Beating the Market

Why is beating the market such a difficult feat? If the market is the average, it would seem that being modestly above average would be more than enough to beat the market by a little, but that isn’t the case. Most managers that use the S&P 500 Index as their benchmark don’t beat the index.

The reason is something called ‘survivorship bias’. Survivorship bias in essence indicates the strong companies “survive” (stay or are added), and the weak “fall” (or are deleted from the index). Some argue the stock market indexes, such the S&P 500, have no such issue, but that would be incorrect.

The S&P 500 Index, which is generally considered passive, has an imbedded active component to it. Standard and Poor’s changes the index components periodically, typically annually, to more adequately reflect to changing underlying companies that are highly relevant in our economy. As they add those, they delete others that have fallen from grace for any number of reasons. According to a Gemini (Google AI) search, 3 to 5 companies have been replaced in the index annually over the last 10-15 years.

Here is an example: Nvidia, the darling of the stock market today, joined the S&P 500 in 2001. The company Nvidia replaced? Enron! Where would the index be today if that change had not been made? Obviously, the index would be much lower, and the lesson is that there is plenty of survivorship bias present in the S&P500 Index. The implication is that the S&P 500 Index, which most view as without bias, is essentially a momentum strategy and quite possibly the reason why the momentum factor has been among the most successful of the various market factors investors utilize.

As if that challenge isn’t enough, fund managers must also respond to other cyclical, pendulum-like swings in popularity. Today, the stock market is as concentrated in a few large stocks as it has been in the last century. Many are viewing this as a warning of tougher times ahead but that conclusion is not necessarily correct. It is important to understand that the stock market can rally on strong breadth, where most stocks are rising, or it can rally on narrow breadth, with a small handful of companies dominating index performance. Money managers would normally prefer strong breadth, because it makes their job a bit easier. If index performance is concentrated in a few names, money managers are forced into the uncomfortable position of chasing that small group of stocks that are leading the way.

Today, the large-cap tech stocks continue with their overwhelming grip on index performance, and the AI explosion makes it appear that they will remain in that position for the foreseeable future. It’s already been so long that it seems normal, and there is no end in sight, but we are confident there will be an end.

Circumstances are becoming so extreme that we could be approaching the apex of the pendulum. But several factors muddy the analytical waters.

-

-

- Passive investing: A large part of the response to a stock market index that is tough to beat is to simply buy the index. The growth of passive investing has served many investors well, particularly in 401(k)s and 403(b)s, but when the index is purchased, it is done without any concern over price or valuation or the prospects for any stock in the index. Passive investing blindly buys the stocks in the then current allocation. Naturally that means it buys more of the big stocks in the Index and less of the small stocks in the Index. That process tends to perpetuate highly concentrated markets, and we view that negatively. The market needs natural checks and balances, and only active investing produces the real price discovery necessary for an efficient market.

- Stock buybacks: Stock buybacks were legalized in 1982. Buybacks were small in the early days and managements tended to be very careful of the price they paid for their own stock. That concern is long gone. Today, the big tech companies buy back their stock no matter the valuation, and a big reason for that is the purchases are often to offset the use of stock as compensation, thus eliminating a steady drift higher in the number of shares outstanding. Big tech has been able to do this because they are generally asset-light businesses (that is, a business that does not require a high level of capital expenditures). That is changing today as the investment in AI continues to suck up the previously free cash flow of these companies. Will AI take all of that free cash flow? We’ll see, but if the current trend continues, buybacks could become more difficult.

- Artificial Intelligence: If you believe in AI, things are unlikely to change very much, and the technology sector should continue to lead the charge.

-

History strongly suggests that all these cycles change eventually. The important question is WHEN?

