Getting Rich Slowly: The Power of Compounding!

Nothing could better demonstrate the power of compounding investment returns than the recent announcement by Michael and Susan Dell, donating more than $6 billion to fund $250 each for 25 million children in the US who are not beneficiaries of the $1,000 contribution to the “Trump accounts” included in the One Big Beautiful Bill (OBBB).

Both the “Trump Accounts” and the Dell donation are aimed at helping to build wealth for everyone by allocating a small amount to a US equity index fund, enabling the participants to benefit from the compounding of returns over time in the equity market. In the process, they will see firsthand the value of compounding investment returns in the equity market versus a certificate of deposit or even the Savings Bonds many kids used to get as gifts.

Over time, the returns in the US equity market remain one of the best investments to grow wealth over longer periods of time, and yet many in the US are not able to or choose not to participate. The hope is that by owning a broad-based slice of the US equity market, the participants will learn firsthand the value of compounding returns and how it can grow wealth.

The irony is that many adults are equally naive as to the value of compounding over longer periods of time, and in fact, if teens and young adults took the longer view and began saving early, investing it in a broad-based US equity index, they would find themselves with more wealth and, in some cases, being able to “Make Work Optional” earlier than the age of 65!

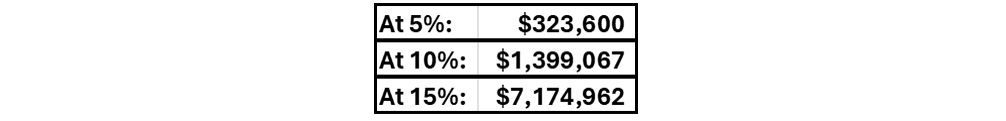

Hypothetical Example of the Potential Effect of Return: Start with $2,500 and save/invest $200 per month for 40 years:

In the example, it shows how rate of return and what you invest in are so impactful. If you started with $5,000 at 5%, it would amount to $341,996, not substantially larger, showing that the ongoing contributions are much more valuable.

DISCLOSURE: THESE ARE HYPOTHETICAL EXAMPLES MEANT TO EDUCATE INVESTORS ON THE POTENTIAL EFFECTS OF BOTH TIME, RETURN, AND INITIAL AMOUNTS ON OUTCOMES.

We know the significant value of compounding, and it is at our core in working with our clients. It is also demonstrated in the Appendix A to Philip Palumbo’s book, “Making Work Optional”, viewable with this link. Looking at the example above, recognizing the value of regular contributions, not necessarily what you start with, one can see the value of investing in higher return assets over time. It is likely one of the motivations for the Trump Accounts and Michael and Susan Dell’s contribution will become obvious!

The actions by the Trump Administration and Michael and Susan Dell should serve as an education for everyone, young and old alike! Regarding compounding, Warren Buffett likens life to a snowball, stating, “The important thing is finding wet snow and a really long hill”. His personal wealth accumulation demonstrates the effect of compounding over time.

Our Advice: If you are able, take advantage of the free money. That is a clear win. However, for most families, other savings vehicles like 529 plans or Roth IRAs provide better tax advantages and flexibility for specific goals like education or retirement. Have questions? Give us a call.

Have a great week!

Appendix – The Dell and Trump Account Opportunities

The New “Trump Accounts” $1,000 Contribution

- Who Gets It: U.S. citizen children born between January 1, 2025, and December 31, 2028.

- When: The government contribution is a one-time deposit when the account is set up, with instructions expected in May 2026.

- Account Type: A tax-advantaged account, similar to an IRA, with earnings growing tax-deferred.

- Investment: Funds are invested in a low-cost U.S. stock index fund.

- Access & Withdrawals:

- Generally inaccessible until age 18.

- At 18, up to 50% can be used for education, business, or a first home (earnings taxed as capital gains).

- At age 30, the full balance is accessible for any purpose.

- Other Contributions: Employers can contribute up to $2,500 annually (tax-free to the employee), and other private funds can also be added.

- Taxation: Earnings are taxed as capital gains; non-qualified withdrawals before age 30 incur penalties.

Details of the Dell Contribution: Amount: $6.25 billion (approx.).

- Recipients: 25 million American children 10 years old or younger.

- Eligibility: Children living in ZIP codes where the median household income is below $150,000.

- Initial Contribution: $250 per eligible child.

- Purpose: To provide a financial foundation for education, job training, starting a business, or buying a first home.

What We’re Reading

-

Treasury yields rise as traders continue to bet on a December rate cut

-

Core inflation rate watched by Fed hit 2.8%, lower than expected

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

By: palumbo