Is the Party Ending?

The stock market experienced a period of intense volatility early this week as a rotation away from the previously dominant AI/technology and growth stock themes gained momentum. The early signs of this began in late 2025 but kicked into high gear this week.

Thursday saw a quick change as the stock market was broadly down, raising fears of a broad repricing of stocks. By Friday, we saw the short-term reversal that appeared to be overdue. That leaves everything up in the air as we await Monday: Will we take another leg down? Will the Friday rally continue, and if it does, will the rotation away from technology still hold?

All of these are impossible questions, but we can take a closer look at the events of the week for some hints.

AI Concerns

As we have discussed previously, the strong tailwind behind everything AI has passed, and investors are becoming more discerning about winners and losers in the AI race. Despite the Friday rally, software stocks have been pummeled based on fears that new AI automation tools could disrupt the industry. The speed of the decline in software stocks was driving investment decisions with a “sell now, ask questions later” mentality.

That assessment is similar in the semiconductor space. Advanced Micro Devices (AMD) saw its worst daily drop since 2017 (falling over 17%) after providing disappointing forward guidance. The price of NVIDIA stock has waffled for months as deals for chip competitors Groq and Cerebras have opened the door to the possibility that Nvidia’s technology may not be as dominant as it first appeared. The development of AI remains at full speed ahead, but the days of AI stocks rising in unison are over. The attempts to sort winners from losers have begun, and that landscape changes with some regularity, which only adds to the overall volatility in markets.

Federal Reserve Policy

In its January 28 meeting, the Fed held interest rates steady at 3.5%–3.75%. Investors are also reacting to the nomination of Kevin Warsh as the next Fed Chair, which has introduced uncertainty regarding the future pace of interest rate cuts.

As a traditional inflation hawk, Warsh is an unusual choice for Fed Chair. He is a long-standing critic of Quantitative Easing (QE) and is expected to push for a significantly smaller Fed footprint in financial markets. This could lead to higher long-term bond yields as the market absorbs the supply previously held by the Fed. At the same time, Warsh has recently argued that AI-driven productivity gains could allow for lower interest rates without sparking inflation. This has created ample confusion about the direction of interest rates.

Earnings Season: Mixed Results

Earnings results have highlighted how divergent trends have become among tech leaders. While Alphabet (Google) beat expectations with strong cloud growth, Microsoft dipped after reporting slowing cloud revenue growth despite massive AI investments. Amazon was whacked after raising its capital expenditure estimate for 2026 to $200 billion. At that level, estimates are that Amazon will have negative free cash flow in 2026. Supporting that conclusion, Amazon filed a shelf registration to issue more securities.

The reaction reminds us of the old Wendy’s commercial: “Where’s the beef?” Infrastructure spending continues to rise at a rapid clip, and there is no firm evidence that the investment will be profitable—at least not yet. There are some signs, such as Amazon AWS revenue growing faster than expected at 24%, but a few extra percentage points of growth are not sufficient to justify the massive capital spend, so plenty of questions remain. Occasional bouts of risk-off sentiment are to be expected until the outcomes become clearer.

Rotation or Correction?

