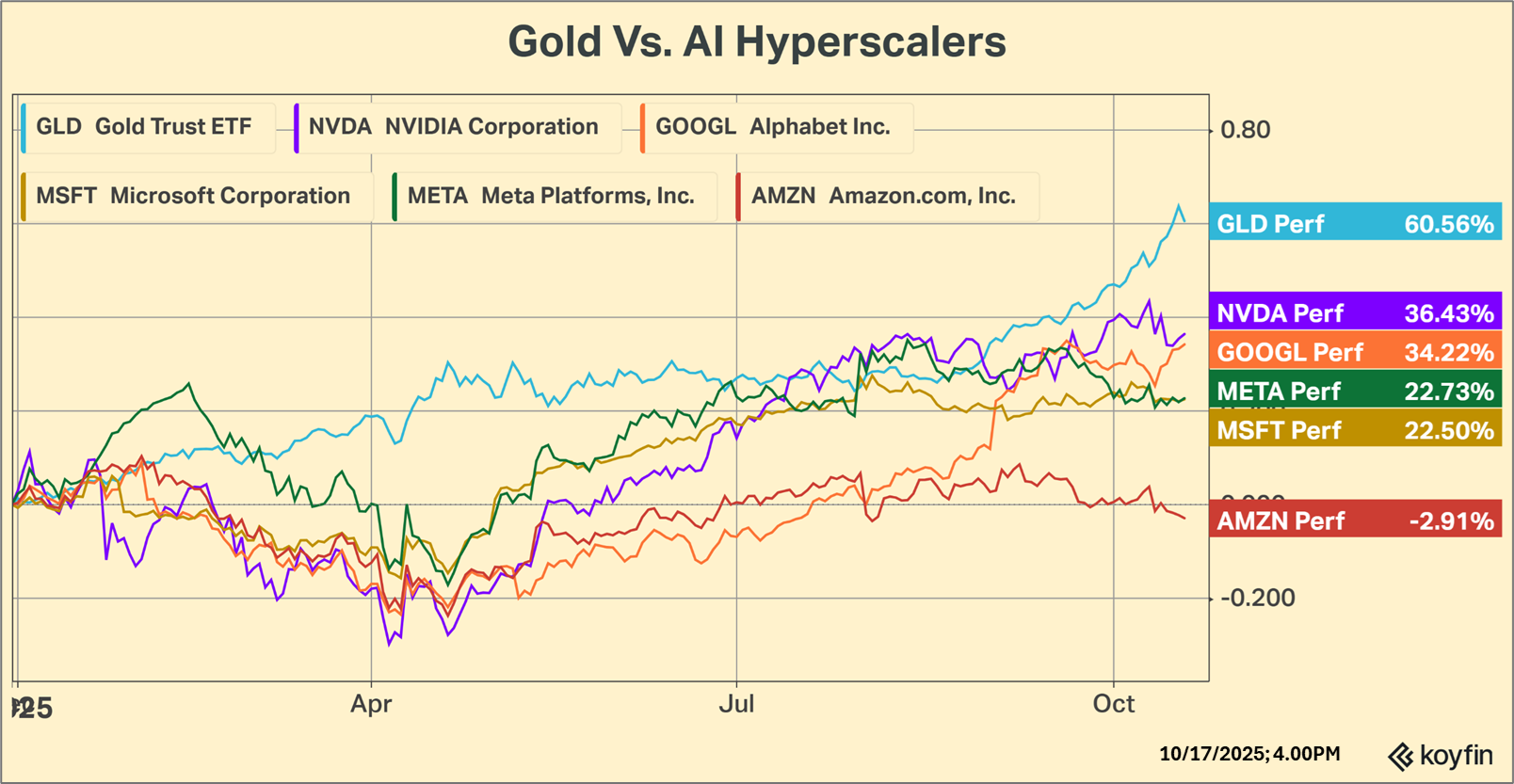

All the talk these days seems to be about the dominance of AI stocks in the stock market, but they aren’t the only game in town. Thus far in 2025, gold has outperformed Nvidia and the hyperscalers, climbing above $4,300/oz. this week, and gold remains the top performing asset class year-to-date, climbing more than 50%. Other than Amazon, the hyperscalers have had a great year, but nothing like gold.

