Trump Accounts: Take the Money and Run

The Trump Administration hopes that the new Trump Accounts will be a ‘path to prosperity’. These accounts are designed to be tool that helps families get a start on saving for education, and with no withdrawals allowed until kids are 18 years old, it can also provide a valuable lesson in financial literacy. From that perspective, we hope the plan succeeds. The problem is that there are better ways to save. Here are some details on Trump accounts and why some other accounts are a better choice.

- Every child born in the U.S. from 2025 through 2028, who is a U.S. citizen and whose parents have Social Security numbers, is automatically enrolled and receives an account established and initially funded with $1,000 by the U.S. Treasury. Parents, relatives, or employers can contribute up to $5,000 per child each year (indexed to inflation). All contributions are made on a past-tax basis.

- Employer contributions (up to $2,500 annually) do not count as taxable income for the employee, but all contributions fall under the same annual $5,000 cap.

- The funds must be invested in a single, diversified fund that tracks a broad U.S. stock index. There is no option to select alternative funds or investments.

- The account is allowed to grow tax deferred. Taxation when withdrawn depends on whether the withdrawal is for a qualified purpose, or not. Withdrawals for qualified purposes are taxed at the long term capital gains rate. Non-qualified withdrawals are taxed as ordinary income, and, like other tax advantaged savings accounts, will incur penalties if withdrawals are taken too early.

Withdrawal options are defined by age and purpose. No withdrawals are allowed before age 18. From age 18 to 30, partial withdrawals are allowed for certain qualified expenses, including

- Higher education costs

- Vocational training

- Capital for starting a small business

- Down payment on a first home

The account holder gains unrestricted access to the funds at age 30, but like a traditional IRA, there are penalties if taken before age 59 ½ and any withdrawals are taxed as ordinary income.

That may not sound so bad, but other options are actually better. The problem is that the Trump account is yet anther savings vehicle with slightly different terms and restrictions. That just confuses matters and that confusion often results in savers making poor decisions, or worse, no decisions. The primary benefit of the Trump account is the initial $1,000 contribution from the Treasury. The primary beef with the Trump account is that the contributions are after tax and the withdrawals are also taxed (capital gains for qualified uses or ordinary income for non-qualified uses). That makes it the only savings vehicle that is taxed at both ends. If you want to save for education, 529 plans would be a better option because qualified distributions are tax free and the contribution limits are higher.

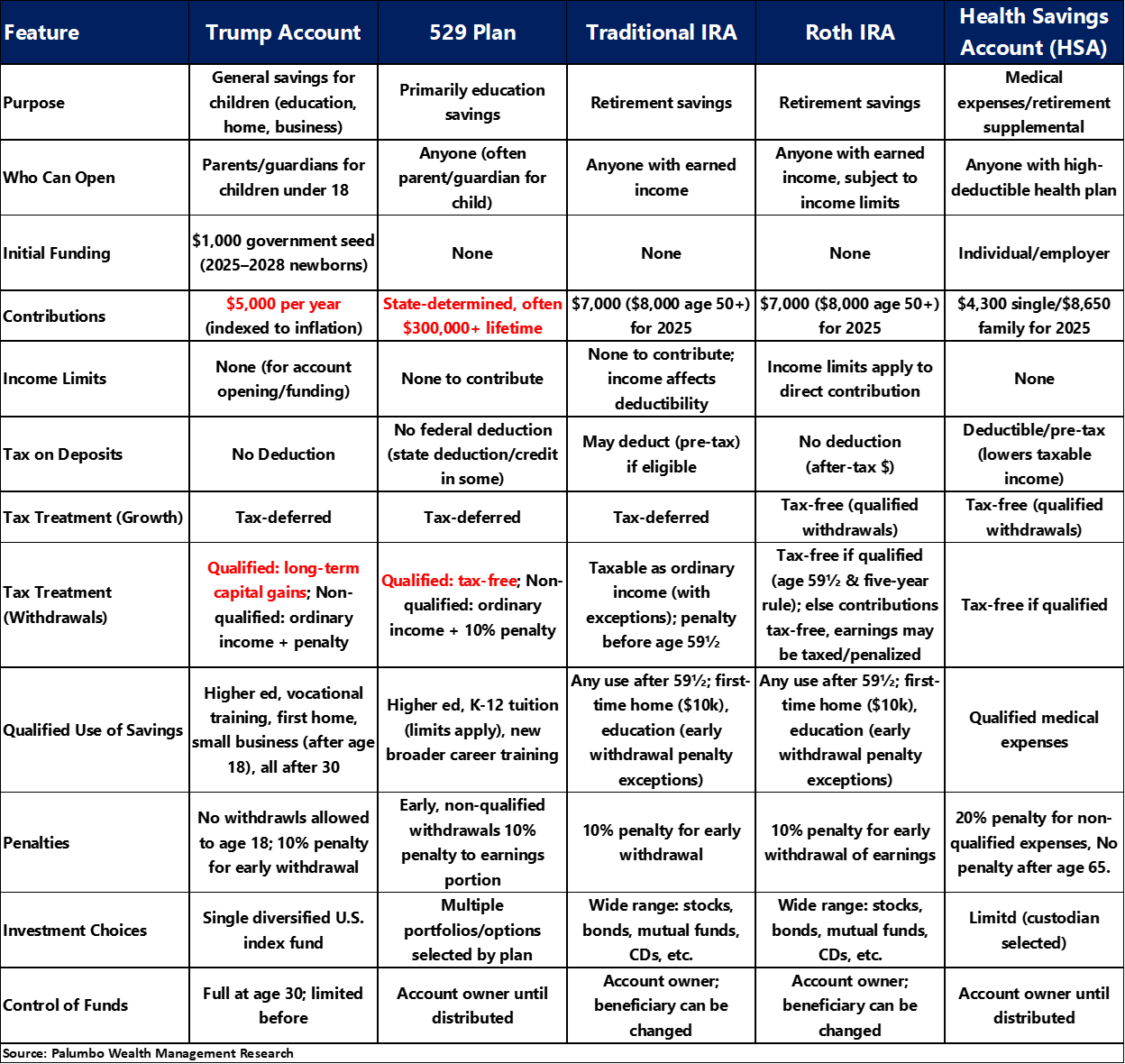

Below, we have accumulated basic data for a variety of individual savings plans and this table really only scratches the surface. The underlying rules are more often more complex than these summaries. If a family requires ultimate flexibility, it may be better to just use a taxable account and eliminate all these rules and potential penalties. But one thing is clear when it comes to Trump accounts. If you are eligible, take the government money and run, but you’re better off putting additional savings into other accounts, not the Trump account. Need more advice? Speak with your advisor. We’re here to help you sort through all the options. In the mean time, we’ll keep hoping the Universal Savings Accounts will someday become reality and we can stop creating these tables!

Have a great week!

What We’re Reading

-

Trump set to open US retirement market to crypto investments

-

Millions could face higher ACA premiums, lower subsidies

-

Inflation outlook tumbles to pre-tariff levels in latest UMich survey

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

529 Plans, IRA, Retirement Accounts, Retirement Savings, Roth IRA, Trump accoutsBy: Adam