The Tariff-Inflation Connection

It was a confusing week of inflation information this week. On Tuesday, the CPI (Consumer Price Index), was reported at 0.2% for the month and 2.7% year over year, essentially as expected. That eased concerns regarding the impact of tariffs on inflation.

Two days later, the PPI (Produce Price Index) reported an inflation jump. PPI was reported at 0.9% for the month and 3.3% year over year, both higher than expected. The quick conclusion is that tariffs are creating some inflation, but that inflation isn’t getting through to consumers, at least not yet. For now, the inflationary impact appears to be absorbed by the supply chain. That’s nice for consumers, but in our view, it’s unlikely that will remain the case.

The Trump administration views the tariffs as a one-time price increase and not inflationary over time. We view it differently. At first, we expect the impact to be muted and then inflation should bleed into the economy over time. Here’s why:

Supply Chains

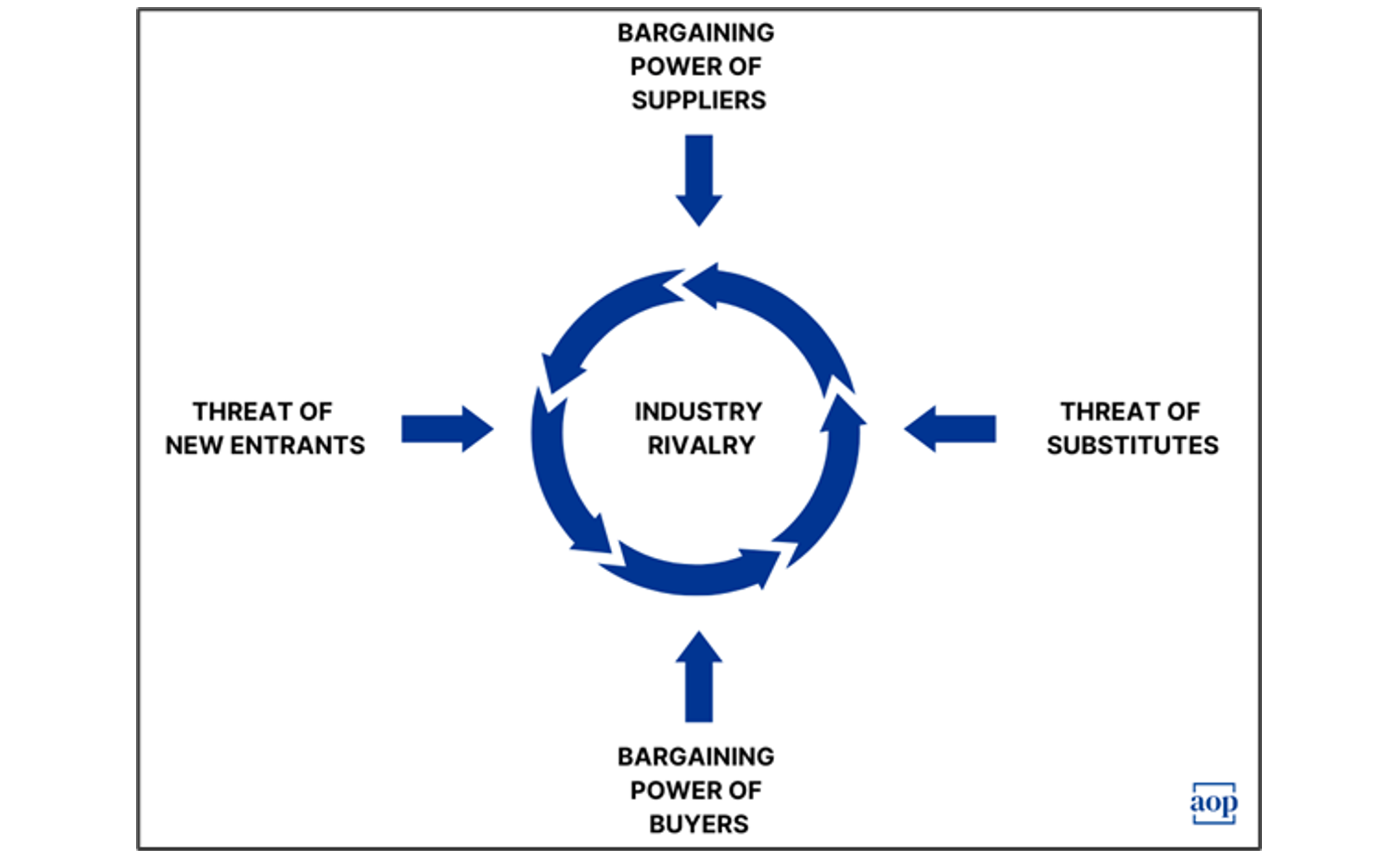

There are competitors at all supply chain levels and each company operates with their own goals for profitability and market share. In general, supply chains function something like this:

Tariffs can be introduced at any point in the supply chain, and in some cases at multiple points. Tariffs create a disturbance in the current ‘equilibrium’ within a supply chain.

For example, a tariff on copper creates a disturbance for the raw material supplier and all the way down the supply chain. The raw material producer wants to pass the extra cost to the supplier; the supplier wants to pass the cost to the manufacturer, etc., etc. Who ultimately pays for the tariff will depend on the relative strength of the various business relationships in the supply chain. In business school, this is taught as a Porter’s Five Forces analysis, as shown below.

Within this framework, it becomes easier to project where much of the tariff bill will initially fall in any given supply chain. For example, a company like Walmart (WMT) has enormous power as a buyer. By pushing the cost of the tariffs back to suppliers, it protects the Walmart consumer (i.e. Walmart profitability) and at the same time it increases Walmart’s advantage versus other retailers that do not have the same clout. Of course, this clout also has limits. Walmart would not benefit by pushing an important supplier into an operating loss in the process. That would be counter-productive in the long term.

The point is that the cost of tariffs is a balancing act. The cost will likely be spread across various supply chains in different ways, depending on who has the business clout. In many cases consumer prices will rise, but some that tariff cost will initially be absorbed within the supply chain. Those companies feeling the pinch of tariffs will react in ways to alleviate that pain and restore profitability and/or market share. That could result in increasing prices in the future, and/or a focus on internal efficiency, or it may initiate investment in automation. Whatever the case, some portion of the impact of tariffs at the consumer level is delayed. We conclude that a 10% tariff is highly unlikely to produce an immediate 10% increase for the consumer. The impact of that tariff will be felt more gradually over the coming years, and in that sense, it will be a continuing story of inflationary pressure in the economy.

From an investment perspective, inflation remains a concern as it erodes the value of the dollar. To gain in real terms, returns need to exceed inflation. Our view is that in most cases, equities need to be the larger portion of portfolios to offset that inflation. That doesn’t necessarily mean taking on significant risk. Over the past several years, many hedged or “collared equity” strategies have emerged as new tools in managing both risk and return, and we believe several of these are capable of producing reasonable returns with less risk than pure equity exposure.

We continue to research these structures as they surface and selectively have been exploiting them in client portfolios to refine the risk and return expectations.

Have a great week!

What We’re Reading

-

China’s super steel for nuclear fusion, new ‘Darwin Monkey’ computer: 7 science highlights

-

Retail sales rise 0.5% in July, missing forecasts but marking second straight monthly gain after spring slide

-

U.S. PPI Surges 0.9% in July 2025, Weakens Fed Rate-Cut Outlook

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

CPI, Inflation, PPI, reciprocal tariffs, Supply Chains, tariffs

By: Adam