Take a Test Drive…

As much as we hate dealing with car salespeople, we love the test drive. We imagine ourselves driving down the street waving to friends in our favorite, brand new car. No doubt, that’s fun, but in the end, it’s just a car. Maybe it’s time we started to feel the same way about retirement. Here are some ideas on how to test drive your retirement:

- Think about work. Does it still provide satisfaction? Can work be performed in a scaled down way? Working longer means a shorter retirement and makes financial planning easier.

- Think about leisure. What do you want to do? Play golf or tennis? Volunteer? Teach? Pre-retirement is great time to take these retirement activities on a serious test drive. Make sure you know what activities will bring you pleasure and satisfaction in retirement.

- Think about lifestyle. Would you consider re-locating? There might be financial reasons for re-locating, but there are plenty of other potential reasons too. Start to explore those possibilities.

- What about your spouse? Do your spouse’s plans mesh with yours? This is also a great time to start discussing any mismatches in retirement dreams.

Sounds great, but how do you go about doing that? Just get started!

- Use vacation time. If you have a block of vacation time, use it to test drive retirement. What would you do? How would you fill your day? What gave you joy, or what didn’t?

- Thinking of relocating? Get an AirBNB in the area and experience what life might be like there.

- Note your spending patterns. The rule of thumb is that you will spend about 25% less in retirement, but spending changes can go either way. It is entirely possible that you will end up spending more. Time that used to be spent working needs to be filled in retirement and often those activities have a high price tag. That can affect how you budget in retirement.

The good news is that you can learn more from a retirement test drive than a new car test drive, and there is no annoying salesperson.

Sustainability and Slower Growth

Sustainability is clearly a catchphrase of this generation, but sustainability is about more than the environment. We need to be economically sustainable as well. We came across a statement this week that anyone under the age of 36 that works in the investment business (and we suspect that is a large percentage of that population) has never worked in an economic environment where central banks were NOT manipulating markets. That is not only amazing, it is a bit scary, too.

- Central Banks have always used monetary policy (i.e., interest rates) to ‘steer’ the economy in the desired direction, albeit, not always with productive results.

- Since the Great Recession/Housing Crisis of 2008, central banks have used new, more aggressive methods, particularly QE, or quantitative easing, which is simply the central banks buying bonds in the open market, thereby creating demand and pushing interest rates lower still.

- The concern has always been that this aggressive tactic creates distortions in markets and these distortions can produce economic effects that make no sense, i.e., they are unsustainable.

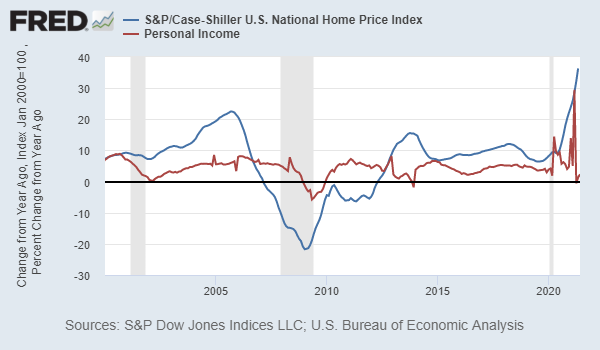

Let’s take a look at housing, which is a major contributor to economic activity and growth. The housing bubble in the mid 2000’s was essentially an outgrowth of central banks response to the tech bubble bursting in 2000. Housing prices took off, rising at greater than 20% rate by 2005 (blue line below). The problem was that incomes were rising at a much lower rate, consistently below 10% (red line). This was clearly unsustainable. Home prices cannot continue to grow at a rate more than double the rate of income growth because income is what pays for the houses! The result was a collapse of the housing market.

As the pandemic hit, home prices absolutely spiked (blue line above at right). The difference this time was that incomes also took off on the back of the stimulus spending (stimmies). The problem we may be starting to see is that the stimmies have ended, but housing prices remain extremely high. This certainly appears unsustainable, unless more stimmies are to come.

A similar picture can be drawn for consumer spending. Consumption is over 75% of GDP. Since 2000, non-farm employment has tracked rather closely with retail sales data, at least until the pandemic hit. Both employment and retail sales crashed during lockdown back in Spring 2020, but employment remains well below pre-pandemic levels (green line below). On the other hand, retail sales have spiked well beyond pre-pandemic levels (blue line below).

The conclusion is similar: This trend is unsustainable. The idea that consumer spending can continue to grow very rapidly while employment remains subpar makes no sense. So why does this trend exist? Again, it is intervention of government. The stimmies affect this too, because stimmies simply pull demand forward. When the stimmies are gone, retail sales growth seems likely to slow down or even briefly reverse.

The markets are worried about slowing growth and based on the above, we see good reason for those concerns.

What We’re Reading

Hoover Dam’s Lake Mead Hits Lowest Water Level Since 1930s

What could Taiwan learn from the US withdrawal from Afghanistan?

Why is the Taliban’s Kabul victory being compared to the fall of Saigon?

Moderate Dems say infrastructure bill must pass before $3.5T spending proposal

Jobless claims hit new pandemic-era low; sign of hope for the employment picture

Federal Reserve preparing for taper this year

Soaring Cost of Food Is Forcing Families to Scrimp at the Dinner Table

Homebuilder sentiment falls as buyers face sticker shock

Retirement Planning:

It’s usually better to keep your money boring

While cryptocurrencies, meme stocks and other buzzy financial products have captured the attention of many young investors, financial experts warn that they shouldn’t come at the expense of other, more traditional investments.

Estate Planning:

Things retirees always forget about estate planning

Estate planning isn’t an easy thing to do at any stage in life, and something many of us choose to ignore. When planning for retirement, however, it’s crucial.

Tax Planning:

Strategies to Deal with Potential Capital Gains Tax Increases

Higher possible tax rates and changes in estate tax law may mean making these adjustments for your personal situation could be a good idea.

Health:

Maintain Healthy Habits After Returning to the Office

Focus on movement, nutrition and relaxation practices.

Entrepreneur:

Manage Your Next Brand Crisis and Come Back Stronger Than Ever

An online brand crisis can hit your brand and damage your credibility at any time. Knowing how to manage and mitigate the fallout is essential to brand survival.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Early Retirement, Economic Growth, Financial Planning, Great Recession, Maintaining Your Lifestyle, Promote Your Hobbies, Quantitative Easing, Retirement, Spending, Stimulus Checks, Vacation, Work-OptionalArticles, General News, Weekly Commentary

By: Adam