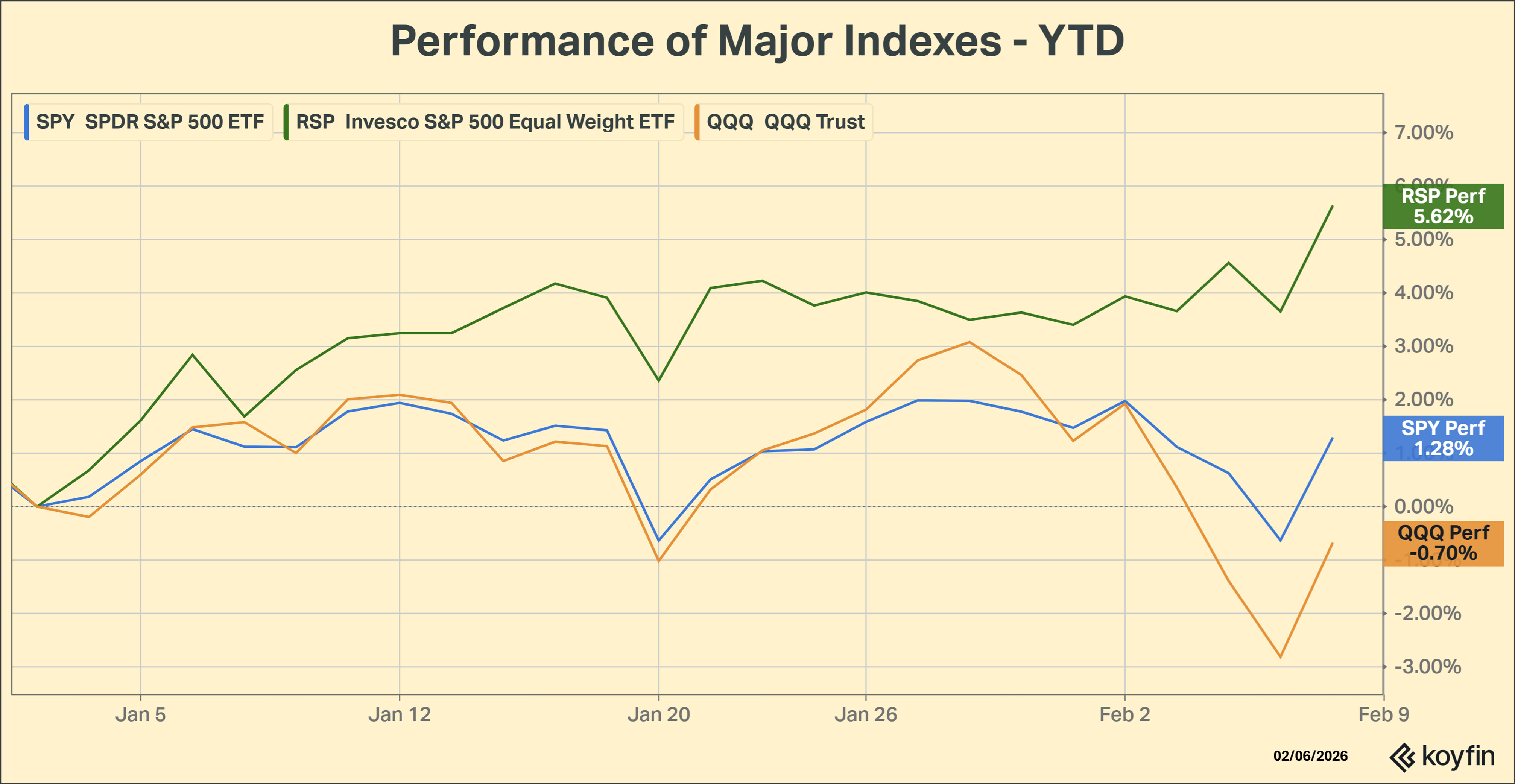

After all the angst this week, the Friday surge left the S&P 500 down about 0.1% for the week. If you were asleep all week, you’d think it was a boring week! Under the surface, other sectors performed well. The S&P 500 Equal Weight ETF (RSP) was up 2% for the week. This divergence is true for the year-to-date as well, as shown in the chart below. The purple line is RSP, which has meaningfully outperformed the S&P 500 index ETF (SPY) as well as the tech-heavy Nasdaq100 Index ETF (QQQ) year-to-date.

The case for rotation lies in the belief that the value derived from AI will not be limited to the hyperscalers and will migrate through to AI users. This would logically result in a shift of market leadership from the “Magnificent 7” tech giants toward everything else. Because the S&P 500 has become heavily weighted toward technology, a shift in leadership could easily produce a declining S&P index despite a majority of the stocks in the index rising.

Stay Calm

While the change in market sentiment was sudden and some sectors, like software, have been hit extremely hard (even after accounting for the Friday rally), this could still morph into a full market correction. Markets like this are uncomfortable and drive investors to question what they have done, or failed to do. This leads to typical questions: Should I just sell something? Should I sell everything? Should I just turn off my TV?

Those are emotional responses, and emotionally driven buying and selling decisions will almost assuredly be the most unattractive path. Panic selling on Thursday would have missed the furious rally on Friday. Diversified portfolios, as we use here, are designed to help clients avoid emotional decisions and stay focused on the long-term view. There have always been bumps in the investment road, and this is just the latest. The current party could be ending, but it’s typically a short ride to the beginning of the next one.

Have a great week!

What We’re Reading

-

Bitcoin drops below $67,000 as sell-off intensifies and pessimism grows about the crypto’s function

-

Qualcomm stock sinks 10% as company issues dire warning on memory shortage

-

‘700 miles of range’: What Ford and Ram replaced their EV pickups with

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be dependable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be dependable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that no such statements are guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Artificial Intelligence, Disruptive technology, Magnificent 7, Market RotationBy: Adam