The Most Important Word in Economics

You don’t read about it much, but productivity is the beating heart of the economy. We all have a sense of our own productivity each day, but we often fail to appreciate what productivity means to an economy. Productivity is what defines our standard of living, so productivity growth is a critical component of what drives a growing economy over the long run.

So, what is productivity in an economy? It’s an imperfect measure that gauges the amount of goods and services produced relative to the resources (labor and capital) used. The primary statistic that measures productivity is “labor productivity,” or the output per hour worked. There are almost innumerable examples: the mechanization of farms has increased food output by leaps and bounds. Steam power and, later, electricity allowed more materials to be produced more easily and with lower costs.

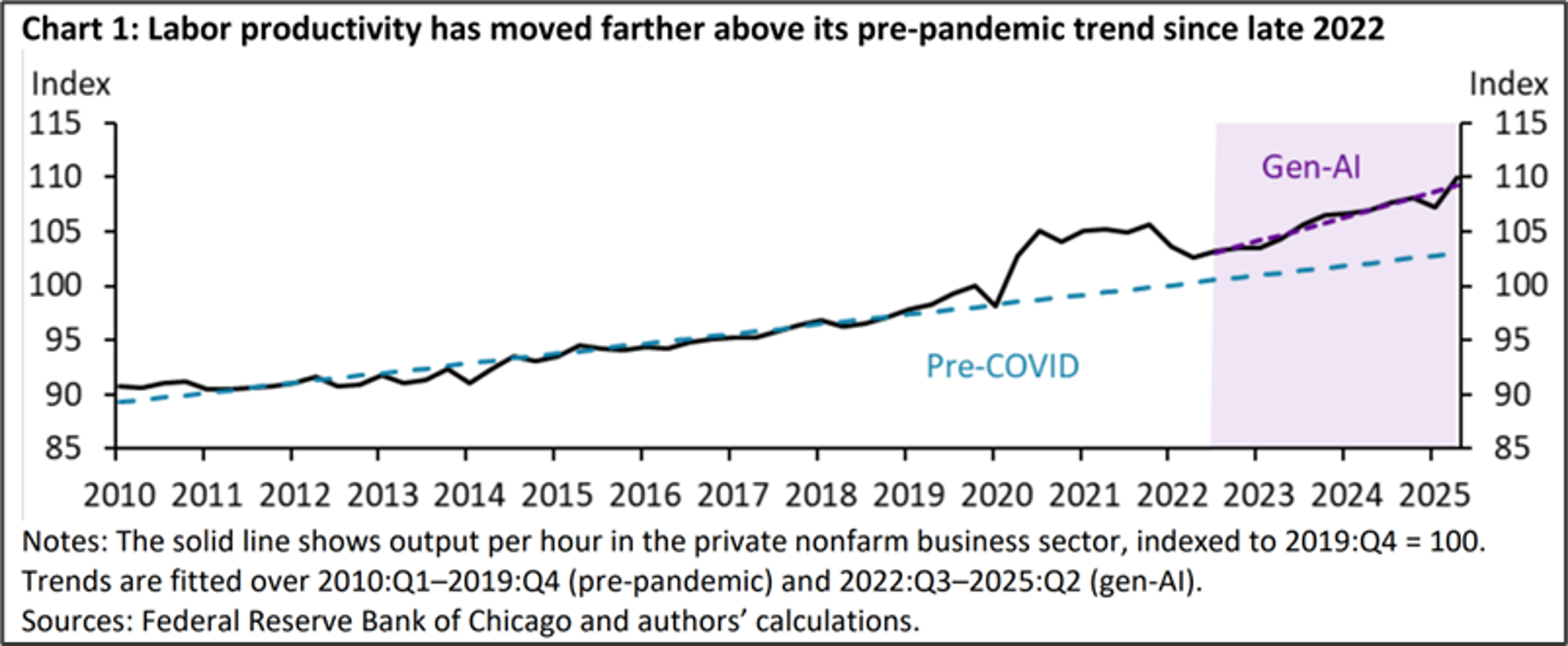

Productivity growth in the 2010s was disappointing at barely above 1%. It appears that social media has not been a great productivity driver; however, the promise of AI is that a new wave of productivity growth is about to happen. If it does, it will be an enormous opportunity to grow real (after-inflation) wages and measurably improve the country’s fiscal situation.

A February 2025 article from the Congressional Research Service, titled “Introduction to U.S. Economy: Productivity,” states the attraction of productivity growth clearly:

“Productivity growth is a primary driver of long-term economic growth and improvements in living standards. As productivity increases, society can produce more goods and services with the same level of resources, which, all else equal, increases incomes and access to goods and services, including additional leisure time.”

Yes, productivity is the Holy Grail of economics.

On a more personal level, those of us who have used AI have likely experienced the time-saving benefits. These tools, while controversial when applied to nefarious things, are beginning to be helpful to many of us in our daily lives. Roll this productivity up nationally, and across business and commercial endeavors, and you can see how productivity may allow you to accomplish more in less time. That’s productivity! We see it here in our tasks every day, bringing efficiency and speed to research, among other tasks.

Is AI helping the broader economy?

