Teach Your Children Well

Here’s a New Year’s resolution that is far easier to keep than losing 10 pounds. Consider making a commitment, or recommitting yourself, to getting your children and grandchildren on the path to long-term wealth accumulation. Compounding works, but it needs time to reap the benefits, so the sooner you start on a path of a regular commitment to savings, the better.

It’s never too early to teach your children the power of compounding, and investing in the US equity markets over a lifetime. As they enter the working world, they need to understand that small amounts of savings, invested over a long-term horizon in US equities can build substantive wealth. For younger kids, starting that investment account early will be a far better example of the power of compounding. This may be one of the most valuable life lessons you can teach them.

From Our December 5th, 2025 Weekly Pulse

Over time, the returns in the US equity market remain one of the best investments to grow wealth over longer periods of time, and yet many in the US are not able to or choose not to participate. The hope is that by owning a broad-based slice of the US equity market, the participants will learn firsthand the value of compounding returns and how it can grow wealth.

The irony is that many adults are equally naive as to the value of compounding over longer periods of time, and in fact, if teens and young adults took the longer view and began saving early, investing it in a broad-based US equity index, they would find themselves with more wealth and, in some cases, being able to “Make Work Optional” earlier than the age of 65!

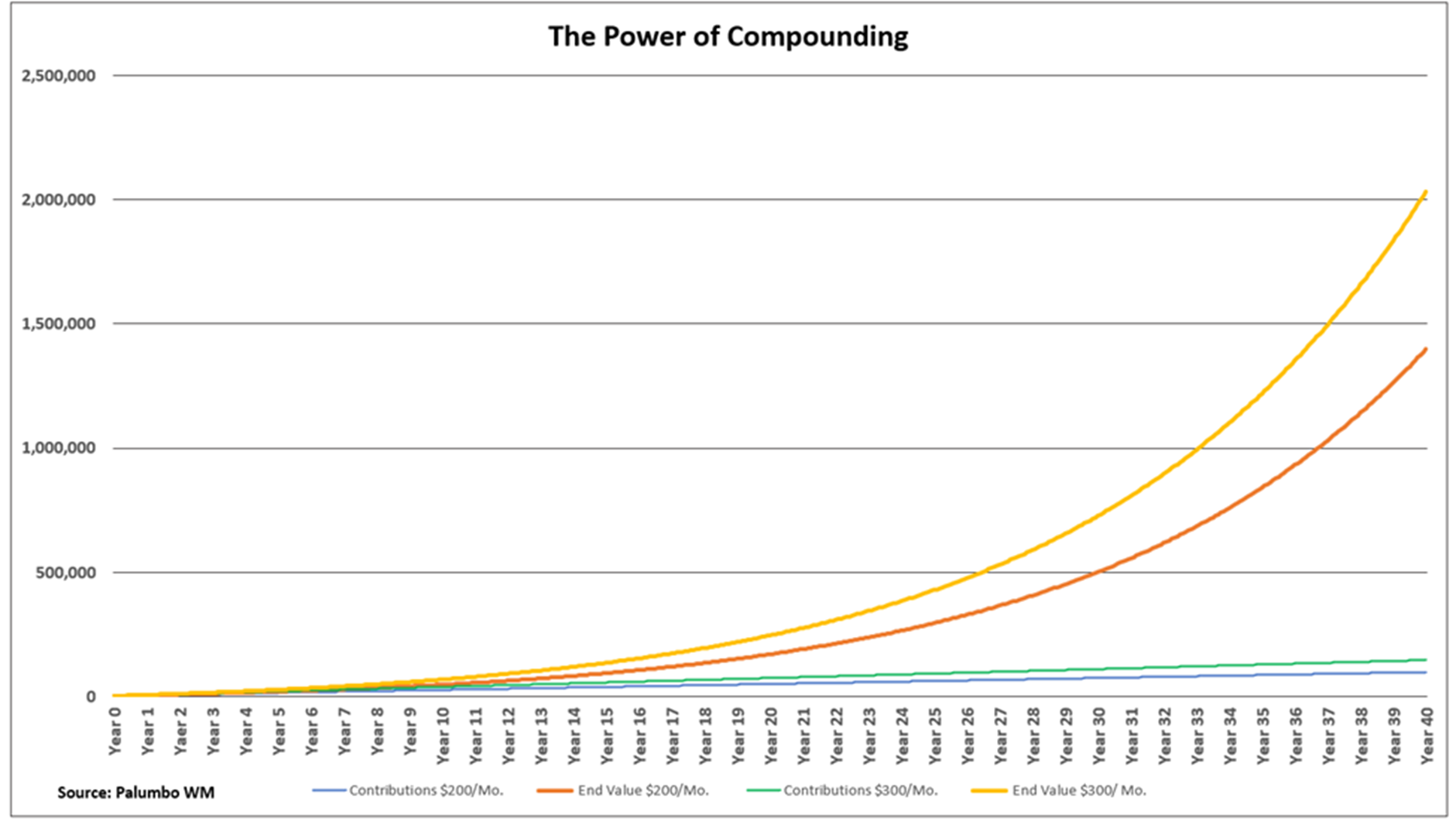

It is easy to dismiss the power of compounding because you’re starting with a small amount of money. That would be a mistake. In the chart below, we demonstrate how rate of return and regular savings is more impactful than the initial dollar amount.

DISCLOSURE: THIS CHART IS A HYPOTHETICAL EXAMPLE FOR EDUCATIONAL PURPOSES ONLY.

The Blue and Green lines are the initial $2,500 contribution to start and then $200/month (blue line, almost $100k over 40 years) and $300/month (green line, almost $150K over 40 years). The Orange and Yellow lines are the total theoretical values after 40 years.

The actual amounts are unimportant. The point is that even relatively small amounts, invested early and regularly are a fabulous tool to build wealth.

We understand the significant value of compounding investment assets, and it is at our core in working with our clients. The full Appendix A in Philip Palumbo’s book, “Making Work Optional” is viewable with this link. Study this example, and have your children do the same. It is an important life lesson that should be understood by everyone, allowing them to make New Years Resolutions on savings that can be life changing. They will see the value that is created by regular contributions and the power of compounding returns.

Starting small is far from pointless as long as the contributions are regular.

Wishing you a Happy New Year Ahead!

What We’re Reading

- Stellantis scraps Jeep, Chrysler plug-in hybrid vehicles amid EV slowdown, recall

- Mortgage rates drop to lowest level in nearly 3 years

- Amazon Pharmacy starts offering Novo Nordisk’s Wegovy weight loss pill

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Compounding Returns, Compounding Wealth, kids investingBy: Adam