Gold Bubble?

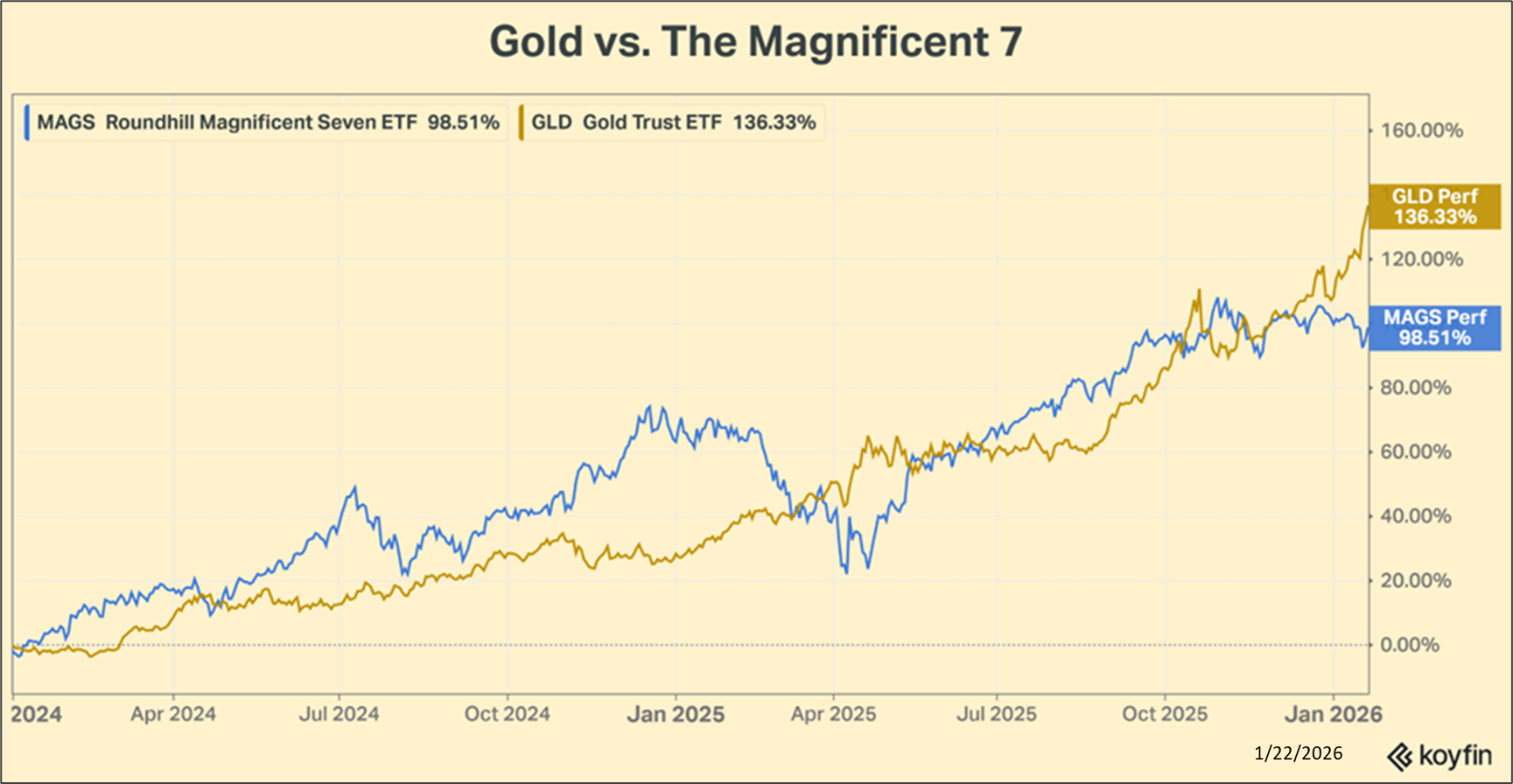

For most of 2025, investors appeared to be fixated on whether we are in an AI bubble. However, despite gold outperforming the mega-cap tech stocks (the “Magnificent 7”) over the past two years, few have questioned whether we are in the midst of a gold bubble!

The Wall Street Journal addressed the huge increase in the price of gold in a story this week, (link here -subscription required). The story identifies five factors that are pushing gold prices higher. We summarize the story below.

The Debasement Trade: Investors concerned about the erosion of the U.S. dollar and other major currencies use gold as a store of value to withstand economic shocks. This is the gold fear trade. Gold acts as insurance because it anticipates governments’ inability to control inflation or debt which will devalue paper currencies, especially the dollar. If spent $100 on New Years Day 2020 on the basket of goods in the Consumer Price Index (CPI), it would require roughly $125 to buy that same basket of goods today. The math says that the value of the dollar has declined 20% over the last 5 years.

Over that same 5-year period, the Dollar Index is up about 9%. So how did the value of the dollar decline? The answer is that the dollar index is based on a relative value of the dollar to other currencies. If the dollar index is up 9% over the last 5 years, it implies that other currencies have devalued more than the dollar over that time frame! Translation: Gold isn’t popular only in the U.S. It is popular all over the world.

Lower Interest Rates: Rate cuts reduce the yield on bonds, lowering the opportunity cost of holding gold, which offers no cash flow. As real (inflation-adjusted) interest rates decline, gold becomes more attractive. While this is true, we doubt this is having a big impact today.

Central Bank Buying: Central banks, especially in countries with strained relationships with the West, like China and Russia, have become major net buyers of gold since around 2010, and accelerated purchases in 2022 after sanctions were placed on Russia. They use gold to diversify their foreign reserves away from dollar-based assets, which reduces their vulnerability to foreign sanctions and provides support for their own currency stability.

We view this as one of the primary reasons for the recent advance of gold and it is one that can have some longevity. It takes years for central banks to adjust their very large reserves.

Expensive Stocks: The stock market hitting record highs is making some investors nervous. Measures like cyclically adjusted price-to-earnings ratios suggest that stocks are extremely expensive. This prompts investors to seek alternatives, such as gold, to diversify their portfolios and hedge against a potential stock market downturn. And gold is substantially ‘under owned’ both retail and institutional asset managers.

Momentum: The WSJ says that gold rallies tend to be long-lasting. In five of the six years before 2025 that gold futures rose by at least 20%, they climbed again the following year, with an average increase of more than 15%. This historical performance and momentum also attracts investors who anticipate continued gains.

Finally, we note that gold is, and remains, a core holding in our portfolios. We have written extensively in the pages that we see gold as a tool to maintain the long-term purchasing power of our clients’ assets as well dampening the volatility of portfolio returns. We believe currency devaluation and central bank acquisitions are the primary drivers of gold’s current rally, indicating a long-term secular trend rather than a speculative bubble.

Have a great week! While we are leery of long-term forecasts, we feel comfortable in warning to be careful shoveling the snow that is likely on its way.

What We’re Reading

- Fed’s main gauge shows inflation at 2.8% in November, edging further away from target

- Dimon says U.S. should impose Trump’s credit card rate cap in Vermont and Massachusetts

- Trump’s push for Greenland mineral rights could block China’s access to rare earths

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be dependable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be dependable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that no such statements are guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

asset bubbles, Cenrtral banks, dollar debasement, Gold, InflationBy: Adam