Recent analysis from the Kansas City Federal Reserve found that the relatively meager productivity growth evident in the 2010s is giving way to a period of faster growth driven by Artificial Intelligence. This is encouraging data that AI is indeed having a positive, albeit limited, impact on the economy.

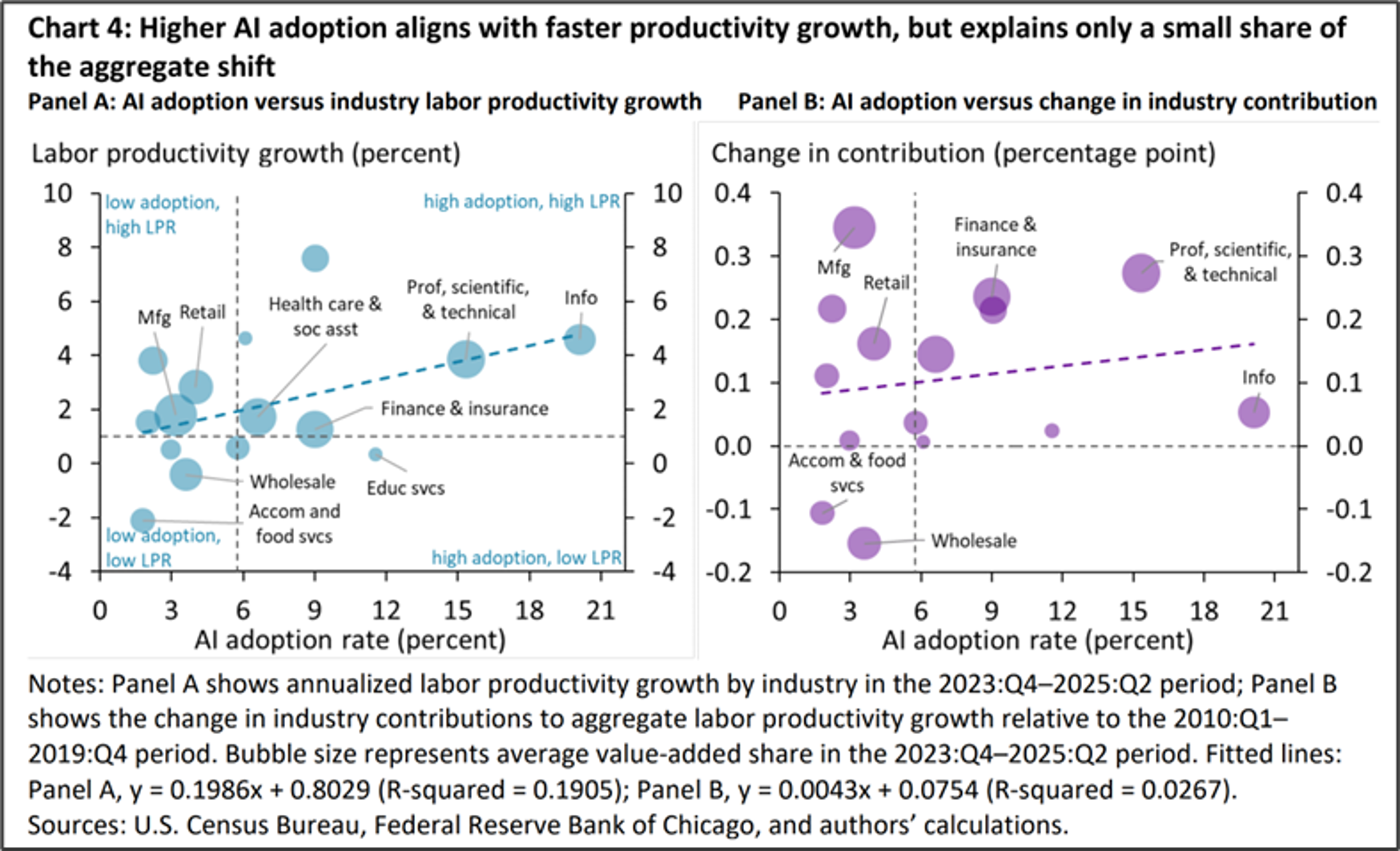

The issue the authors found was that the AI benefit was in a limited number of industries, specifically information technology and scientific and technical sectors. Major technology changes typically bring more broadly-based benefits. We’re not at all discouraged by these findings; we view it as natural that these industries should lead the way, and there is ample evidence that other industries are embracing the opportunities that AI brings.

The critical question remains: What are the consequences for the workforce? The speed of AI development, fueled by massive capital investment from “mega-cap” tech firms, is staggering. While productivity may soar, there is a risk that the “real” economy—and its workforce—cannot adapt at the same pace, leading to significant employment dislocations.

It is heartening to see productivity emerge from its long malaise. However, as the labor force enters this new reality, it is vital for government policy to keep pace, assisting workers in adapting to an AI-augmented landscape.

Have a great week!

What We’re Reading

-

Supreme Court strikes down Trump tariffs

-

Fourth-quarter U.S. GDP up just 1.4%, badly missing estimate

-

Trump could attack Iran in days — what’s at stake for the oil market

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be dependable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be dependable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that no such statements are guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

By: Adam