Asset Class Return Projections

- The higher asset prices rise, the lower the expected return on an asset is.

- That sounds counter intuitive, but if assets rise to their true value, then the higher the price goes, the less upside there is left, i.e., expected returns are lower.

- This concept is important as many asset prices are at or near peaks. Expectations need to be adjusted.

Typically, as asset prices go higher and higher, investors and traders become more and more excited about investing. We came across some research form Vanguard this week that is very helpful in understanding this point not only from a mathematical point of view, but from a fundamental analysis point of view. The key points from the Vanguard report are:

- The pace of growth is expected to slow in the second half of the year (i.e., we are at peak growth now, as we discussed last week). However, growth is still expected to remain strong.

- Core inflation is, and is expected to continue, above the Fed’s 2% target, but price increases are expected to moderate toward the end of the year.

- The Fed now see the first interest rate hike happening in 2023, not 2024 (recall our dot plot story from 2 weeks ago)

- Vanguard expects robust job growth in the U.S> during the third quarter.

Looking around the globe, Vanguard sees the following:

Euro Area: Peak growth in the EU arrives later than in the U.S. due to delays in the vaccine roll-out, but a rebound in consumption is expected as restrictions are lifted and substantial bounce back is expected in Q3.

China: The Chinese government has acted recently to rein in inflationary pressures by reducing demand. Although growth is still expected to be rapid, estimates have been gradually coming down.

Emerging Markets: EM is also expected to grow, but will be will dependent on vaccine distribution and management of the pandemic.

No matter the short-term projections, longer term we will need to remove ourselves from this pandemic induced spending spree and that implies that the markets will need to shift from relying on government transfer payments to relying on the real economy as a driver. The current pace of spending is clearly unsustainable and with each passing day, we get closer to the point where the government will begin to ease its foot off the accelerator. Mid-teens equity returns are higher than the long-term average so some sort of correction is due, maybe overdue. Whatever the case, the prospect of a reduced economic ‘push’ from the government implies that returns need to slow down at some point.

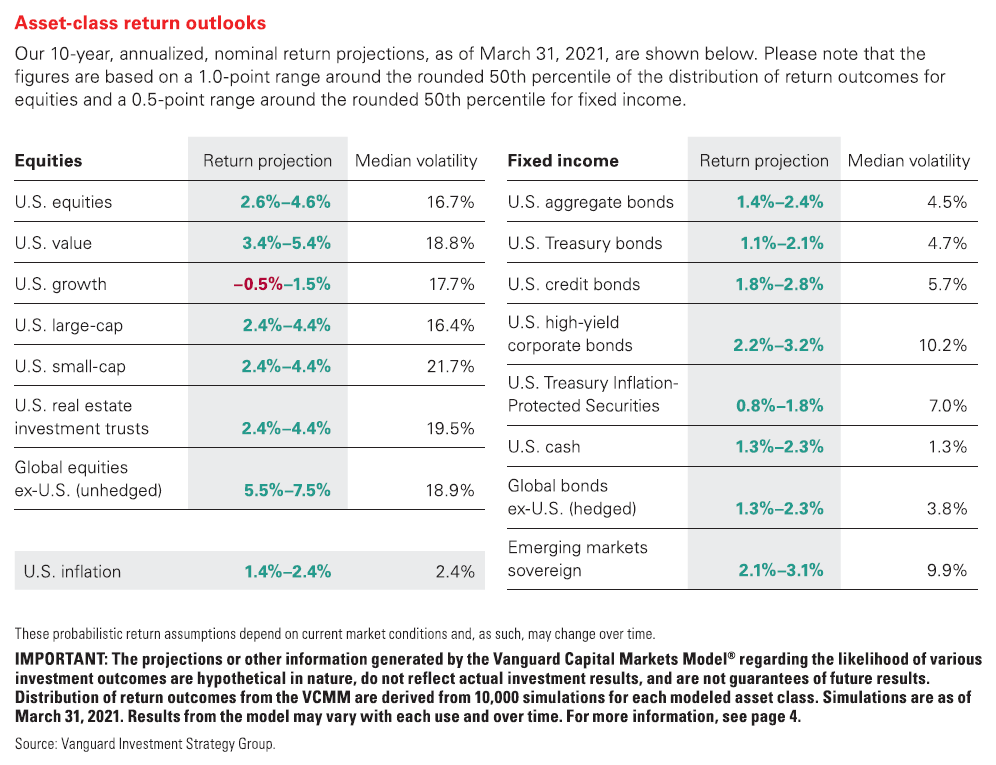

Vanguard regularly makes statistical ten-year projections of asset class returns (plus or minus 1% from the median) as shown in the table below. We don’t rely on these projections to be specifically correct, but are likely to be correct directionally. You should not read these numbers as precise projections. Rather, the implication of the statistical analysis is that asset returns have been unusually high for a long time now and if we are to return to ‘normal’, asset returns will need to be below average for a while.

This doesn’t mean that returns can’t remain high over coming quarters. No one knows how long the Fed can keep this going, but at some point, we return to a more normal environment and in the long run, there is a ‘payback’ for pulling forward returns with excessive monetary accommodation. Rougher waters may lie ahead.

What We’re Reading

What the Latest Jobs Report Means for the U.S. Economy (2 Min. Video)

El-Erian: The system is not wired for persistently higher inflation (2 Min. Video)

J&J Covid vaccine should work against delta variant

Treasury Yields Signal Investors’ Waning Economic Exuberance

Why some biologists and ecologists think social media is a risk to humanity

Oil Rallies Above $75 With OPEC+ Output Deal Left in Limbo

Billionaire Glasenberg’s Last Deal Says Coal Isn’t Dead Yet

Americans, Can You Answer These Questions?

Era ends, war looms as U.S. forces quit main base in Afghanistan

When a 59% Annual Return Just Isn’t Enough

Retirement Planning:

REITs can generate income and provide inflation protection in retirement

REITs are companies that own and/or operate properties like shopping malls, office buildings, warehouses and apartment buildings. Although they come with more risk than some other income-producing investments they also have inflation protection built into them.

Tax Planning:

The Most-Overlooked Tax Breaks for Retirees

For new retirees, it’s more important than ever to take full advantage of every tax break available.

Health:

Your Guide to Exercising with Weighted Vests

If you’ve had a hard time changing up your workouts to increase the intensity or vary the difficulty level, weighted vests may be an option.

Entrepreneur:

Forming a limited liability company can be the perfect strategy for a business.

Disclosures:

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Asia, Asset Allocation, Asset Classes, Asset Valuation, China, Emerging Markets, Europe, Growth, ReturnsArticles, General News, Weekly Commentary

By: Adam