Why Gold? Why Now?

The reasons for this astounding resurgence in gold are numerous.

- The declining utility of the dollar as a reserve currency. The ever-escalating rise in the U.S. debt level gradually sows doubt into the wisdom of holding the dollar as a central bank reserve asset. Central banks have been significant and consistent buyers of gold as they diversify away from the dollar and replace it with gold.

- Street consensus is that the dollar is in a secular decline. Although the dollar rallied a bit in early October, the dollar index is down more than 9% year-to-date. (The U.S. dollar index is a measure of the value of the U.S. dollar relative to a basket of foreign currencies specifically, the Euro, Canadian dollar, Yen, Swiss Franc and the Swedish Krona.) A weaker dollar would generally produce a higher gold price. One of the more interesting characteristics of gold trading recently is that it is rising whether the dollar is up or down.

- Inflation risk. This ties into both items above, but inflation degrades the value of the dollar and that lesson had been lost for some time, but was re-discovered during the pandemic. Since 2020, the dollar has lost 20% of its value (data from www.in2013dollars.com), which is why everything is so much more expensive! Although gold is not a perfect hedge against inflation, inflation is one of the factors that influences the value of gold and inflation stokes the demand for gold from individual investors.

Inflation has been a reasonably persistent problem since President Nixon ended dollar convertibility into gold in 1971, ending the post WWII Bretton Woods system that fixed exchange rates as well as the dollars exchange into gold. This action coincided with wage-price controls to address the growing inflation problem caused by the Vietnam War.

Since then, the dollar has been a true fiat currency, meaning that the dollar was no longer backed a physical commodity like gold or silver. The lack of this backing has allowed rapid money creation that has fostered inflation. In fact, since 1972, the dollar has lost 88.9% of its value! (Data from www.in2013dollars.com).

In 1930, at gold’s official price of $20.67/oz. a kilo of gold had a value of about $663, which was enough to buy a new car (the average car cost $600-$700 at the time). Today, a kilo of gold is worth about $130,000, more than 2 times today’s average car price of about $50,000.

Bottom line, there are many recent reasons for gold’s rise and despite the enormity of the recent price increase, those reasons largely remain in place and they are the reason we are not shying away from gold as a core investment.

Nonetheless, we have to recognize the massive run gold has had and we need to exercise some caution. Securities that have parabolic price runs are prone to corrections and gold is no exception to that rule.

