The Times They Are a-Changin’

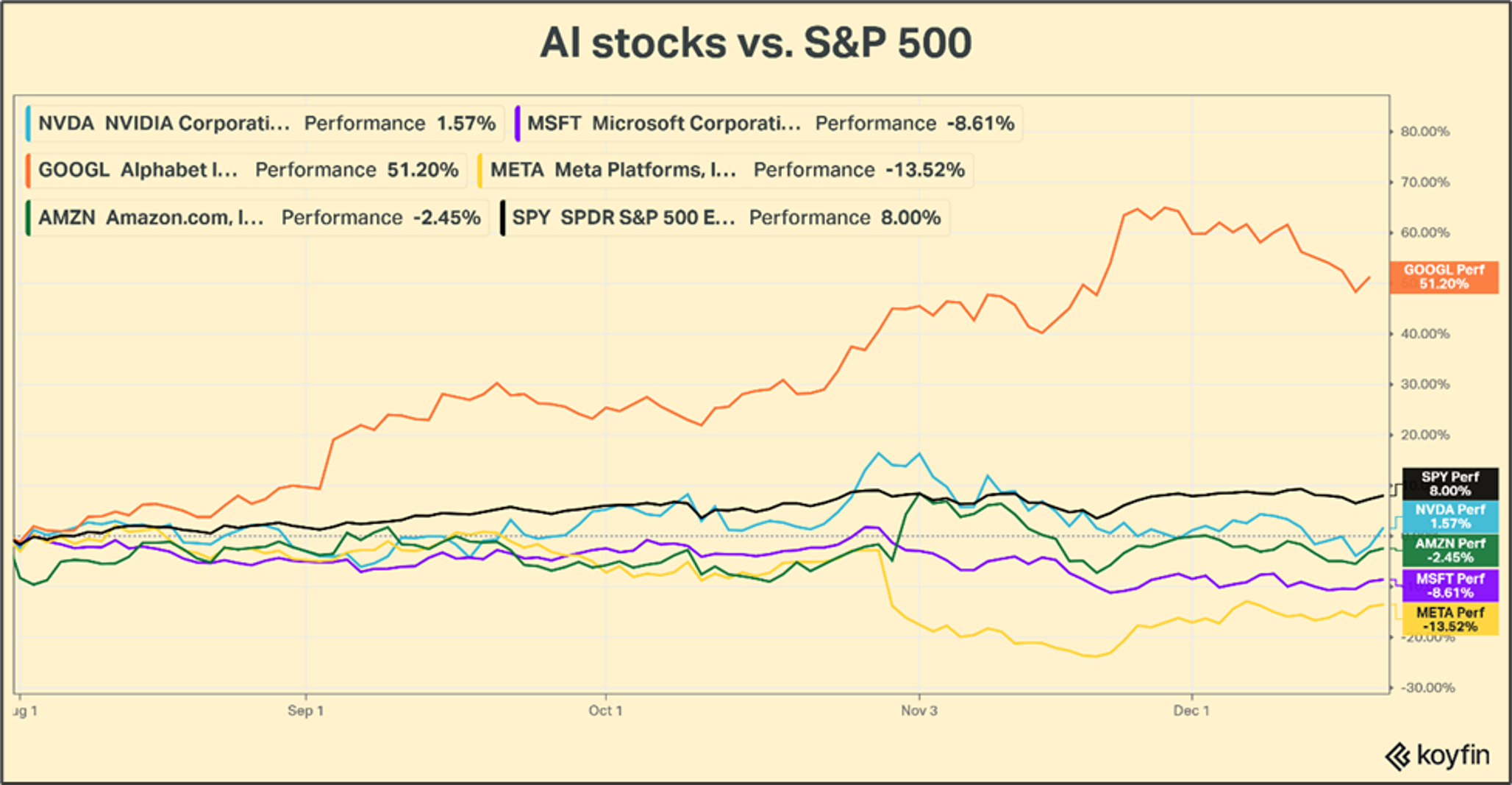

It was another topsy turvy week for tech stocks. More circular financing deals (I invest in your company so you can buy my products) spooked the market once again. Worries about the development of AI are becoming the norm, not the exception and that is evident in the chart below.

Since August, the hyperscalers and NVIDIA (NVDA) are flat-to-down and underperforming the S&P 500. The lone exception is Alphabet (GOOGL) which resurrected itself with the new Gemini 3 LLM (Large Language Model). Gemini 3 is one of the current LLM frontrunners along with ChatGPT 5.2. The market has begun to differentiate between the major players, a sign that the easy money in AI may be in the rear view mirror.

This week’s circular deal was Open AI rumored to be in talks with Amazon on a $10 billion deal, but this one was a little bit different. The details of any deal are not yet set in stone, but the talk is that Amazon would invest $10 billion into Open AI who would in turn, buy Amazon’s Trainium AI chips, not NVIDIA chips.

What makes this deal so interesting is that the Trainium chips are not considered ‘best in class,’ however, NVIDIA chips are priced so richly that the Amazon chips still deliver very attractive price/performance and energy efficiency characteristics. Amazon claims that Trainium can offer up to 50% better price-performance compared to “equivalent” GPU systems (read: NVIDIA) for specific AI workloads.

The fact is that every hyperscaler is developing their own AI chips and that makes one thing clear. NVIDIA is beginning to be pushed from its position at the center of the AI universe. As Marc Weiss, of Open Field Capital, has warned on several occasions on these pages, NVIDIA’s extremely high profit margins are effectively a tax on all customers looking to use their chips for AI processes. Marc’s conclusion has consistently been that NVIDIA can defend market share, or they can defend their profit margins, but they cannot defend both.

By all appearances, chip demand continues to outpace supply and that is the bullish case for NVIDIA. Shortages imply high prices and no threat to market share, but the hyperscalers are focused on a vertical AI strategy that minimizes costs. There is plenty of hype around AI, but in the long run, the low-cost producers are likely to be the biggest winners and minimizing the cost impact of NVIDIA margins on their cost structures is something that will continue. It is not hard to reach the conclusion that competition is entering the AI infrastructure race.

Another trend we are expecting to develop is for the more attractive forward AI opportunity set to begin shifting away from infrastructure and more to applications. As this occurs, additional pressure could arise for NVIDIA.

We are not implying that NVIDIA will not continue to play a key role in AI development, but if NVIDIA chooses to defend market share, it will have to be the result of lower prices and profitability. If they choose to defend price, it will have to be as a result of lower unit sales volume. Despite the recent weakness, we do not believe the stock market is prepared for the day that NVIDIA earnings or outlook disappoints. We do not want to overreact, but we surely need to be careful not to underreact too.

Have a great week!

What We’re Reading

-

Economists see a lot of flaws in delayed CPI report showing downward inflation

-

Bessent says U.S. will finish the year with 3% GDP growth, sees ‘very strong’ holiday season

-

CNBC’s Official College Sports Valuations 2025: Top 75 athletic programs

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

GPU, hyperscalers, Nvidia, Open AI, TrainiumBy: Adam