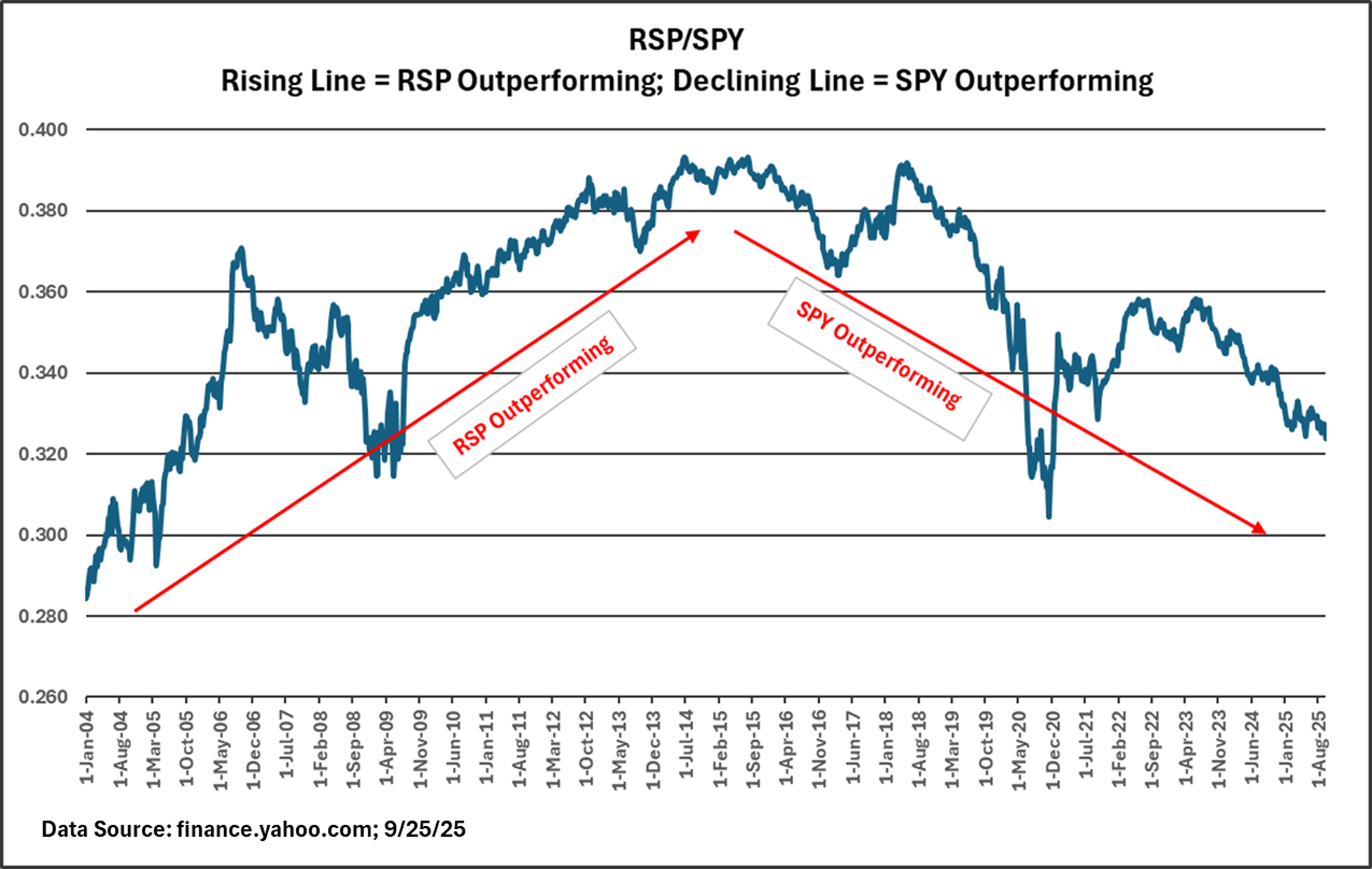

We don’t have that answer, but when the pendulum swings, the tenor of markets changes, and those changes can be observed. The chart below takes the value of the RSP, the Invesco S&P 500 Equal Weight ETF, and divides it by the value of SPY, the SPDR S&P 500 Index ETF, from 2004 to present. When the line is rising, the Equal Weight ETF is outperforming the Index ETF, and when the line is declining, the Index is outperforming the Equal Weight ETF.

Beginning in 2004, in the years following the Internet Bubble, the Equal Weight ETF experienced a long period of outperformance right through 2015. At that point, the tenor of the market began to change, and despite almost regaining the 2015 peak in 2018, the S&P 500 Index has largely outperformed the Equal Weight ETF since then. Yes, there are periods of interruption within those two broad trends; the general direction was maintained.

What has driven this shift is earnings dominance of large-cap technology stocks relative to the rest of the stock market. Not only did earnings drive stock prices higher, but P/E multiples expanded as well, and this resulted in a strong concentration in the Index which is driving overall Index performance.

Are We Due for a Change?

That story could be changing because more balanced earnings growth across the index is expected in 2026. While large-cap tech is still expected to lead in earnings growth in 2026, the gap between the “Magnificent Seven” and the “S&P 493” is projected to narrow considerably. The market’s earnings strength, which was dominated by technology in recent years, is shifting back toward a broader, more widespread corporate recovery. That could imply that the pendulum is beginning to swing back to favor a broader array of stocks beyond technology and a resurgence of the other stocks in the index.

Have a great week!

What We’re Reading

-

Existing-Home Sales Report Shows 0.2% Decrease in August

-

Subprime Auto Lender Goes Bankrupt—Fraud Alleged, Cars Repossessed

-

Core inflation rate held at 2.9% in August, as expected

-

Shooting down Russian jets ‘on the table,’ von der Leyen says

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Active management, buybacks, Passive Investing, S&P 500 Equal Weight, S&P 500 Index, survivorship biasBy: Adam