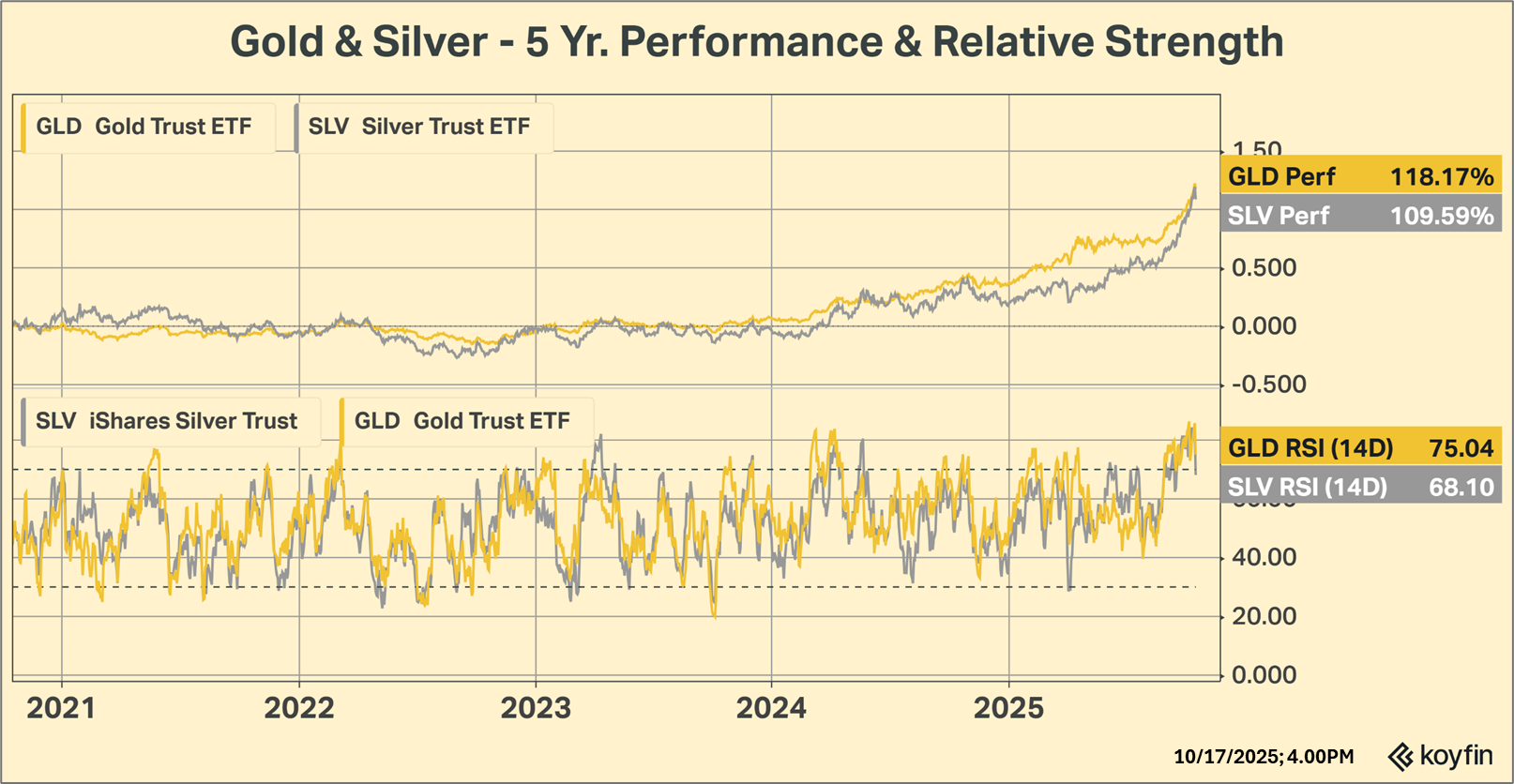

On a short-term basis, gold is amazingly overbought at current levels, suggesting that after a strong bullish gold run (and silver too) it may be time for a breather. The evidence is in the chart below, which shows the incredible run for both gold and silver on top. The more interesting data is what is on the bottom, the Relative Strength Index, or RSI. With RSI’s near 85, we are in rarified air in terms of relative strength. When the RSI gets above 70, it has reached overbought territory and that typically begins to create headwinds for further near term performance. It would not be at all surprising for these precious metals to take a bit of a breather soon.

A comment regarding gold from The Market Ear hit our desk Friday afternoon. It read:

“The fundamental gold story hasn’t changed: inflation hedging, rate cuts, and reserve diversification. But the tactical setup has: sentiment, positioning, and volatility all scream too crowded. Gold may still be the “right” asset — just at the wrong price, right now.”

The role of gold as a currency has evolved over the centuries, but it remains the one hard currency that becomes popular in times of stress and when central banks and investors need a currency that cannot be de-valued by government policies. It is unreasonable to expect gold to have similar returns in 2026, but it still appears to be an investment that is likely to retain its popularity over the foreseeable future. It is for all these reasons that we have held onto our gold allocation, which we have maintained since the company’s inception.

Have a great week!

What We’re Reading

-

Utilities grapple with a multibillion question: How much AI data center power demand is real

-

Latest bank turmoil turns spotlight to ‘NDFI’ lending market. What is that and should you be worried?

-

Trump declares U.S.-China trade war as Bessent floats long truce

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

budget deficits, dollar debasement, Gold, Inflation Hedge, Reserve CurrencyBy: Adam